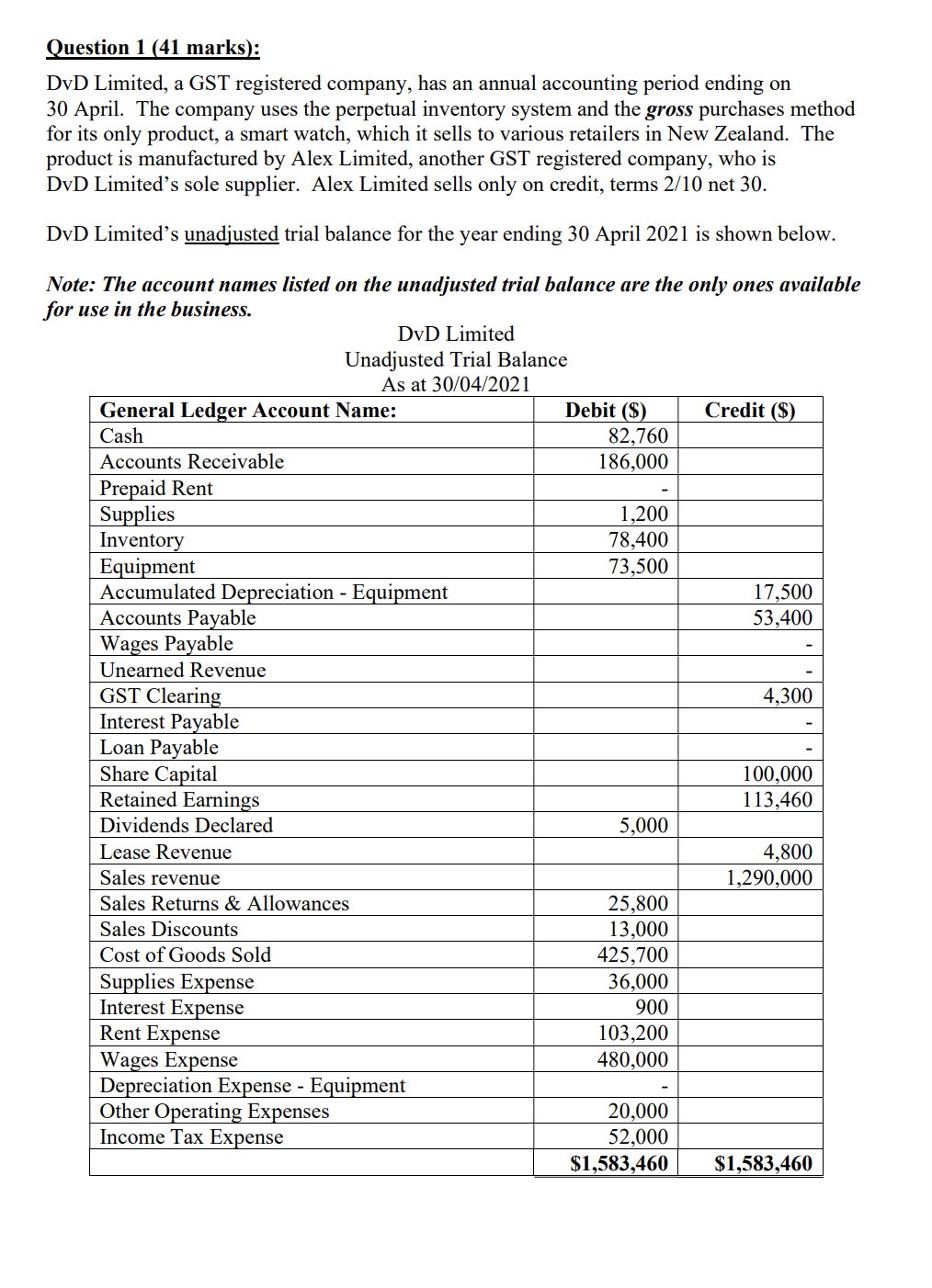

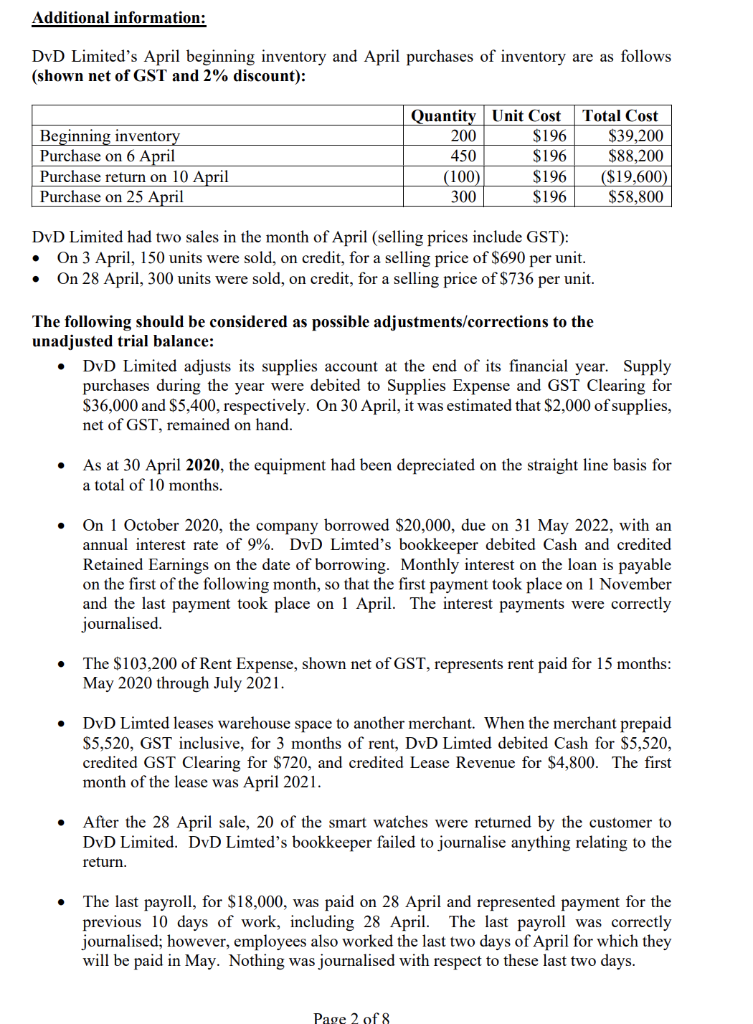

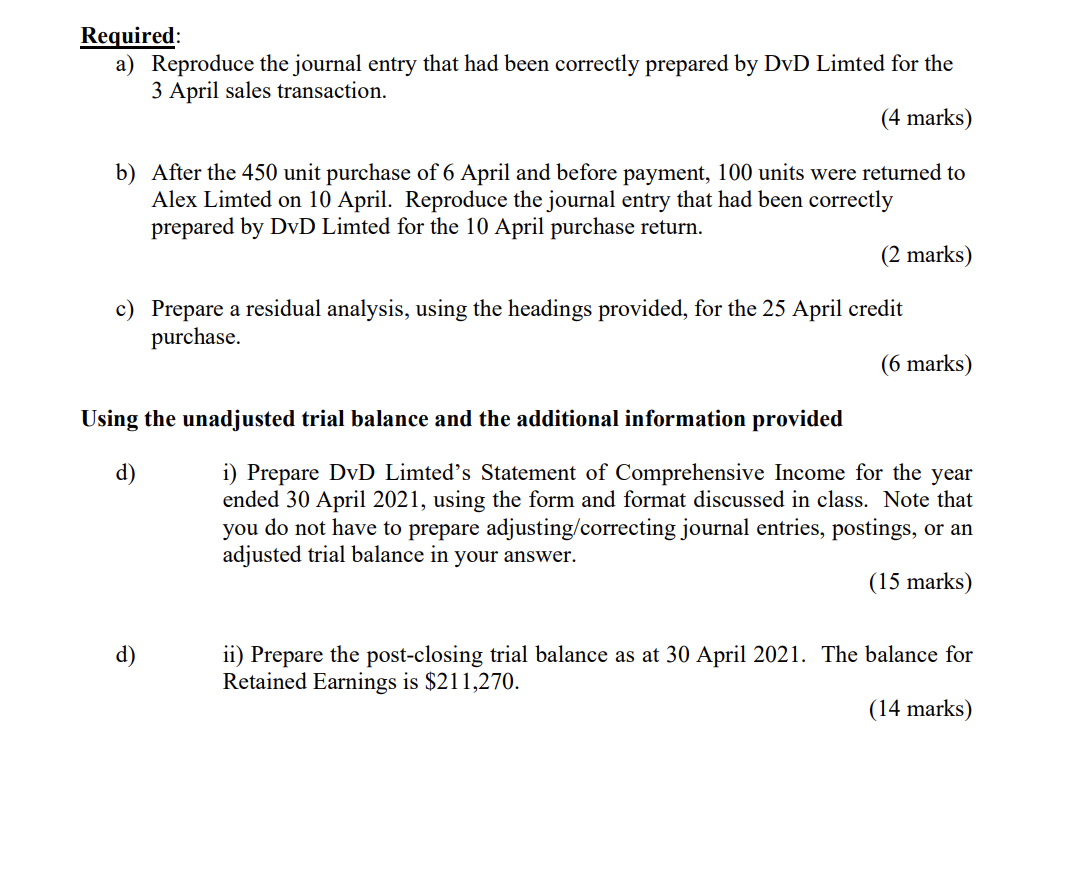

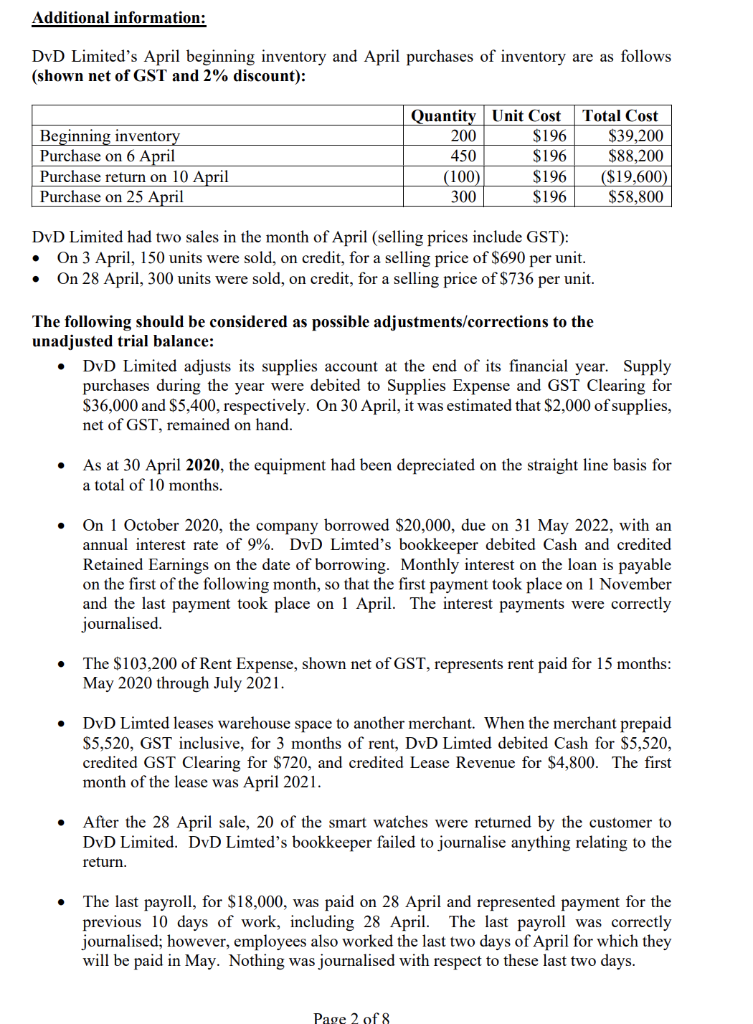

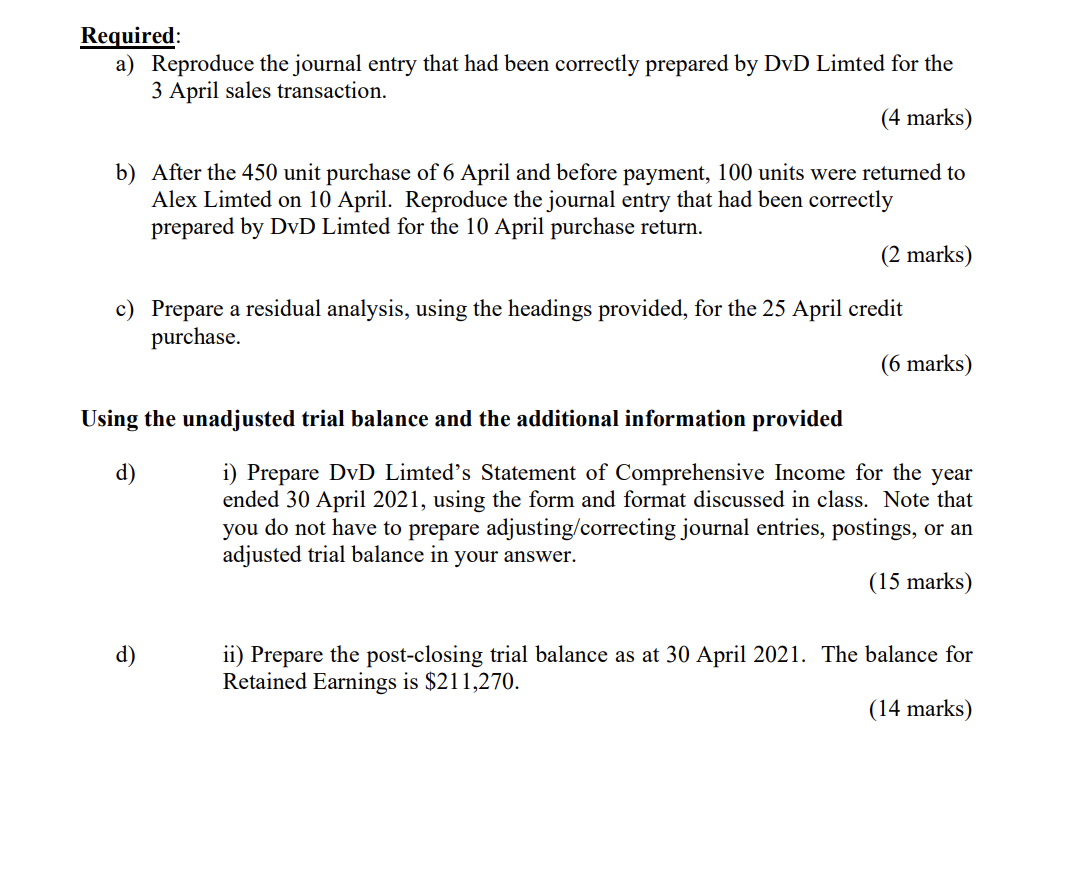

Question 1 (41 marks): DvD Limited, a GST registered company, has an annual accounting period ending on 30 April. The company uses the perpetual inventory system and the gross purchases method for its only product, a smart watch, which it sells to various retailers in New Zealand. The product is manufactured by Alex Limited, another GST registered company, who is DvD Limited's sole supplier. Alex Limited sells only on credit, terms 2/10 net 30. DvD Limited's unadjusted trial balance for the year ending 30 April 2021 is shown below. Note: The account names listed on the unadjusted trial balance are the only ones available for use in the business. DVD Limited Unadjusted Trial Balance As at 30/04/2021 General Ledger Account Name: Debit ($) Credit ($) Cash 82,760 Accounts Receivable 186,000 Prepaid Rent Supplies 1,200 Inventory 78,400 Equipment 73,500 Accumulated Depreciation - Equipment 17,500 Accounts Payable 53,400 Wages Payable Unearned Revenue GST Clearing 4,300 Interest Payable Loan Payable Share Capital 100,000 Retained Earnings 113,460 Dividends Declared 5,000 Lease Revenue 4,800 Sales revenue 1,290,000 Sales Returns & Allowances 25,800 Sales Discounts 13,000 Cost of Goods Sold 425,700 Supplies Expense 36,000 Interest Expense 900 Rent Expense 103,200 Wages Expense 480,000 Depreciation Expense - Equipment Other Operating Expenses 20,000 Income Tax Expense 52,000 $1,583,460 $1,583,460 