What is/are the risk(s) faced by Jazztel in borrowing medium-term debt denominated in U.S. dollars or euros, given its Iberian footprint. solution

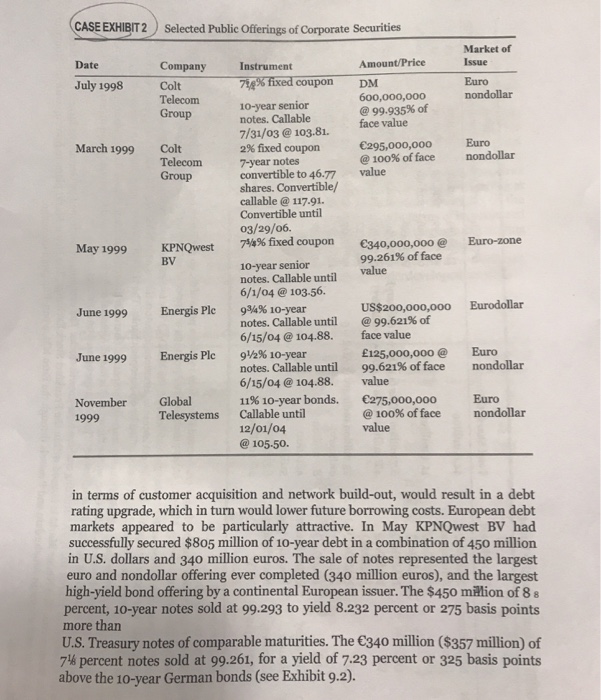

FINANCING STRATEGY Venturecapitalist andserial entrepreneurMartin Varsavskyprovided Jazztel'sinitial operating capital of pesetas (Pts) 60 million in June 1998. In February 1999 an ad- ditional 64.3 million of equity was raised from several private equity firms, such as Apax Partners and Advent International, which specialized in the financing of telecommunication firms. In April 1999, Jazztel expanded its financing base, successfully raising a two- tranche high-yield issue of 203-4 million. The offering consisted of 10o,ooo dollar- denominated units and 110,000 euro-denominated units. Each unit was worth $i,oooand1,000, respectively,and carried fivewarrants forthe purchase of Jazztel stock. The 10-year notes carried a coupon rate of 14 percent. Of the ?203.4 million in proceeds, 79.4 million was placed in an escrow ac- count to fund the first six biannual interest payments through 2001. No interest payments from company cash flow were scheduled until 2002. It was the largest such offering ever completed by a Spanish firm. Furthermore, the offering was two times oversubscribed. In July, to further support its capital expenditures (capex) requirements, the company secured a 30o million senior secured credit facility from a syndicate of banks, including Argenteria SA, Barclays Plc, and Chase Manhattan Corp., among others. The facility entailed two tranches: a 200 million term loan and a 10o million revolving facility. The term loan (Tranche A) carried an interest rate of 3.75 percent over Euribor. The revolving facility (Tranche B) carried an interest rate of 2.50 percent over Euribor. Both facilities had an eight-yeartenor. Both tranches were available subject to an extensive series of availability tests. Drawdown was monitored by ongoing operational and financial covenants, such as minimum coverage ratios and minimum annualized direct customer revenue levels. Although owning its own network was expected to eventually lower operating costs, the required capital expenditure for the network build-out was midable. Management expected cumulative capital expenditures to reach 566 million through 2003 with an additional 261 million required through 2008 Additional funding was required, and the timing seemed right for another round of financing Jazztel's initial debt offering had been assigned a rating of Caa2 by Moody's; however, management was hopeful that the company's favorable progress to da the euro-zone on January 1, The peseta (Pta) was Spain's national currency until Spainjo 999, adopting the euro as its currency at the exchange rate of Pta 166 - e