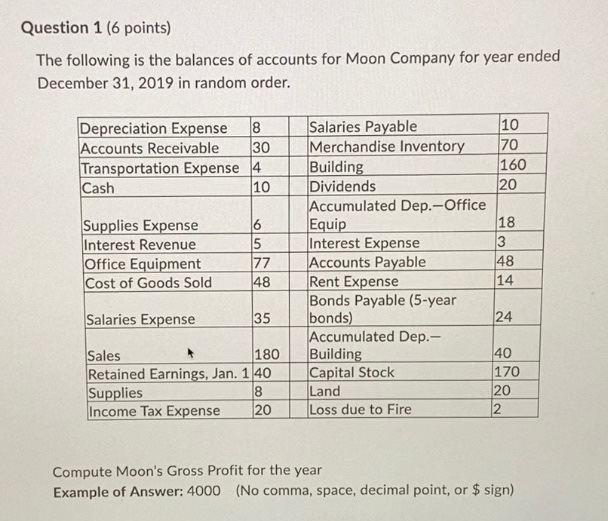

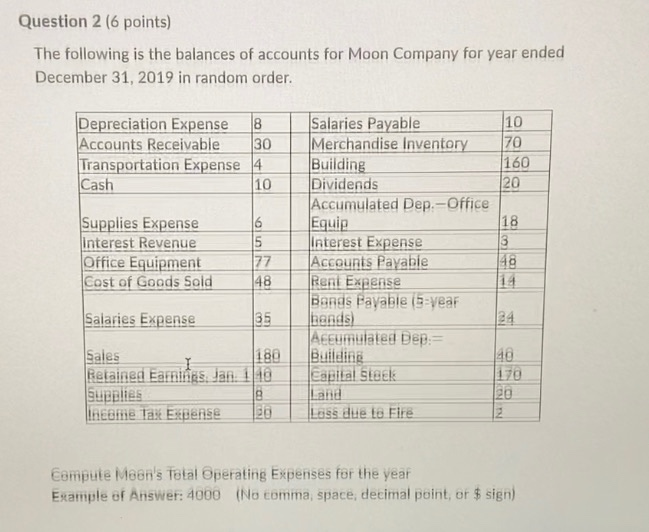

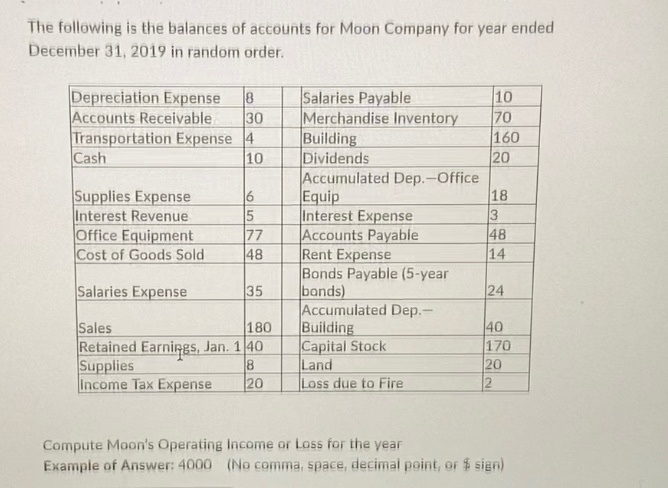

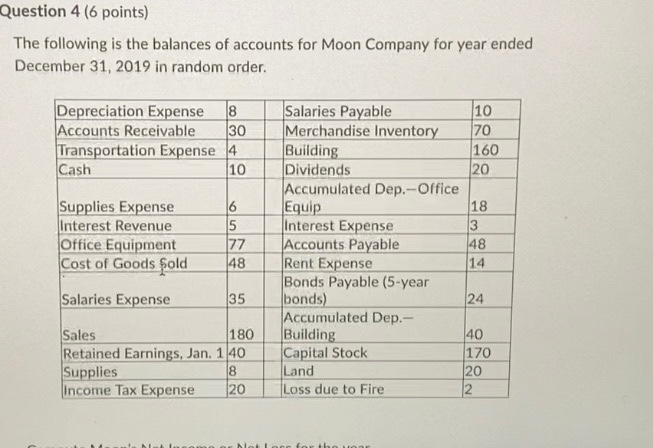

Question 1 (6 points) The following is the balances of accounts for Moon Company for year ended December 31, 2019 in random order. Depreciation Expense 8 Accounts Receivable 30 Transportation Expense 4 Cash 10 Supplies Expense Interest Revenue Office Equipment Cost of Goods Sold 6 5 177 48 Salaries Payable 10 Merchandise Inventory 70 Building 160 Dividends 20 Accumulated Dep.-Office Equip 18 Interest Expense 3 Accounts Payable 48 Rent Expense 14 Bonds Payable (5-year bonds) 24 Accumulated Dep.- Building 40 Capital Stock 170 Land 20 Loss due to Fire 2 Salaries Expense 35 Sales 180 Retained Earnings, Jan. 1 40 Supplies 8 Income Tax Expense 20 Compute Moon's Gross Profit for the year Example of Answer: 4000 (No comma, space, decimal point, or $ sign) Question 2 (6 points) The following is the balances of accounts for Moon Company for year ended December 31, 2019 in random order. Depreciation Expense 8 Accounts Receivable 30 Transportation Expense 4 Cash 10 Supplies Expense Interest Revenue Office Equipment Cost of Goods Sold 16 15 177 Salaries Payable 10 Merchandise Inventory 70 Building 160 Dividends 20 Accumulated Dep.-Office Equip 18 Interest Expense 3 Accounts Payable 49 Rent Expense 14 Bangs Payable (svear bends) Accumulates Dep:= 48 Eapital Steek 148 Salaries Expense 35 Sales 189 Retained Earnines, Jan. 110 Supplies 8 Income Tax Extense Lass due la Fire Campute Meen's Total Operating Expenses for the year Example of Answer: 4000 (No comma, space, decimal point, or $ sign) The following is the balances of accounts for Moon Company for year ended December 31, 2019 in random order. Depreciation Expense 8 Accounts Receivable 30 Transportation Expense 4 Cash 10 Supplies Expense Interest Revenue Office Equipment Cost of Goods Sold 15 77 48 Salaries Payable 10 Merchandise Inventory 70 Building 160 Dividends 20 Accumulated Dep.-Office Equip 18 Interest Expense 3 Accounts Payable Rent Expense 14 Bonds Payable (5-year bonds) 24 Accumulated Dep.- Building 40 Capital Stock 170 Land 20 Loss due to Fire 2 48 Salaries Expense 35 Sales 180 Retained Earnings, Jan. 140 Supplies 8 Income Tax Expense 20 Compute Moon's Operating income or Loss for the year Example of Answer: 4000 (No comma, space, decimal point, or $ sien) Question 4 (6 points) The following is the balances of accounts for Moon Company for year ended December 31, 2019 in random order. Depreciation Expense 8 Accounts Receivable 30 Transportation Expense 4 Cash 10 Supplies Expense Interest Revenue Office Equipment Cost of Goods Sold Salaries Expense 16 5 77 48 Salaries Payable 10 Merchandise Inventory 70 Building 160 Dividends 20 Accumulated Dep.-Office Equip 18 Interest Expense 3 Accounts Payable 48 Rent Expense 14 Bonds Payable (5-year bonds) 24 Accumulated Dep.- Building 40 Capital Stock 170 Land 20 Loss due to Fire 2 35 Sales 180 Retained Earnings, Jan. 140 Supplies 8 Income Tax Expense 20 nunni