Answered step by step

Verified Expert Solution

Question

1 Approved Answer

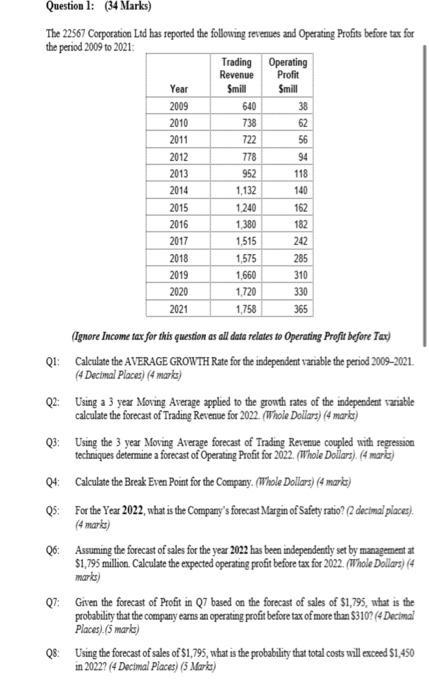

Question 1: (34 Marks) The 22567 Corporation Ltd has reported the following revenues and Operating Profits before tax for the period 2009 to 2021

Question 1: (34 Marks) The 22567 Corporation Ltd has reported the following revenues and Operating Profits before tax for the period 2009 to 2021 Year 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Trading Revenue Smill Q7: 640 738 722 778 952 1,132 1,240 1,380 1,515 1,575 1,660 1,720 1,758 Operating Profit Smill 38 62 56 94 118 140 162 182 242 285 310 330 365 (Ignore Income tax for this question as all data relates to Operating Profit before Tax) Q1: Calculate the AVERAGE GROWTH Rate for the independent variable the period 2009-2021. (4 Decimal Places) (4 marks) Q2: Using a 3 year Moving Average applied to the growth rates of the independent variable calculate the forecast of Trading Revenue for 2022 (Whole Dollars) (4 marks) Q3: Using the 3 year Moving Average forecast of Trading Revenue coupled with regression techniques determine a forecast of Operating Profit for 2022. (Whole Dollars). (4 marks) Calculate the Break Even Point for the Company. (Whole Dollars) (4 marks) Q4: Q5: For the Year 2022, what is the Company's forecast Margin of Safety ratio? (2 decimal places). (4 marks) Q6: Assuming the forecast of sales for the year 2022 has been independently set by management at $1,795 million. Calculate the expected operating profit before tax for 2022. (Whole Dollars) (4 marks) Given the forecast of Profit in Q7 based on the forecast of sales of $1,795, what is the probability that the company earns an operating profit before tax of more than $310? (4 Decimal Places) (5 marks) Q8: Using the forecast of sales of $1,795, what is the probability that total costs will exceed $1,450 in 2022? (4 Decimal Places) (5 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Q1 The average growth rate for the period 20092021 is 98 Revenue 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 640 38 738 722 778 952 1132 1240 1380 1515 1575 1660 1720 1758 Operati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started