Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Research and Development projects in the New Product Development and Innovation are capital intensive and required adequate finance to avoid locking up scarce

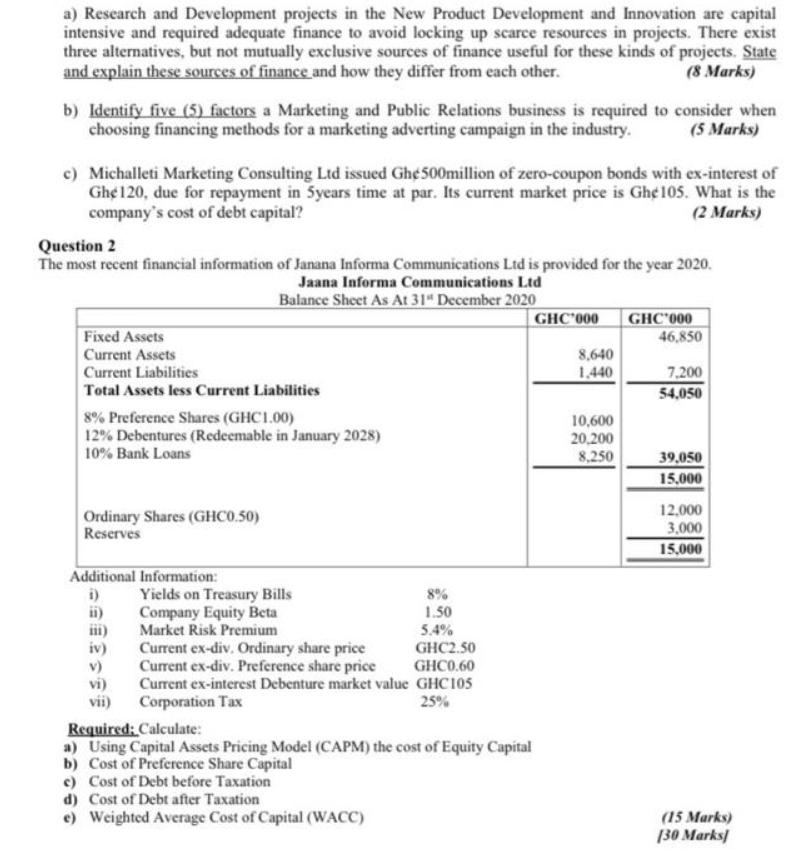

a) Research and Development projects in the New Product Development and Innovation are capital intensive and required adequate finance to avoid locking up scarce resources in projects. There exist three alternatives, but not mutually exclusive sources of finance useful for these kinds of projects. State and explain these sources of finance and how they differ from each other. (8 Marks) b) Identify five (5) factors a Marketing and Public Relations business is required to consider when choosing financing methods for a marketing adverting campaign in the industry. (5 Marks) c) Michalleti Marketing Consulting Ltd issued Ghe 500million of zero-coupon bonds with ex-interest of Gh 120, due for repayment in 5years time at par. Its current market price is Ghe105. What is the company's cost of debt capital? (2 Marks) Question 2 The most recent financial information of Janana Informa Communications Ltd is provided for the year 2020. Jaana Informa Communications Ltd Balance Sheet As At 31" December 2020 GHC'000 GHC 000 46,850 Fixed Assets Current Assets 8,640 Current Liabilities Total Assets less Current Liabilities 1.440 7,200 54,050 8% Preference Shares (GHC1.00) 12% Debentures (Redeemable in January 2028) 10% Bank Loans 10,600 20,200 8,250 39,050 15,000 Ordinary Shares (GHCO.50) Reserves 12,000 3,000 15,000 Additional Information: i) ii) ii) iv) Yields on Treasury Bills Company Equity Beta Market Risk Premium 8% 1.50 5.4% GHC2.50 GHCO.60 Current ex-interest Debenture market value GHC105 25% Current ex-div. Ordinary share price Current ex-div. Preference share price v) vi) vii) Corporation Tax Required: Calculate: a) Using Capital Assets Pricing Model (CAPM) the cost of Equity Capital b) Cost of Preference Share Capital c) Cost of Debt before Taxation d) Cost of Debt after Taxation e) Weighted Average Cost of Capital (WACC) (15 Marks) 130 Marks

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer Ques1 A SOME OF THE INNOVATIVE WAYS TO FINANCE A STARTUP iEvery startup needs access to capital whether for funding product development acquiring machinery and inventory or paying salaries to i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started