Answered step by step

Verified Expert Solution

Question

1 Approved Answer

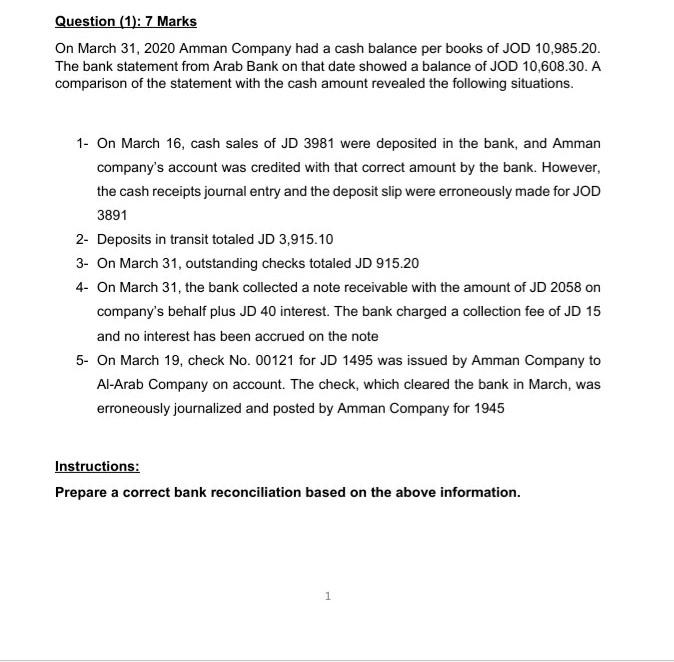

Question (1): 7 Marks On March 31, 2020 Amman Company had a cash balance per books of JOD 10,985.20. The bank statement from Arab Bank

