Answered step by step

Verified Expert Solution

Question

1 Approved Answer

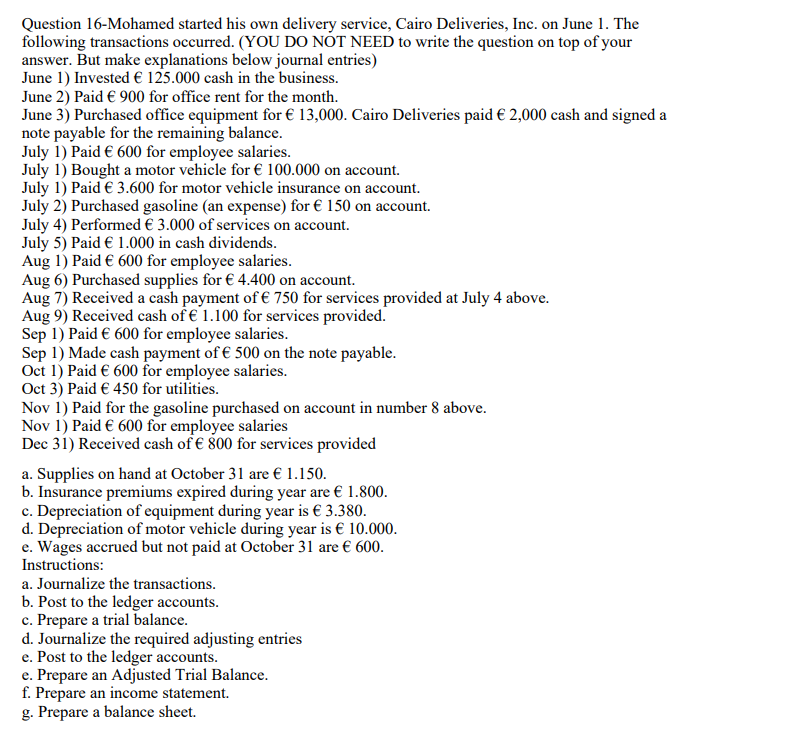

Question 1 6 - Mohamed started his own delivery service, Cairo Deliveries, Inc. on June 1 . The following transactions occurred. ( YOU DO NOT

Question Mohamed started his own delivery service, Cairo Deliveries, Inc. on June The

following transactions occurred. YOU DO NOT NEED to write the question on top of your

answer. But make explanations below journal entries

June Invested cash in the business.

June Paid for office rent for the month.

June Purchased office equipment for Cairo Deliveries paid cash and signed a

note payable for the remaining balance.

July Paid for employee salaries.

July Bought a motor vehicle for on account.

July Paid for motor vehicle insurance on account.

July Purchased gasoline an expense for on account.

July Performed of services on account.

July Paid in cash dividends.

Aug Paid for employee salaries.

Aug Purchased supplies for on account.

Aug Received a cash payment of for services provided at July above.

Aug Received cash of for services provided.

Sep Paid for employee salaries.

Sep Made cash payment of on the note payable.

Oct Paid for employee salaries.

Oct Paid for utilities.

Nov Paid for the gasoline purchased on account in number above.

Nov Paid for employee salaries

Dec Received cash of for services provided

a Supplies on hand at October are

b Insurance premiums expired during year are

c Depreciation of equipment during year is

d Depreciation of motor vehicle during year is

e Wages accrued but not paid at October are

Instructions:

a Journalize the transactions.

b Post to the ledger accounts.

c Prepare a trial balance.

d Journalize the required adjusting entries

e Post to the ledger accounts.

e Prepare an Adjusted Trial Balance.

f Prepare an income statement.

g Prepare a balance sheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started