Answered step by step

Verified Expert Solution

Question

1 Approved Answer

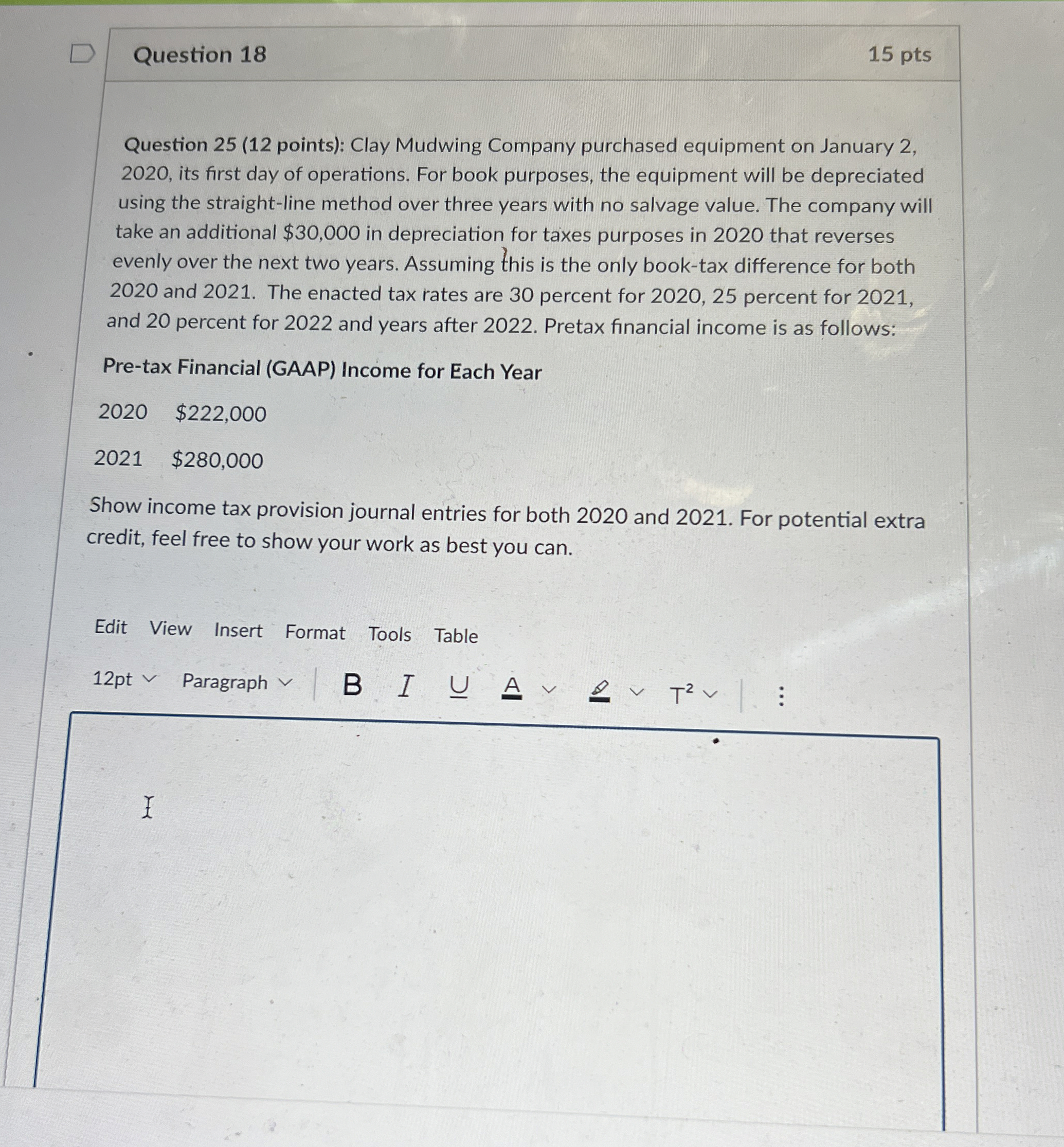

Question 1 8 1 5 pts Question 2 5 ( 1 2 points ) : Clay Mudwing Company purchased equipment on January 2 , 2

Question

pts

Question points: Clay Mudwing Company purchased equipment on January its first day of operations. For book purposes, the equipment will be depreciated using the straightline method over three years with no salvage value. The company will take an additional $ in depreciation for taxes purposes in that reverses evenly over the next two years. Assuming this is the only booktax difference for both and The enacted tax rates are percent for percent for and percent for and years after Pretax financial income is as follows:

Pretax Financial GAAP Income for Each Year

$

$

Show income tax provision journal entries for both and For potential extra credit, feel free to show your work as best you can.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started