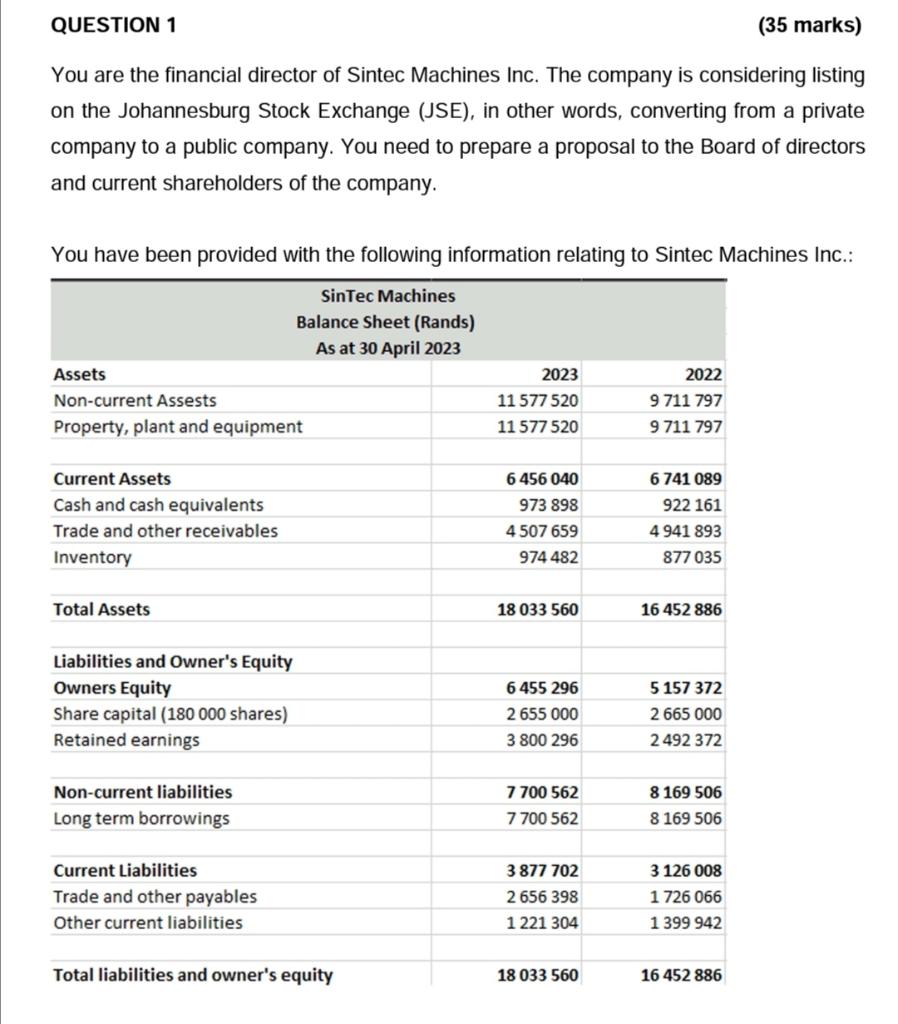

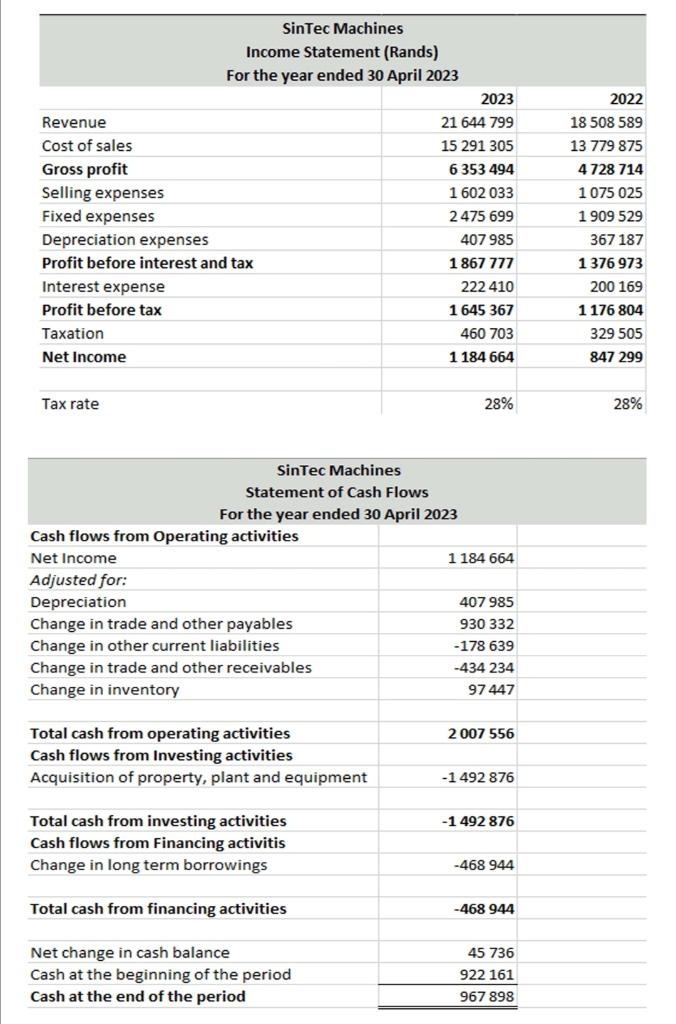

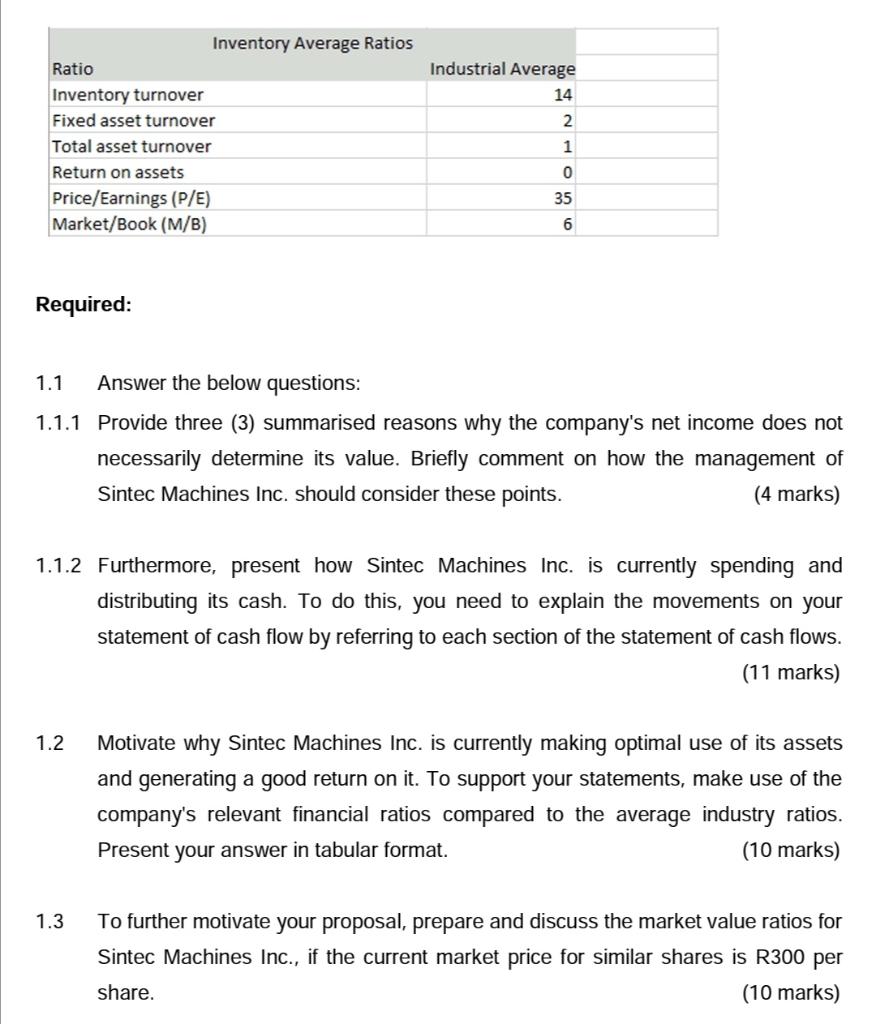

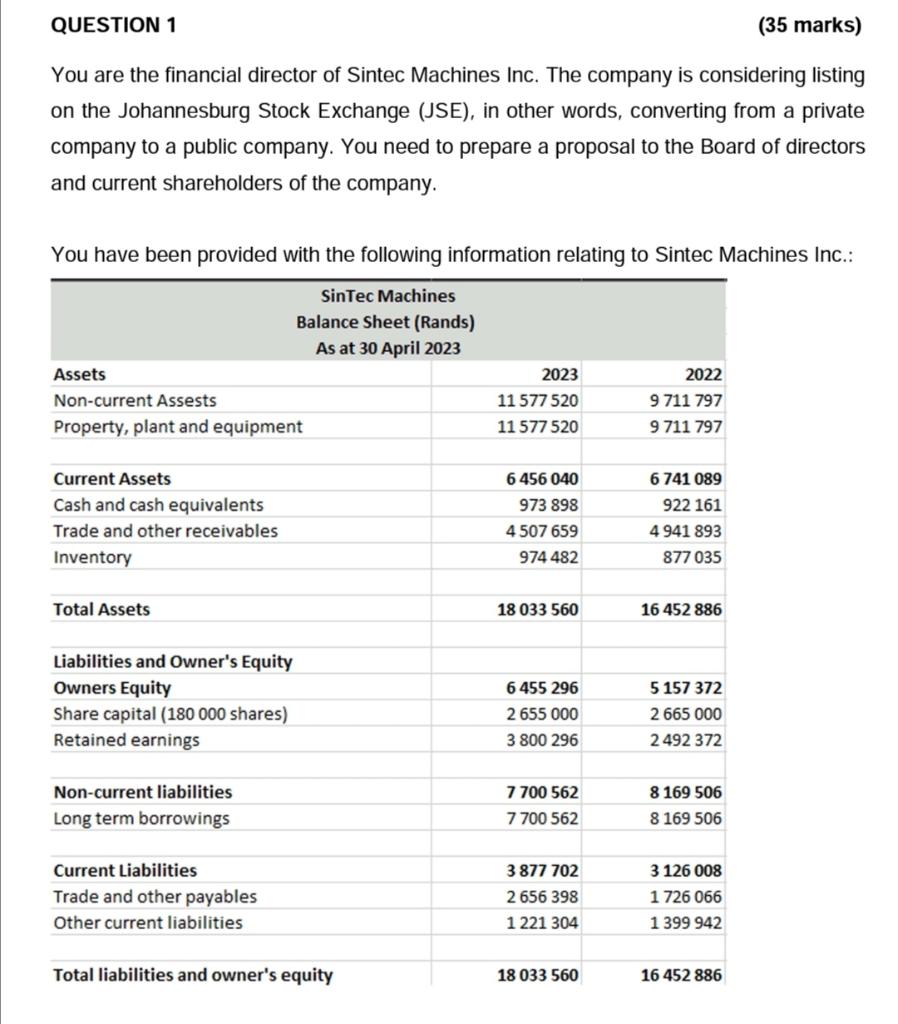

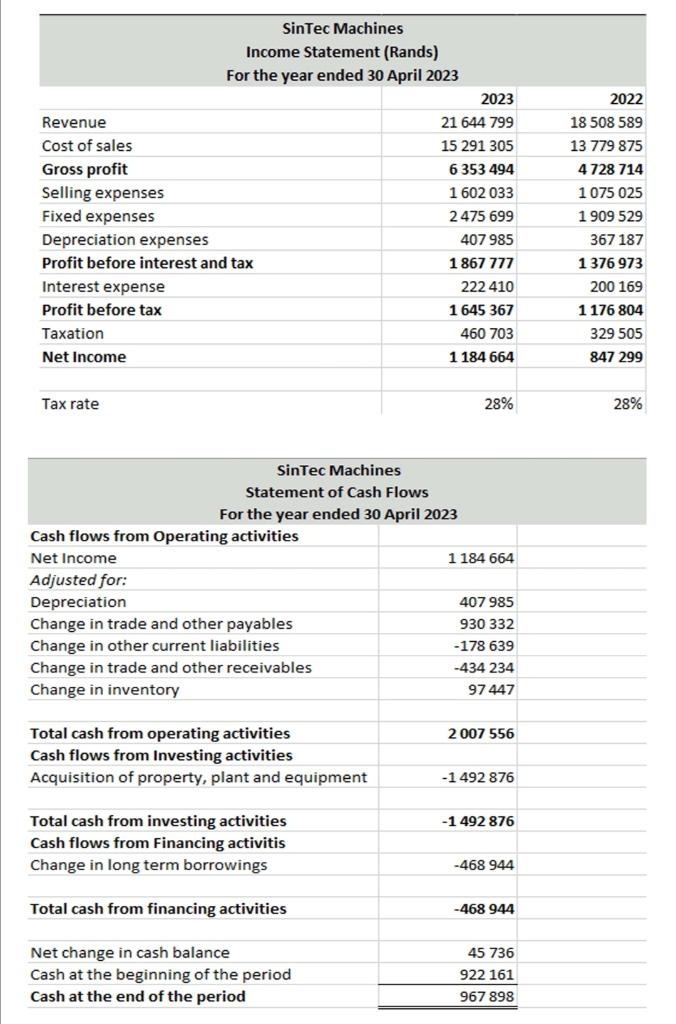

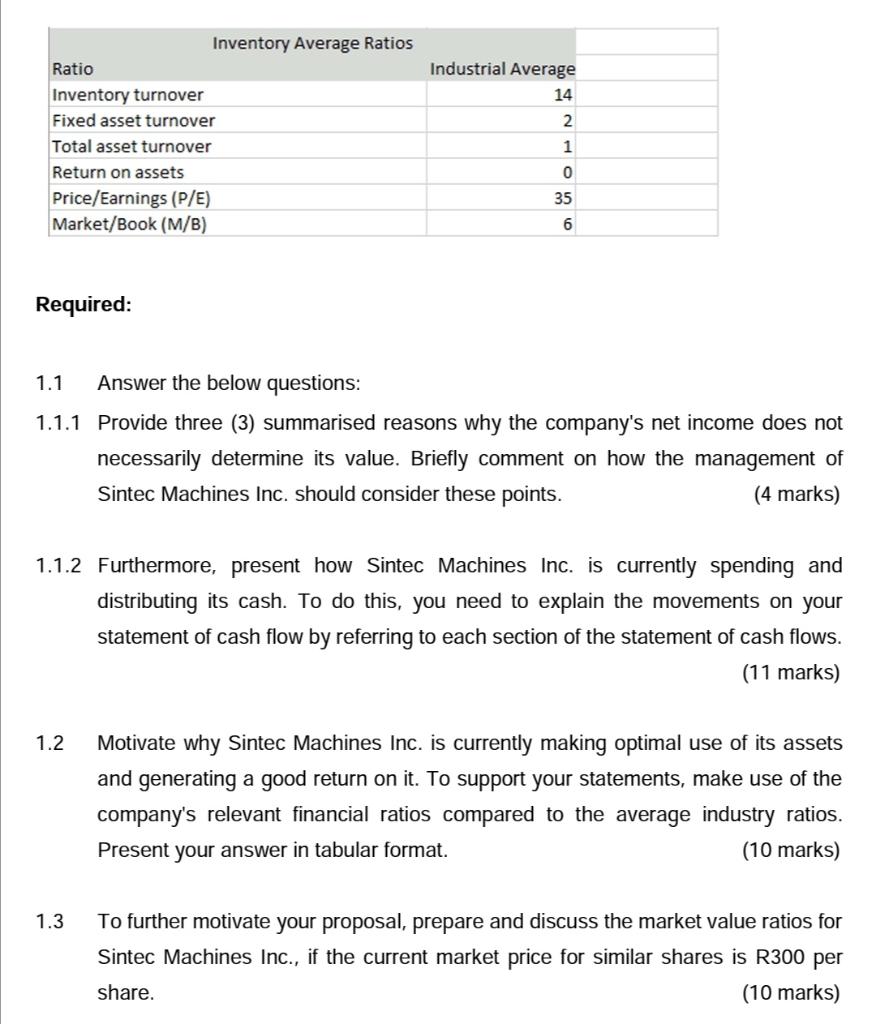

QUESTION 1 (35 marks) You are the financial director of Sintec Machines Inc. The company is considering listing on the Johannesburg Stock Exchange (JSE), in other words, converting from a private company to a public company. You need to prepare a proposal to the Board of directors and current shareholders of the company. achines Inc.: 1.1 Answer the below questions: 1.1.1 Provide three (3) summarised reasons why the company's net income does not necessarily