Additional information: DvD Limited's April beginning inventory and April purchases of inventory are as follows (shown net of GST and 2% discount): Beginning inventory Purchase on 6 April Purchase return on 10 April Purchase on 25 April Quantity Unit Cost 200 $196 450 $196 $196 300 $196 Total Cost $39,200 $88,200 ($19,600) $58,800 (100) DvD Limited had two sales in the month of April (selling prices include GST): On 3 April, 150 units were sold, on credit, for a selling price of $690 per unit. On 28 April, 300 units were sold, on credit, for a selling price of $736 per unit. . . The following should be considered as possible adjustments/corrections to the unadjusted trial balance: DvD Limited adjusts its supplies account at the end of its financial year. Supply purchases during the year were debited to Supplies Expense and GST Clearing for $36,000 and $5,400, respectively. On 30 April, it was estimated that $2,000 of supplies, net of GST, remained on hand. As at 30 April 2020, the equipment had been depreciated on the straight line basis for a total of 10 months. On 1 October 2020, the company borrowed $20,000, due on 31 May 2022, with an annual interest rate of 9%. DvD Limted's bookkeeper debited Cash and credited Retained Earnings on the date of borrowing. Monthly interest on the loan is payable on the first of the following month, so that the first payment took place on 1 November and the last payment took place on 1 April. The interest payments were correctly journalised. . The $103,200 of Rent Expense, shown net of GST, represents rent paid for 15 months: May 2020 through July 2021. DvD Limted