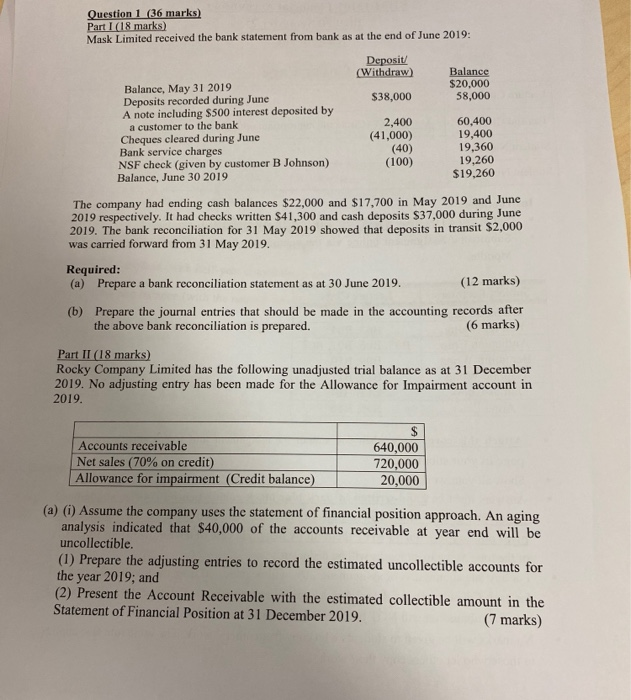

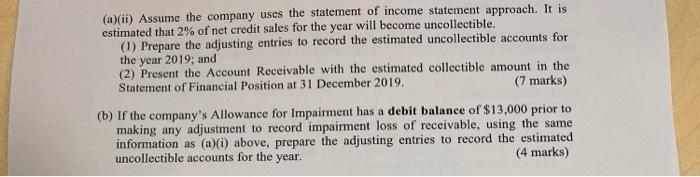

Question 1 (36 marks) Part I (18 marks) Mask Limited received the bank statement from bank as at the end of June 2019: Deposit/ (Withdraw Balance $20,000 58,000 $38,000 Balance, May 31 2019 Deposits recorded during June A note including $500 interest deposited by a customer to the bank Cheques cleared during June Bank service charges NSF check (given by customer B Johnson) Balance, June 30 2019 2,400 (41,000) (40) (100) 60,400 19,400 19,360 19,260 $19,260 The company had ending cash balances $22,000 and $17,700 in May 2019 and June 2019 respectively. It had checks written S41,300 and cash deposits S37,000 during June 2019. The bank reconciliation for 31 May 2019 showed that deposits in transit $2,000 was carried forward from 31 May 2019. Required: (a) Prepare a bank reconciliation statement as at 30 June 2019. (12 marks) the above bank reconciliation is prepared. (6 marks) Part II (18 marks) Rocky Company Limited has the following unadjusted trial balance as at 31 December 2019. No adjusting entry has been made for the Allowance for Impairment account in 2019. Accounts receivable Net sales (70% on credit) Allowance for impairment (Credit balance) 640,000 720,000 20,000 (a) (i) Assume the company uses the statement of financial position approach. An aging analysis indicated that $40,000 of the accounts receivable at year end will be uncollectible. (1) Prepare the adjusting entries to record the estimated uncollectible accounts for the year 2019; and (2) Present the Account Receivable with the estimated collectible amount in the Statement of Financial Position at 31 December 2019. (7 marks) (a)(ii) Assume the company uses the statement of income statement approach. It is estimated that 2% of net credit sales for the year will become uncollectible. (1) Prepare the adjusting entries to record the estimated uncollectible accounts for the year 2019; and (2) Present the Account Receivable with the estimated collectible amount in the Statement of Financial Position at 31 December 2019. (7 marks) (b) If the company's Allowance for Impairment has a debit balance of $13,000 prior to making any adjustment to record impairment loss of receivable, using the same information as (a)(i) above, prepare the adjusting entries to record the estimated uncollectible accounts for the year. (4 marks)