Answered step by step

Verified Expert Solution

Question

1 Approved Answer

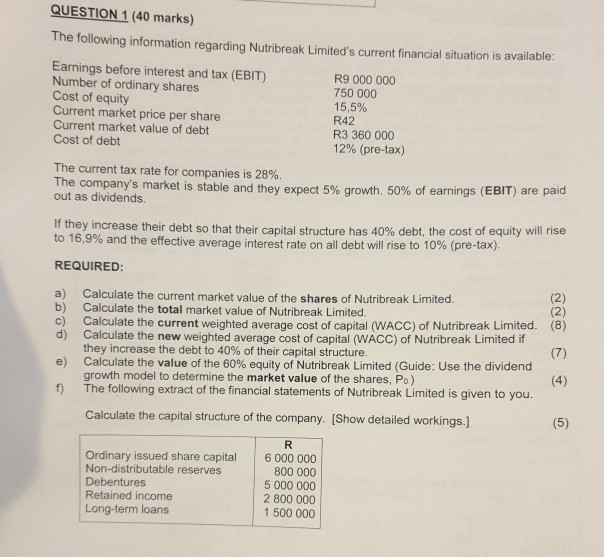

QUESTION 1 (40 marks) The following information regarding Nutribreak Limited's current financial situation is available: Earnings before interest and tax (EBIT) Number of ordinary shares

QUESTION 1 (40 marks) The following information regarding Nutribreak Limited's current financial situation is available: Earnings before interest and tax (EBIT) Number of ordinary shares Cost of equity Current market price per share Current market value of debt Cost of debt R9 000 000 750 000 15,5% R42 R3 360 000 12% (pre-tax) The current tax rate for companies is 28%. The company's market is stable and they expect 5% growth, 50% of earnings (EBIT) are paid out as dividends. If they increase their debt so that their capital structure has 40% debt, the cost of equity will rise to 16, 9% and the effective average interest rate on all debt will rise to 10% (pre-tax). REQUIRED: a) Calculate the current market value of the shares of Nutribreak Limited. b) Calculate the total market value of Nutribreak Limited. c) Calculate the current weighted average cost of capital (WACC) of Nutribreak Limited. (8) d) Calculate the new weighted average cost of capital (WACC) of Nutribreak Limited if they increase the debt to 40% of their capital structure. Calculate the value of the 60% equity of Nutribreak Limited (Guide: Use the dividend growth model to determine the market value of the shares, Po) e) f) The following extract of the financial statements of Nutribreak Limited is given to you. Calculate the capital structure of the company. [Show detailed workings.] Ordinary issued share capital 6 000 000 Non-distributable reserves Debentures Retained income Long-term loans 800 000 5 000000 2 800 000 1 500 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started