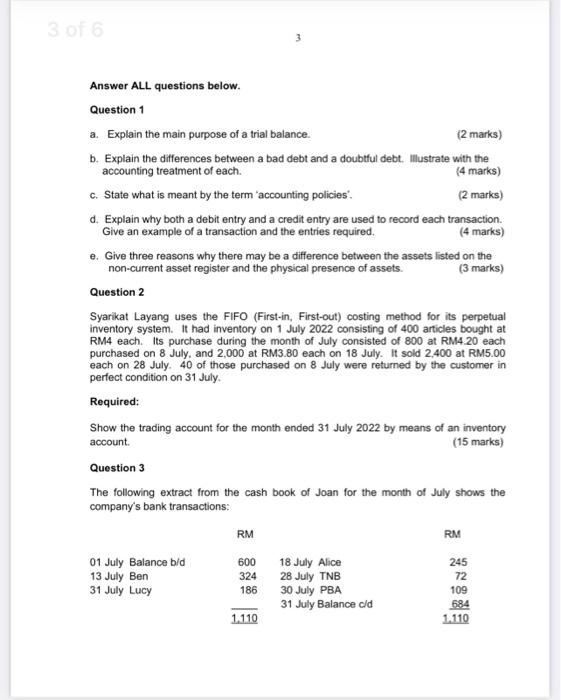

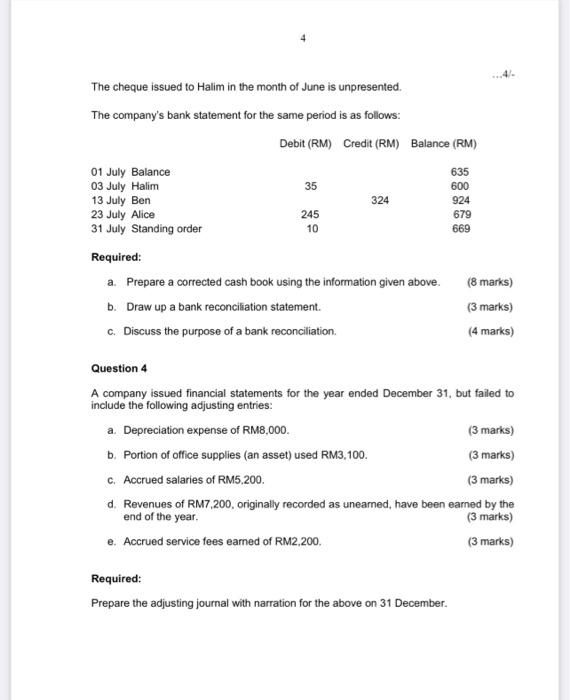

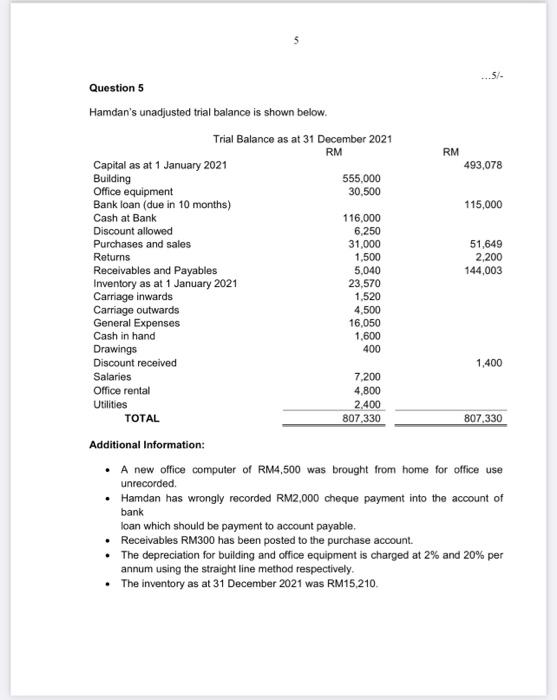

Question 1 a. Explain the main purpose of a trial balance. (2 marks) b. Explain the differences between a bad debt and a doubtful debt. Illustrate with the accounting treatment of each. (4 marks) c. State what is meant by the term 'accounting policies'. (2 marks) d. Explain why both a debit entry and a credit entry are used to record each transaction. Give an example of a transaction and the entries required. (4 marks) e. Give three reasons why there may be a difference between the assets listed on the non-current asset register and the physical presence of assets. (3 marks) The cheque issued to Halim in the month of June is unpresented. The company's bank statement for the same period is as follows: Required: a. Prepare a corrected cash book using the information given above. (8 marks) b. Draw up a bank reconciliation statement. (3 marks) c. Discuss the purpose of a bank reconciliation. (4 marks) Question 4 A company issued financial statements for the year ended December 31 , but failed to include the following adjusting entries: a. Depreciation expense of RM8,000. (3 marks) b. Portion of office supplies (an asset) used RM3,100. (3 marks) c. Accrued salaries of RM5.200. (3 marks) d. Revenues of RM7,200, originally recorded as uneamed, have been earned by the end of the year. (3 marks) e. Accrued service fees eamed of RM2,200. (3 marks) Required: Prepare the adjusting journal with narration for the above on 31 December. Question 5 Hamdan's unadjusted trial balance is shown below. Additional Information: - A new office computer of RM4,500 was brought from home for office use unrecorded. - Hamdan has wrongly recorded RM2,000 cheque payment into the account of bank loan which should be payment to account payable, - Receivables RM300 has been posted to the purchase account. - The depreciation for building and office equipment is charged at 2% and 20% per annum using the straight line method respectively. - The inventory as at 31 December 2021 was RM15,210. Required: a. Prepare General Journal for the above additional information. (6 marks) b. Prepare the statement of comprehensive income for the year ended 31 December 2021. (22 marks) c. Prepare the statement of financial position as at 31 December 2021. (12 marks]