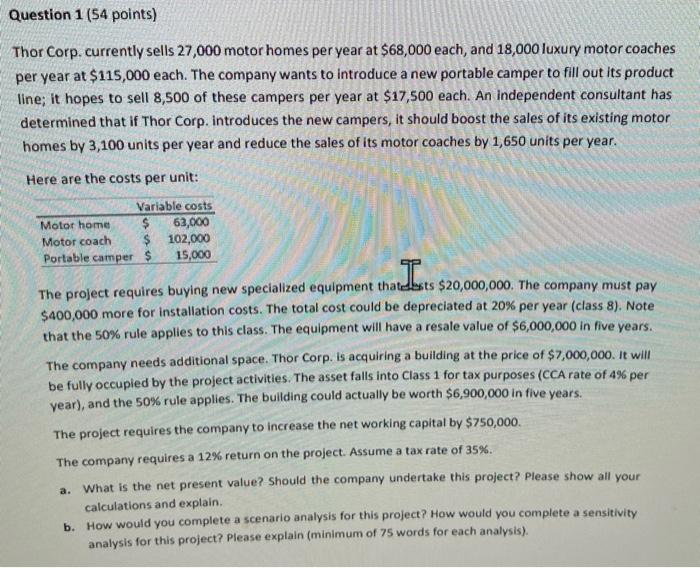

Question 1 (54 points) Thor Corp.currently sells 27,000 motor homes per year at $68,000 each, and 18,000 luxury motor coaches per year at $115,000 each. The company wants to introduce a new portable camper to fill out its product line; it hopes to sell 8,500 of these campers per year at $17,500 each. An independent consultant has determined that if Thor Corp. introduces the new campers, it should boost the sales of its existing motor homes by 3,100 units per year and reduce the sales of its motor coaches by 1,650 units per year. Here are the costs per unit: Variable costs Motor home $ 63,000 Motor coach $ 102,000 Portable camper $ 15,000 The project requires buying new specialized equipment thateksts $20,000,000. The company must pay $400,000 more for installation costs. The total cost could be depreciated at 20% per year (class 8). Note that the 50% rule applies to this class. The equipment will have a resale value of $6,000,000 in five years. The company needs additional space. Thor Corp. is acquiring a building at the price of $7,000,000. It will be fully occupied by the project activities. The asset falls into Class 1 for tax purposes (CCA rate of 4% per year), and the 50% rule applies. The building could actually be worth $6,900,000 in five years. The project requires the company to increase the networking capital by $750,000 The company requires a 12% return on the project. Assume a tax rate of 35%. a. What is the net present value? Should the company undertake this project? Please show all your calculations and explain. b. How would you complete a scenario analysis for this project? How would you complete a sensitivity analysis for this project? Please explain (minimum of 75 words for each analysis). Question 1 (54 points) Thor Corp.currently sells 27,000 motor homes per year at $68,000 each, and 18,000 luxury motor coaches per year at $115,000 each. The company wants to introduce a new portable camper to fill out its product line; it hopes to sell 8,500 of these campers per year at $17,500 each. An independent consultant has determined that if Thor Corp. introduces the new campers, it should boost the sales of its existing motor homes by 3,100 units per year and reduce the sales of its motor coaches by 1,650 units per year. Here are the costs per unit: Variable costs Motor home $ 63,000 Motor coach $ 102,000 Portable camper $ 15,000 The project requires buying new specialized equipment thateksts $20,000,000. The company must pay $400,000 more for installation costs. The total cost could be depreciated at 20% per year (class 8). Note that the 50% rule applies to this class. The equipment will have a resale value of $6,000,000 in five years. The company needs additional space. Thor Corp. is acquiring a building at the price of $7,000,000. It will be fully occupied by the project activities. The asset falls into Class 1 for tax purposes (CCA rate of 4% per year), and the 50% rule applies. The building could actually be worth $6,900,000 in five years. The project requires the company to increase the networking capital by $750,000 The company requires a 12% return on the project. Assume a tax rate of 35%. a. What is the net present value? Should the company undertake this project? Please show all your calculations and explain. b. How would you complete a scenario analysis for this project? How would you complete a sensitivity analysis for this project? Please explain (minimum of 75 words for each analysis)