Question

Question 1 (a) (i) With reference to IAS (36) briefly discuss the relevance of the impairment of tangible non-current assets, explaining the steps required in

Question 1 (a) (i) With reference to IAS (36) briefly discuss the relevance of the impairment of tangible non-current assets, explaining the steps required in an impairment review. (ii) Tonson Plc had acquired a machine on 1 January 2020 at a cost of 100,000 with an estimated useful economic life of ten years. The fair value of the machine is 52,000 and the selling costs are 4,000. The expected future cash flows are 10,000 per annum for the next five years. The current cost of capital is 10%. An annuity factor for this rate over this period is 3.791. Required: Prepare extracts from the financial statement for the year-ended 31 December 2020. Show all your workings. (b) (i) Briefly consider the role of cash generating units (CGU) in the impairment of Goodwill.

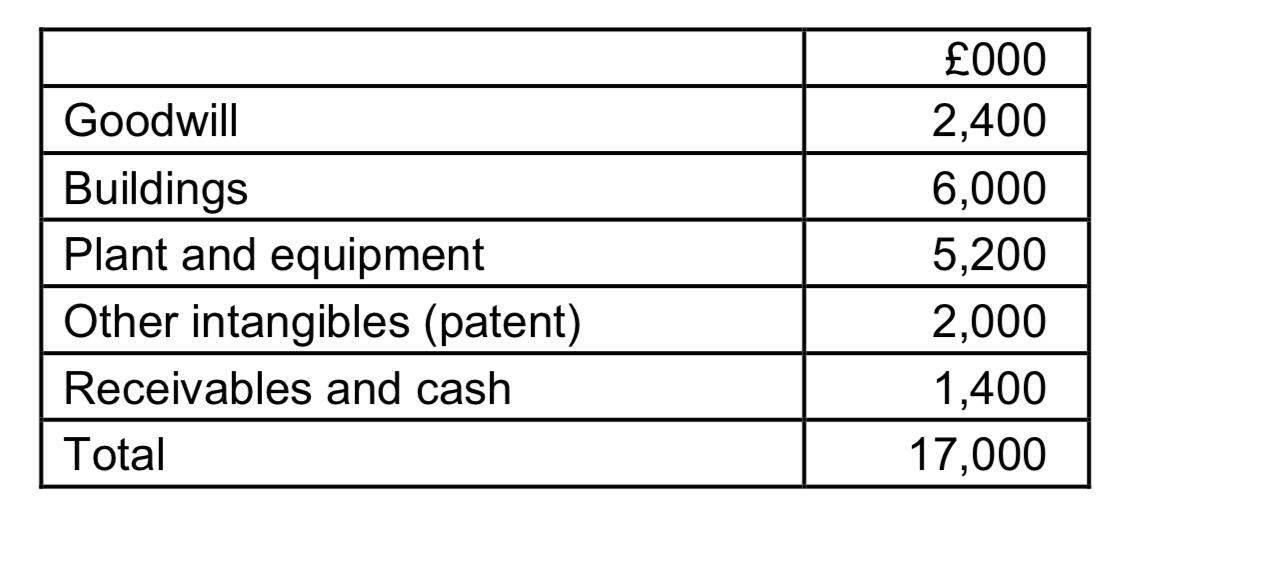

(ii) Oracle Plc owned100% of the equity share capital of Red Plc, a wholly owned subsidiary. The assets at the reporting date of Red Plc were as follows: On the reporting date a fire within one of Reds buildings led to an impairment review being carried out. The recoverable amount of the business was determined to be 9.8 million. The fire destroyed some plant and equipment with a carrying value of 1.2 million and there was no option but to scrap it. The other intangibles consist of a licence to operate Reds plant and equipment. Following the scrapping of some of the plant and equipment a competitor offered to purchase the patent for 1.5 million. The receivables and cash are both stated at their realisable value and do not require impairment. Required: Show how the impairment loss in Red is allocated amongst the assets. Show all your workings.

On the reporting date a fire within one of Reds buildings led to an impairment review being carried out. The recoverable amount of the business was determined to be 9.8 million. The fire destroyed some plant and equipment with a carrying value of 1.2 million and there was no option but to scrap it. The other intangibles consist of a licence to operate Reds plant and equipment. Following the scrapping of some of the plant and equipment a competitor offered to purchase the patent for 1.5 million. The receivables and cash are both stated at their realisable value and do not require impairment. Required: Show how the impairment loss in Red is allocated amongst the assets. Show all your workings.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started