leases warehouse space to another merchant. When the merchant prepaid $5,520, GST inclusive, for 3 months of rent, DvD Limted debited Cash for $5,520, credited GST Clearing for $720, and credited Lease Revenue for $4,800. The first month of the lease was April 2021. After the 28 April sale, 20 of the smart watches were returned by the customer to DvD Limited. DvD Limted's bookkeeper failed to journalise anything relating to the return . The last payroll, for $18,000, was paid on 28 April and represented payment for the previous 10 days of work, including 28 April. The last payroll was correctly journalised; however, employees also worked the last two days of April for which they will be paid in May. Nothing was journalised with respect to these last two days. Page 2 of 8 Required: a) Reproduce the journal entry that had been correctly prepared by DvD Limted for the 3 April sales transaction. (4 marks) b) After the 450 unit purchase of 6 April and before payment, 100 units were returned to Alex Limted on 10 April. Reproduce the journal entry that had been correctly prepared by DvD Limted for the 10 April purchase return. (2 marks) c) Prepare a residual analysis, using the headings provided, for the 25 April credit purchase. (6 marks) Using the unadjusted trial balance and the additional information provided i) Prepare DvD Limted's Statement of Comprehensive Income for the year ended 30 April 2021, using the form and format discussed in class. Note that you do not have to prepare adjusting/correcting journal entries, postings, or an adjusted trial balance in your answer. (15 marks) d) ii) Prepare the