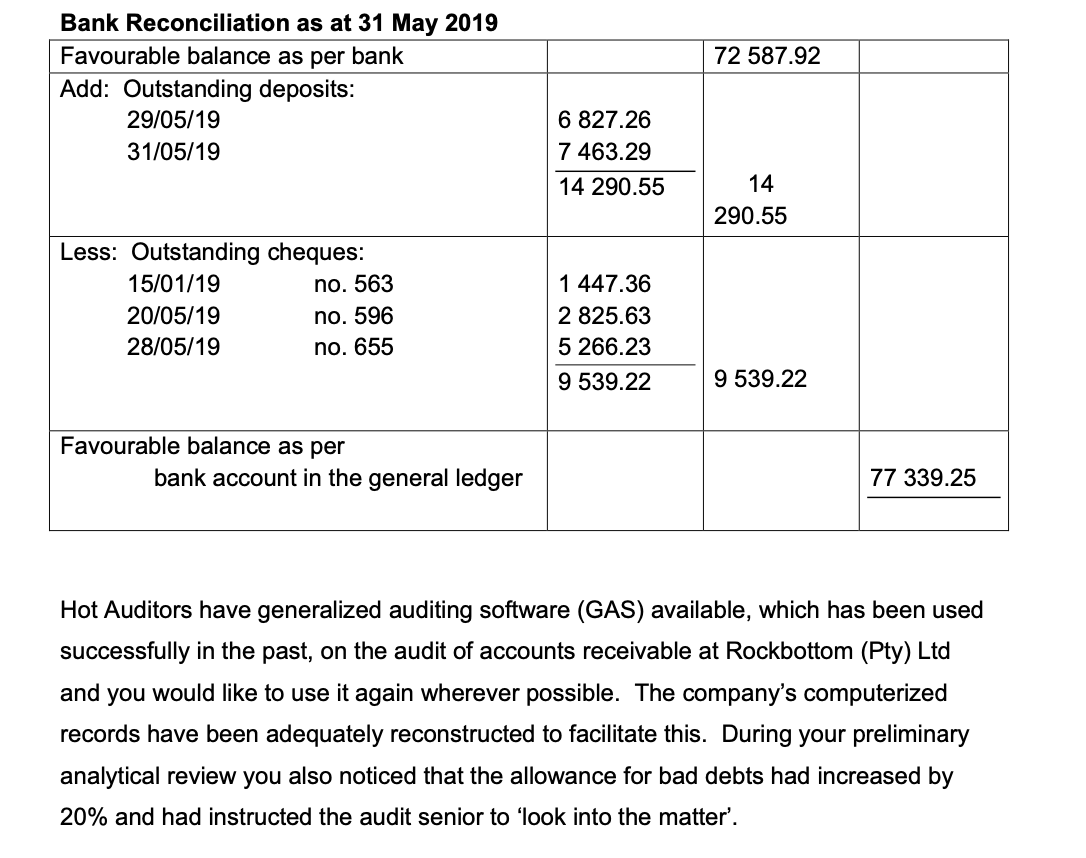

Question 1 [50] You are a partner in the auditing firm of Hot Auditors. You are currently engaged with the annual audit of one of your clients, Rockbottom (Pty) Ltd, a company which retails fashion footware. The company operates from twelve retail stores situated in a number of the larger centres in KwaZulu-Natal. A substantial proportion of all sales made are on credit and the terms are strictly 30 days. The head office of the company is situated in Newcastle. All accounting records are maintained on a computerized accounting system located in the head office building. The head office has network links to remote terminals at each of the retail stores. Transactions at the retail stores are updated via these terminals to the head office in daily batches. These daily batch files are normally stored for a period of two years. Rockbottom (Pty) Ltd suffered a major disaster in March this year, when vandals broke into the company's head office and destroyed virtually all of the computer equipment. As a result, most of the financial data and records on the computer, relating to accounts receivable, were lost, as this information had all been stored on the hard disk of one of the vandalized computers. The company subsequently had to undertake a costly and time-consuming manual reconstruction of its accounts receivable records, based on the hard copy documentation which existed at both head office and the twelve retail stores. Mick Foley, the financial manager, mentioned to you in discussion, that he was concerned about the possibility of similar disasters occurring in the future and has asked for advice from Hot Auditors in this regard. Although controls at Rockbottom (Pty) Ltd are generally good, you have established that no-one had known what to do, or where to start when the full extent of the vandalism had become clear. Mick Foley also provided you with a bank reconciliation based on the most recent set of bank statements received from the bank. Details are as follows: 72 587.92 Bank Reconciliation as at 31 May 2019 Favourable balance as per bank Add: Outstanding deposits: 29/05/19 31/05/19 6 827.26 7463.29 14 290.55 14 290.55 Less: Outstanding cheques: 15/01/19 no. 563 20/05/19 no. 596 28/05/19 no. 655 1 447.36 2 825.63 5 266.23 9 539.22 9 539.22 Favourable balance as per bank account in the general ledger 77 339.25 Hot Auditors have generalized auditing software (GAS) available, which has been used successfully in the past, on the audit of accounts receivable at Rockbottom (Pty) Ltd and you would like to use it again wherever possible. The company's computerized records have been adequately reconstructed to facilitate this. During your preliminary analytical review you also noticed that the allowance for bad debts had increased by 20% and had instructed the audit senior to 'look into the matter