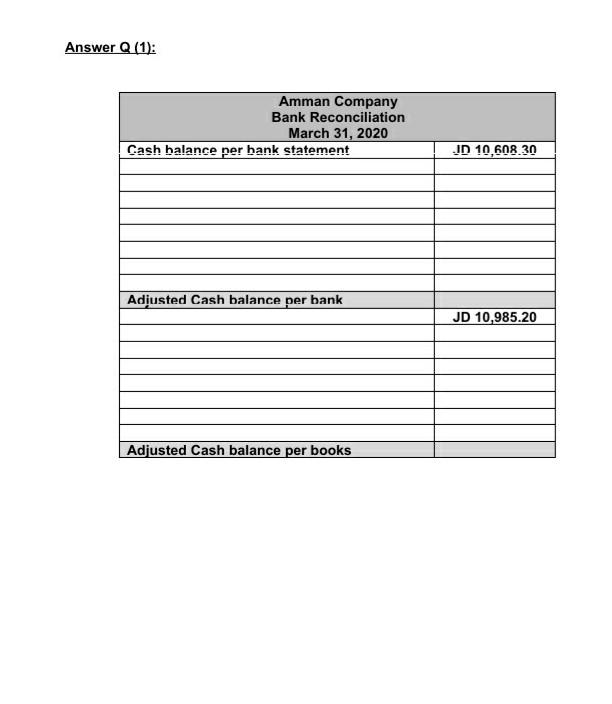

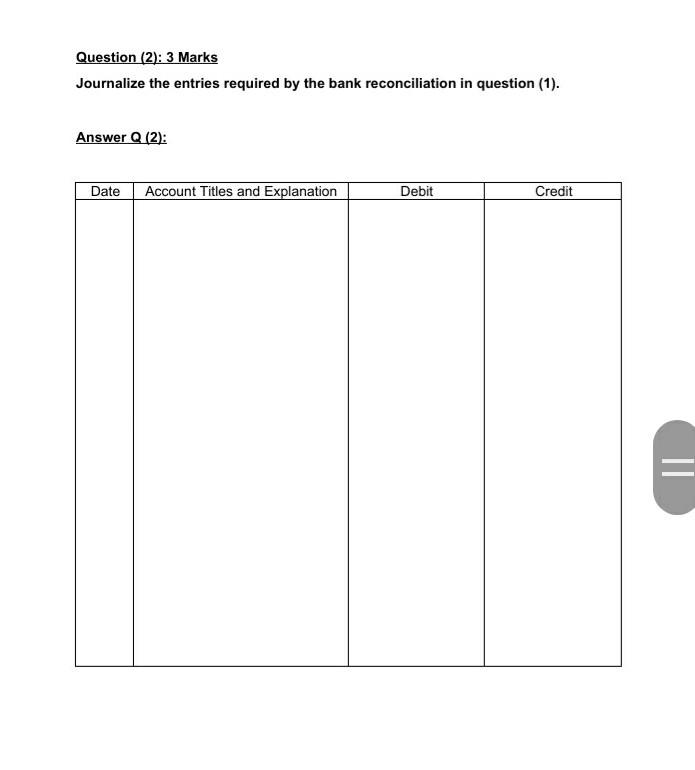

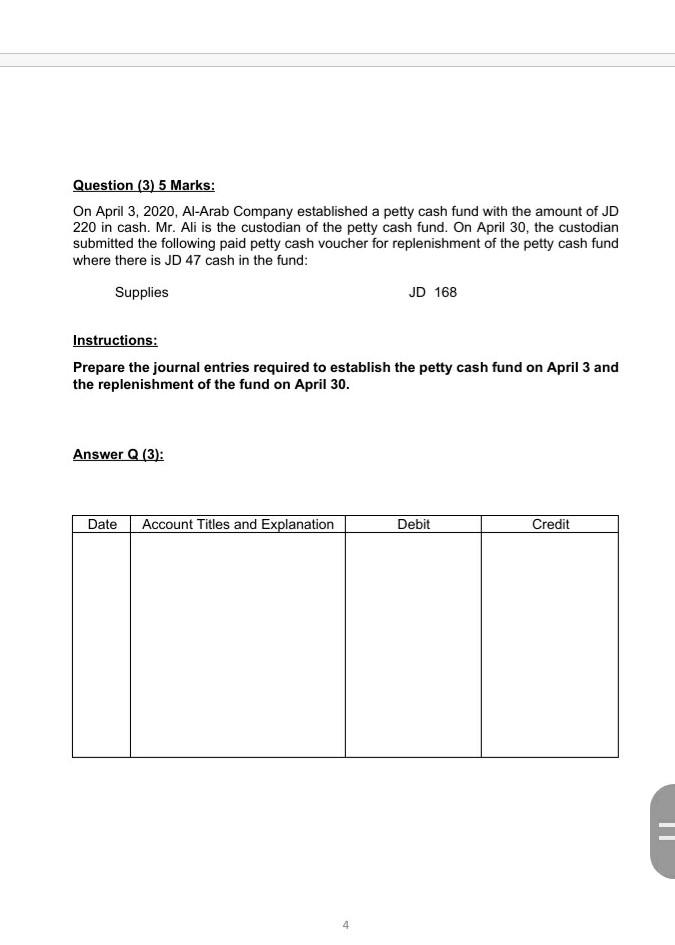

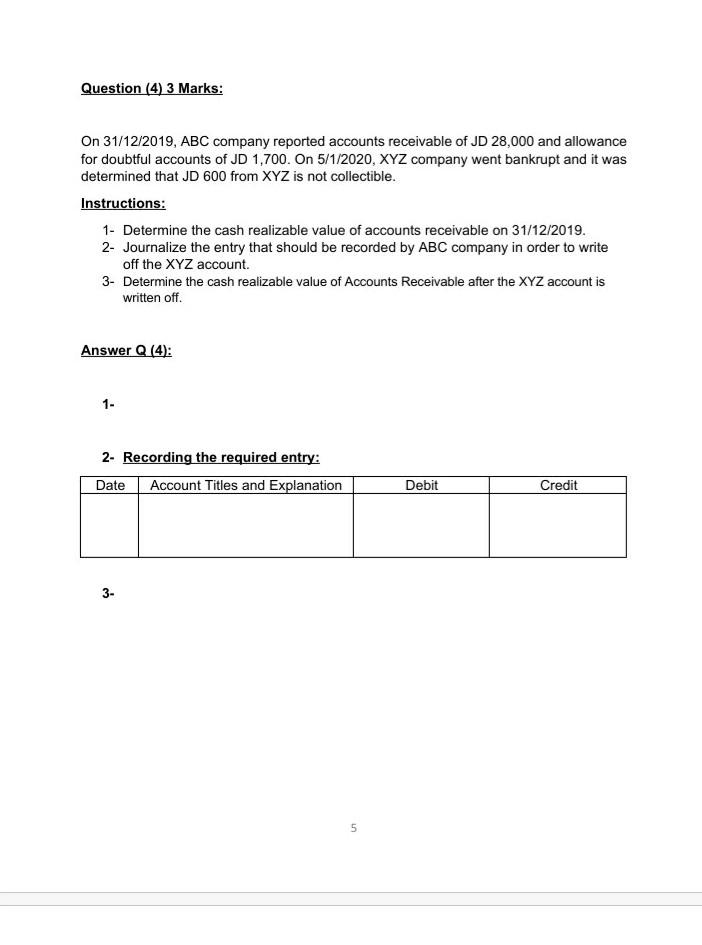

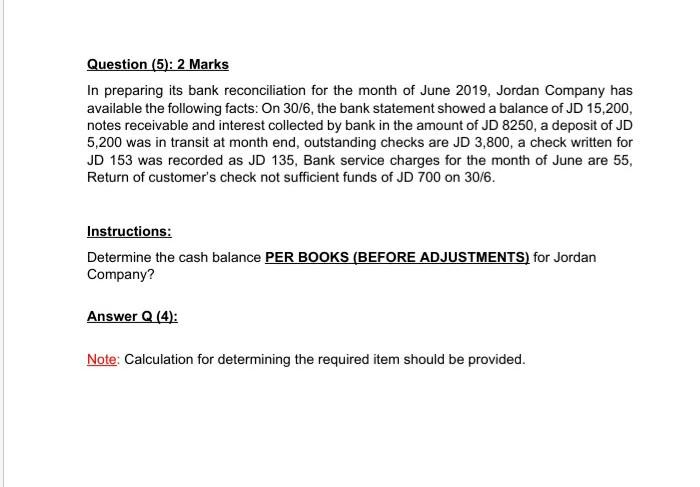

Question (1): 7 Marks On March 31, 2020 Amman Company had a cash balance per books of JOD 10,985.20. The bank statement from Arab Bank on that date showed a balance of JOD 10,608.30. A comparison of the statement with the cash amount revealed the following situations. 1- On March 16, cash sales of JD 3981 were deposited in the bank, and Amman company's account was credited with that correct amount by the bank. However, the cash receipts journal entry and the deposit slip were erroneously made for JOD 3891 2- Deposits in transit totaled JD 3,915.10 3- On March 31, outstanding checks totaled JD 915.20 4- On March 31, the bank collected a note receivable with the amount of JD 2058 on company's behalf plus JD 40 interest. The bank charged a collection fee of JD 15 and no interest has been accrued on the note 5- On March 19, check No. 00121 for JD 1495 was issued by Amman Company to Al-Arab Company on account. The check, which cleared the bank in March, was erroneously journalized and posted by Amman Company for 1945 Instructions: Prepare a correct bank reconciliation based on the above information. 