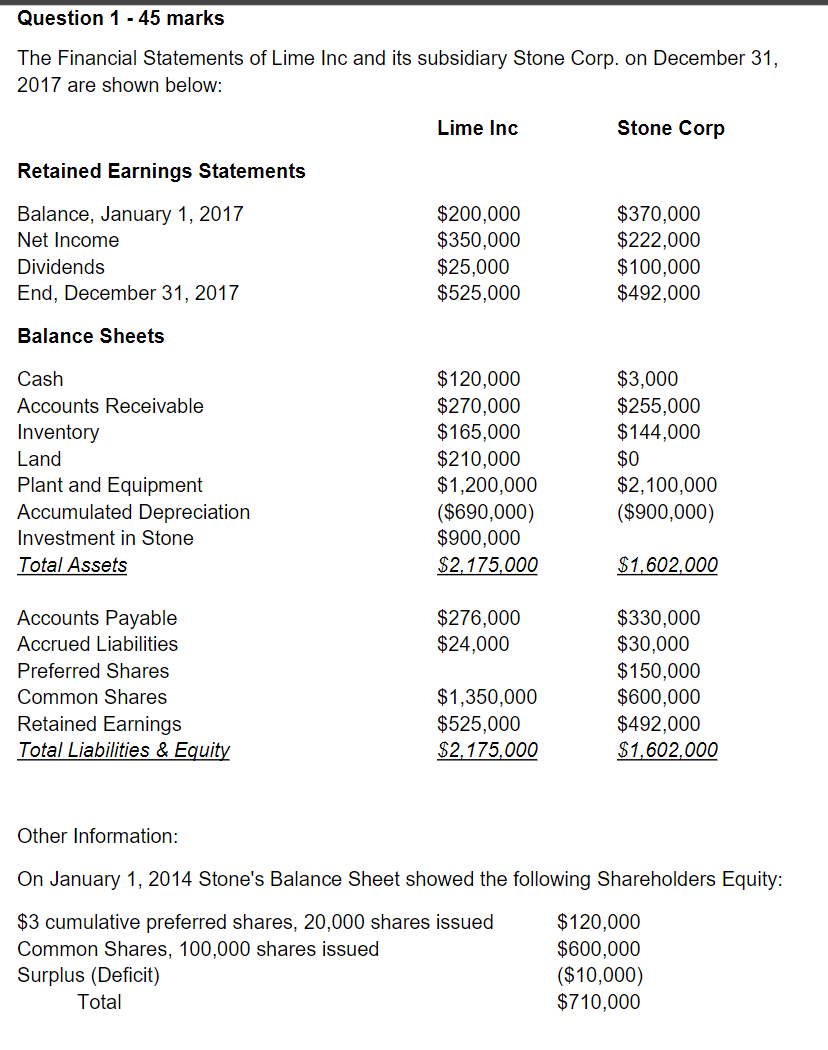

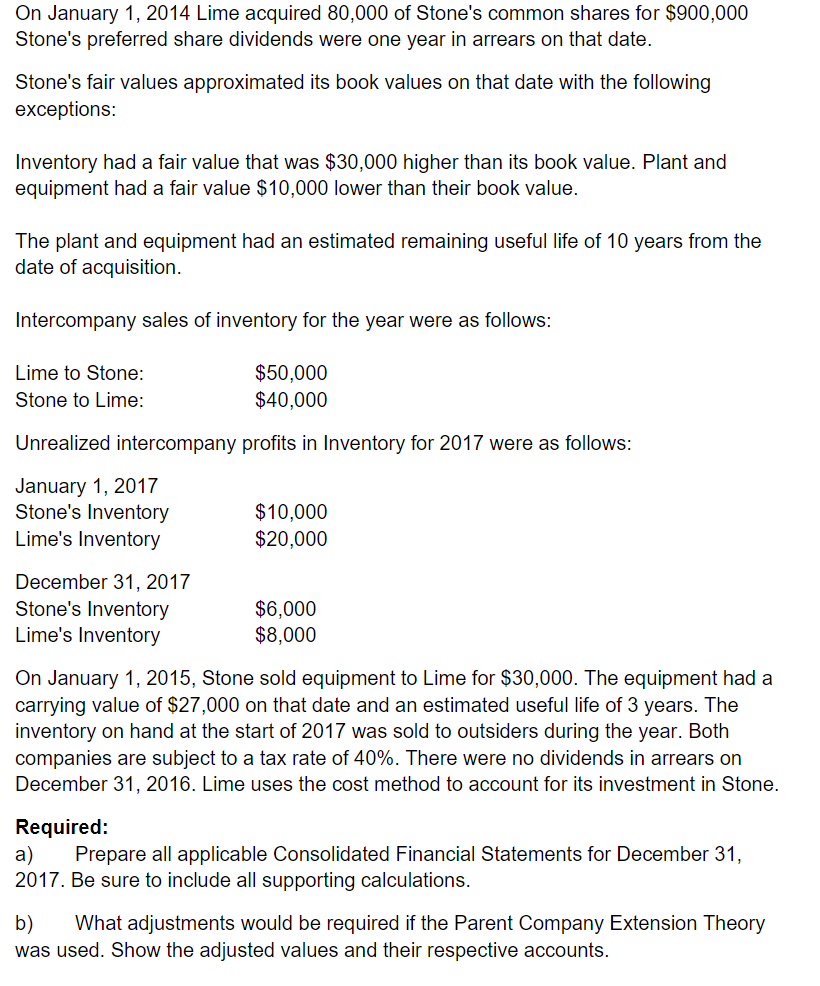

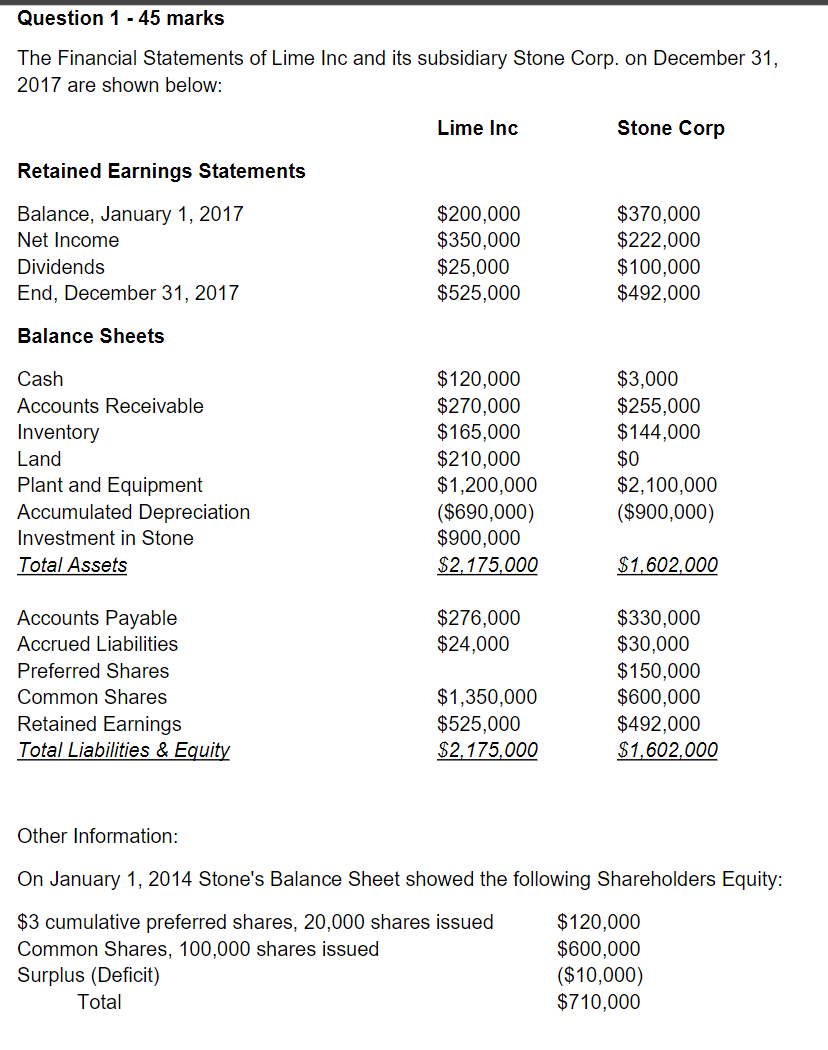

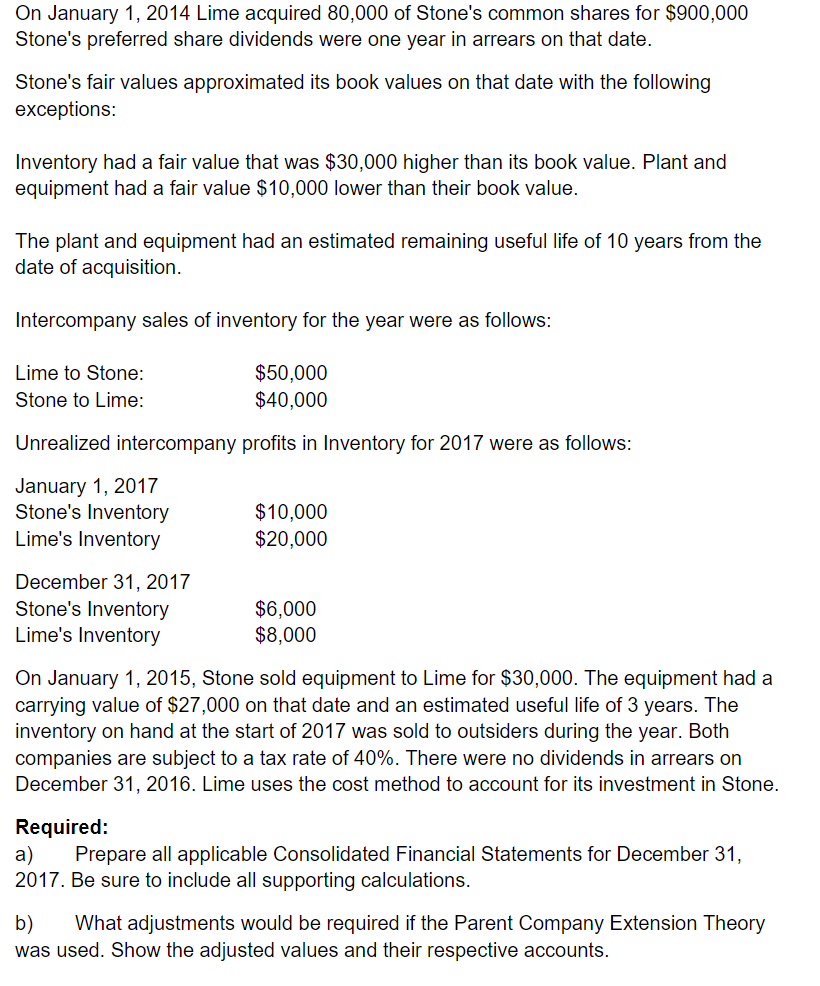

Question 1 - 45 marks The Financial Statements of Lime Inc and its subsidiary Stone Corp. on December 31, 2017 are shown below: Lime Inc Stone Corp Retained Earnings Statements Balance, January 1, 2017 Net Income Dividends End, December 31, 2017 $200,000 $350,000 $25,000 $525,000 $370,000 $222,000 $100,000 $492,000 Balance Sheets Cash Accounts Receivable Inventory Land Plant and Equipment Accumulated Depreciation Investment in Stone Total Assets $120,000 $270,000 $165,000 $210,000 $1,200,000 ($690,000) $900,000 $2,175,000 $3,000 $255,000 $144,000 $0 $2,100,000 ($900,000) $1,602,000 $276,000 $24,000 Accounts Payable Accrued Liabilities Preferred Shares Common Shares Retained Earnings Total Liabilities & Equity $330,000 $30,000 $150,000 $600,000 $492,000 $1,602,000 $1,350,000 $525,000 $2.175,000 Other Information: On January 1, 2014 Stone's Balance Sheet showed the following Shareholders Equity: $3 cumulative preferred shares, 20,000 shares issued $120,000 Common Shares, 100,000 shares issued $600,000 Surplus (Deficit) ($10,000) Total $710,000 On January 1, 2014 Lime acquired 80,000 of Stone's common shares for $900,000 Stone's preferred share dividends were one year in arrears on that date. Stone's fair values approximated its book values on that date with the following exceptions: Inventory had a fair value that was $30,000 higher than its book value. Plant and equipment had a fair value $10,000 lower than their book value. The plant and equipment had an estimated remaining useful life of 10 years from the date of acquisition. Intercompany sales of inventory for the year were as follows: Lime to Stone: Stone to Lime: $50,000 $40,000 Unrealized intercompany profits in Inventory for 2017 were as follows: $10,000 $20,000 January 1, 2017 Stone's Inventory Lime's Inventory December 31, 2017 Stone's Inventory Lime's Inventory $6,000 $8,000 On January 1, 2015, Stone sold equipment to Lime for $30,000. The equipment had a carrying value of $27,000 on that date and an estimated useful life of 3 years. The inventory on hand at the start of 2017 was sold to outsiders during the year. Both companies are subject to a tax rate of 40%. There were no dividends in arrears on December 31, 2016. Lime uses the cost method to account for its investment in Stone. Required: a) Prepare all applicable Consolidated Financial Statements for December 31, 2017. Be sure to include all supporting calculations. b) What adjustments would be required if the Parent Company Extension Theory was used. Show the adjusted values and their respective accounts