Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1: a. Calculate and briefly explain regarding the cash conversion cycle (CCC) status of the company. (10 marks) Question 4: a. Survey short-term loan

Question 1:

a. Calculate and briefly explain regarding the cash conversion cycle (CCC) status of the company. (10 marks)

Question 4:

a. Survey short-term loan product from the bank for the companys working capital. Then identify and explain any three (3) sources of short-term financing from bank. (9 Marks)

b. Discuss the pros and cons of the above sources of short-term financing that have been selected. (10 Marks) c. Identify the best/ appropriate sources to obtain the additional capital and state your reasons (minimum five reasons). (11 Marks)

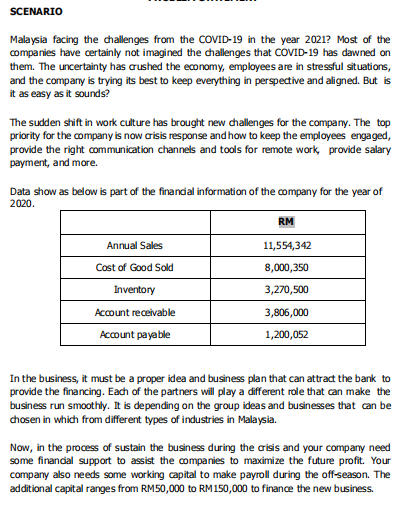

SCENARIO Malaysia facing the challenges from the COVID-19 in the year 2021? Most of the companies have certainly not imagined the challenges that COVID-19 has dawned on them. The uncertainty has crushed the economy, employees are in stressful situations, and the company is trying its best to keep everything in perspective and aligned. But is it as easy as it sounds? The sudden shift in work culture has brought new challenges for the company. The top priority for the company is now crisis response and how to keep the employees engaged, provide the right communication channels and tools for remote work provide salary payment, and more Data show as below is part of the financial information of the company for the year of 2020. RM Annual Sales 11,554,342 8,000,350 3,270,500 Cost of Good Sold Inventory Account receivable Account payable 3,806,000 1,200,052 In the business, it must be a proper idea and business plan that can attract the bank to provide the financing. Each of the partners will play a different role that can make the business run smoothly. It is depending on the group ideas and businesses that can be chosen in which from different types of industries in Malaysia. Now, in the process of sustain the business during the crisis and your company need some financial support to assist the companies to maximize the future profit. Your company also needs some working capital to make payroll during the off-season. The additional capital ranges from RM50,000 to RM150,000 to finance the new businessStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started