Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 A company that produces electric cars is considering expanding its production capacity. The company estimates that the first car produced will cost

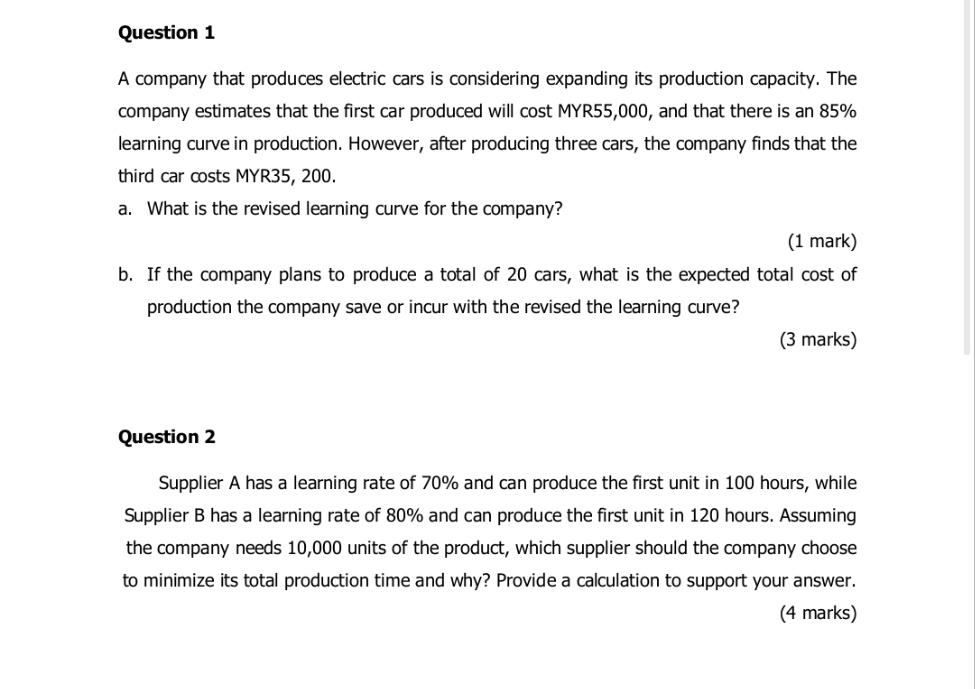

Question 1 A company that produces electric cars is considering expanding its production capacity. The company estimates that the first car produced will cost MYR55,000, and that there is an 85% learning curve in production. However, after producing three cars, the company finds that the third car costs MYR35, 200. a. What is the revised learning curve for the company? (1 mark) b. If the company plans to produce a total of 20 cars, what is the expected total cost of production the company save or incur with the revised the learning curve? (3 marks) Question 2 Supplier A has a learning rate of 70% and can produce the first unit in 100 hours, while Supplier B has a learning rate of 80% and can produce the first unit in 120 hours. Assuming the company needs 10,000 units of the product, which supplier should the company choose to minimize its total production time and why? Provide a calculation to support your answer. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To find the revised learning curve we can use the learning curve formula Revised Cost Initial Cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started