1 Answer Q (1): Amman Company Bank Reconciliation March 31, 2020 Cash balance per bank statement JD 10,608 30 Adjusted Cash balance per bank JD 10,985.20 Adjusted Cash balance per books Question (2): 3 Marks Journalize the entries required by the bank reconciliation in question (1). Answer Q (2): Date Account Titles and Explanation Debit Credit Question (3) 5 Marks: On April 3, 2020, Al-Arab Company established a petty cash fund with the amount of JD 220 in cash. Mr. Ali is the custodian of the petty cash fund. On April 30, the custodian submitted the following paid petty cash voucher for replenishment of the petty cash fund where there is JD 47 cash in the fund: Supplies JD 168 Instructions: Prepare the journal entries required to establish the petty cash fund on April 3 and the replenishment of the fund on April 30. Answer Q (3): Date Account Titles and Explanation Debit Credit 4 Question (5): 2 Marks In preparing its bank reconciliation for the month of June 2019, Jordan Company has available the following facts: On 30/6, the bank statement showed a balance of JD 15,200, notes receivable and interest collected by bank in the amount of JD 8250, a deposit of JD 5,200 was in transit at month end, outstanding checks are JD 3,800, a check written for JD 153 was recorded as JD 135, Bank service charges for the month of June are 55, Return of customer's check not sufficient funds of JD 700 on 30/6. Instructions: Determine the cash balance PER BOOKS (BEFORE ADJUSTMENTS) for Jordan Company? Answer Q (4): Note: Calculation for determining the required item should be provided

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started