Answered step by step

Verified Expert Solution

Question

1 Approved Answer

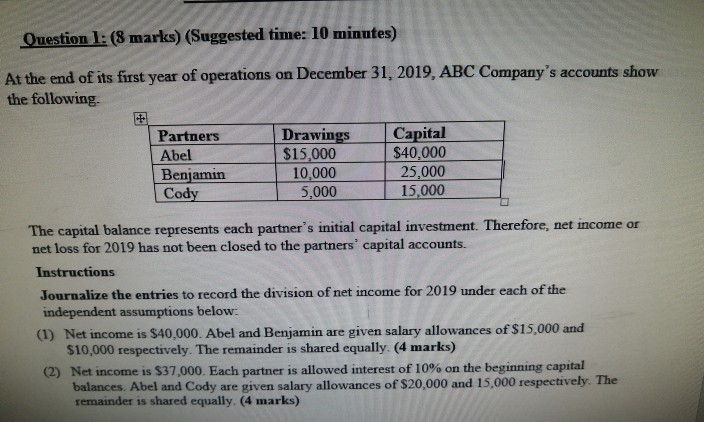

Question 1: (8 marks) (Suggested time: 10 minutes) At the end of its first year of operations on December 31, 2019, ABC Company's accounts show

Question 1: (8 marks) (Suggested time: 10 minutes) At the end of its first year of operations on December 31, 2019, ABC Company's accounts show the following. Partners Abel Benjamin Cody Drawings $15,000 10,000 5,000 Capital $40,000 25.000 15,000 The capital balance represents each partner's initial capital investment. Therefore, net income or net loss for 2019 has not been closed to the partners' capital accounts. Instructions Journalize the entries to record the division of net income for 2019 under each of the independent assumptions below: (1) Net income is $40,000. Abel and Benjamin are given salary allowances of $15,000 and $10,000 respectively. The remainder is shared equally (4 marks) (2) Net income is $37,000. Each partner is allowed interest of 10% on the beginning capital balances. Abel and Cody are given salary allowances of $20,000 and 15,000 respectively. The remainder is shared equally. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started