post-closing trial balance as at 30 April 2021. The balance for Retained Earnings is $211,270. (14 marks) Question 1 (41 marks): DvD Limited, a GST registered company, has an annual accounting period ending on 30 April. The company uses the perpetual inventory system and the gross purchases method for its only product, a smart watch, which it sells to various retailers in New Zealand. The product is manufactured by Alex Limited, another GST registered company, who is DvD Limited's sole supplier. Alex Limited sells only on credit, terms 2/10 net 30. DvD Limited's unadjusted trial balance for the year ending 30 April 2021 is shown below. Note: The account names listed on the unadjusted trial balance are the only ones available for use in the business. DVD Limited Unadjusted Trial Balance As at 30/04/2021 General Ledger Account Name: Debit ($) Credit ($) Cash 82,760 Accounts Receivable 186,000 Prepaid Rent Supplies 1,200 Inventory 78,400 Equipment 73,500 Accumulated Depreciation - Equipment 17,500 Accounts Payable 53,400 Wages Payable Unearned Revenue GST Clearing 4,300 Interest Payable Loan Payable Share Capital 100,000 Retained Earnings 113,460 Dividends Declared 5,000 Lease Revenue 4,800 Sales revenue 1,290,000 Sales Returns & Allowances 25,800 Sales Discounts 13,000 Cost of Goods Sold 425,700 Supplies Expense 36,000 Interest Expense 900 Rent Expense 103,200 Wages Expense 480,000 Depreciation Expense - Equipment Other Operating Expenses 20,000 Income Tax Expense 52,000 $1,583,460 $1,583,460 Additional information: DvD Limited's April beginning inventory and April purchases of inventory are as follows (shown net of GST and 2% discount): Beginning inventory Purchase on 6 April Purchase return on 10 April Purchase on 25 April Quantity Unit Cost 200 $196 450 $196 $196 300 $196 Total Cost $39,200 $88,200 ($19,600) $58,800 (100) DvD Limited had two sales in the month of April (selling prices include GST): On 3 April, 150 units were sold, on credit, for a selling price of $690 per unit. On 28 April, 300 units were sold, on credit, for a selling price of $736 per unit. . . The following should be considered as possible adjustments/corrections to the unadjusted trial balance: DvD Limited adjusts its supplies account at the end of its financial year. Supply purchases during the year were debited to Supplies Expense and GST Clearing for $36,000 and $5,400, respectively. On 30 April, it was estimated that $2,000 of supplies, net of GST, remained on hand. As at 30 April 2020, the equipment had been depreciated on the straight line basis for a total of 10 months. On 1 October 2020, the company borrowed $20,000, due on 31 May 2022, with an annual interest rate of 9%. DvD Limted's bookkeeper debited Cash and credited Retained Earnings on the date of borrowing. Monthly interest on the loan is payable on the first of the following month, so that the first payment took place on 1 November and the last payment took place on 1 April. The interest payments were correctly journalised. . The $103,200 of Rent Expense, shown net of GST, represents rent paid for 15 months: May 2020 through July 2021. DvD Limted leases warehouse space to another merchant. When the merchant prepaid $5,520, GST inclusive, for 3 months