determine its value. Briefly comment on how the management of Sintec Machines Inc. should consider these points. (4 marks) 1.1.2 Furthermore, present how Sintec Machines Inc. is currently spending and distributing its cash. To do this, you need to explain the movements on your statement of cash flow by referring to each section of the statement of cash flows. (11 marks) 1.2 Motivate why Sintec Machines Inc. is currently making optimal use of its assets and generating a good return on it. To support your statements, make use of the company's relevant financial ratios compared to the average industry ratios. Present your answer in tabular format. (10 marks) 1.3 To further motivate your proposal, prepare and discuss the market value ratios for Sintec Machines Inc., if the current market price for similar shares is R300 per share. (10 marks) QUESTION 1 (35 marks) You are the financial director of Sintec Machines Inc. The company is considering listing on the Johannesburg Stock Exchange (JSE), in other words, converting from a private company to a public company. You need to prepare a proposal to the Board of directors and current shareholders of the company. achines Inc.: 1.1 Answer the below questions: 1.1.1 Provide three (3) summarised reasons why the company's net income does not necessarily determine its value. Briefly comment on how the management of Sintec Machines Inc. should consider these points. (4 marks) 1.1.2 Furthermore, present how Sintec Machines Inc. is currently spending and distributing its cash. To do this, you need to explain the movements on your statement of cash flow by referring to each section of the statement of cash flows. (11 marks) 1.2 Motivate why Sintec Machines Inc. is currently making optimal use of its assets and generating a good return on it. To support your statements, make use of the company's relevant financial ratios compared to the average industry ratios. Present your answer in tabular format. (10 marks) 1.3 To further motivate your proposal, prepare and discuss the market value ratios for Sintec Machines Inc., if the current market price for similar shares is R300 per share. (10 marks)