Answered step by step

Verified Expert Solution

Question

1 Approved Answer

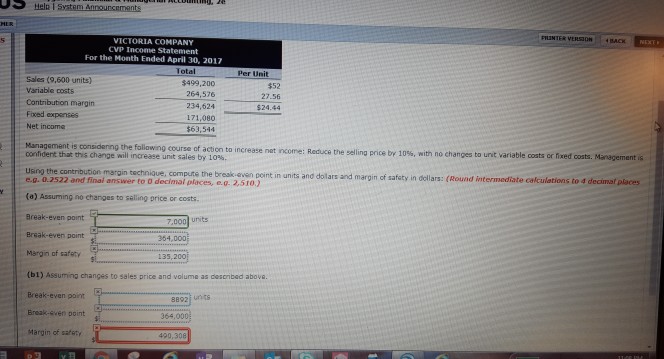

help please THANK you VICTORIA COMPANY CVP Income Statement For the Month Ended April 30, 2017 Per Unit Sales (9,600 units) variable costs Contribution margirn

help please

THANK you

VICTORIA COMPANY CVP Income Statement For the Month Ended April 30, 2017 Per Unit Sales (9,600 units) variable costs Contribution margirn Foxed expenses Net income $499,200 264,576 234,624 171,080 $63,544 $52 27.56 24.44 er a ement s conso e ng the o own confident that this course of action to increase net re ne: Reace the se i ng prce or 10% Reduce the selling price by 10%, with no changes to unt variable costs or s to unt anable costs r fixed co s. Managements change will increase unat sales by 10%. th no c a using the contribution margin technique, compute the break-even point in units and dolars and m e.g. 0.2522 and final answer to 0 decimai places, e.o. 2,510) argin of safsty in dollars: (Round intermediate calculations to d decimaf places (o) Assuming ne changes to selling orice or costs. Break-even point Break-even point Margin of safety (b1) Assuming changes to sales price and volume as dlescribed abova. Break-even paint Break-sven point Margin of safety 7.000 units 354 8892 unts 364Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started