of rent, DvD Limted debited Cash for $5,520, credited GST Clearing for $720, and credited Lease Revenue for $4,800. The first month of the lease was April 2021. After the 28 April sale, 20 of the smart watches were returned by the customer to DvD Limited. DvD Limted's bookkeeper failed to journalise anything relating to the return . The last payroll, for $18,000, was paid on 28 April and represented payment for the previous 10 days of work, including 28 April. The last payroll was correctly journalised; however, employees also worked the last two days of April for which they will be paid in May. Nothing was journalised with respect to these last two days. Page 2 of 8 Required: a) Reproduce the journal entry that had been correctly prepared by DvD Limted for the 3 April sales transaction. (4 marks) b) After the 450 unit purchase of 6 April and before payment, 100 units were returned to Alex Limted on 10 April. Reproduce the journal entry that had been correctly prepared by DvD Limted for the 10 April purchase return. (2 marks) c) Prepare a residual analysis, using the headings provided, for the 25 April credit purchase. (6 marks) Using the unadjusted trial balance and the additional information provided i) Prepare DvD Limted's Statement of Comprehensive Income for the year ended 30 April 2021, using the form and format discussed in class. Note that you do not have to prepare adjusting/correcting journal entries, postings, or an adjusted trial balance in your answer. (15 marks) d) ii) Prepare the post-closing trial balance as at 30 April 2021. The balance for Retained Earnings is $211,270. (14 marks)