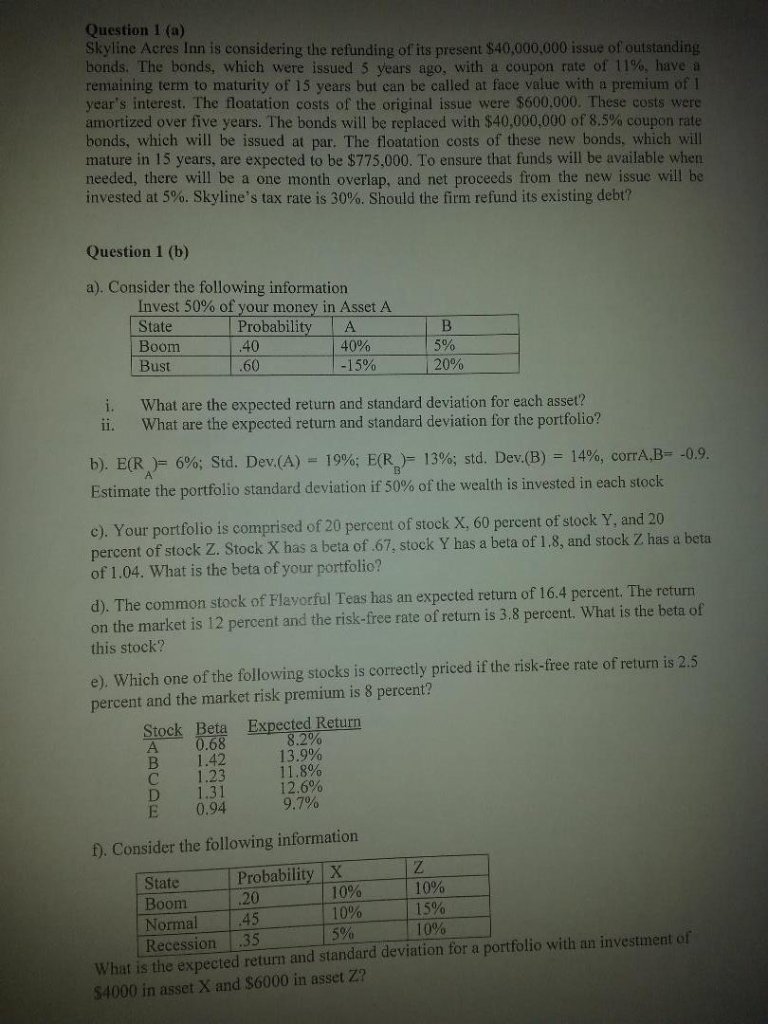

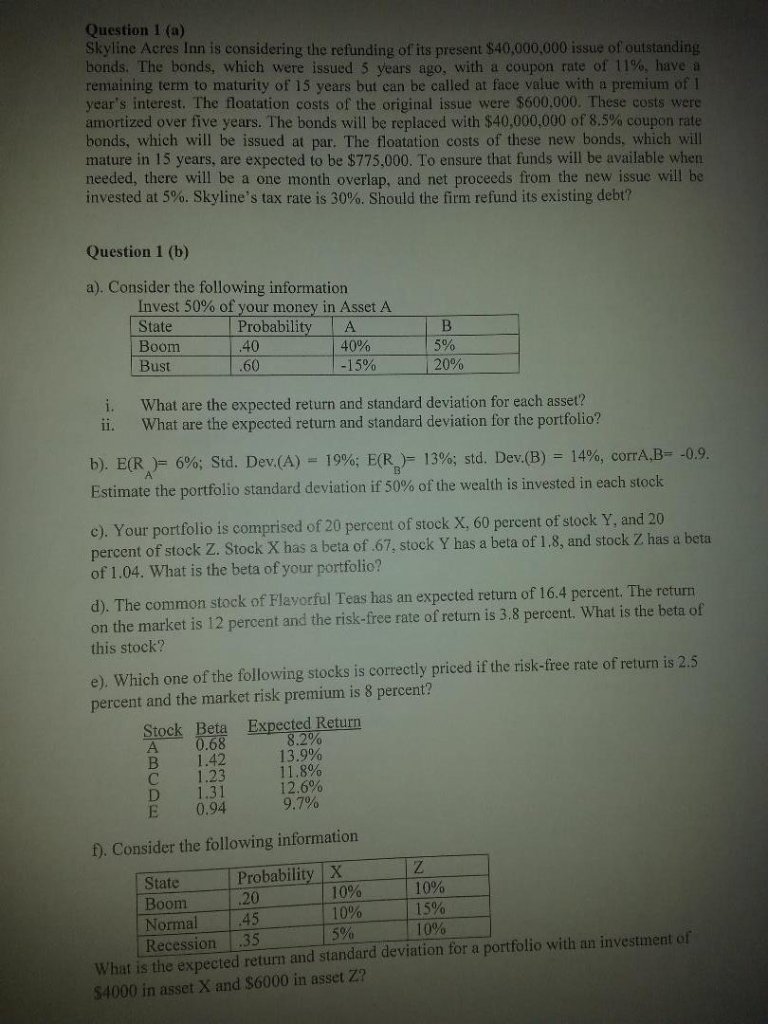

Question 1 (a) Skyline Acres Inn is considering the refunding of its present $40,000,000 issue of outstanding bonds. The bonds, which were issued 5 years ago, with a coupon rate of 11%, have a remaining term to maturity of 15 years but can be called at face value with a premium of I year's interest. The floatation costs of the original issue were $600.000. These costs were amortized over five years. The bonds will be replaced with $40,000,000 of 8.5% coupon rate bonds, which will be issued at par. The floatation costs of these new bonds, which will mature in 15 years, are expected to be $775,000. To ensure that funds will be available when needed, there will be a one month overlap, and net proceeds from the new issue will be invested at 5%. Skyline's tax rate is 30%. Should the firm refund its existing debt? Question 1 (b) a). Consider the following information Invest 50% of your money in Asset A State Boom Bust Probability A 40 60 40% -15% 5% 20% i. What are the expected return and standard deviation for each asset? i. What are the expected return and standard deviation for the portfolio? b). E(RA)= 6%; Std. Dev(A) = 19%; E(R) 0% std. Dex(B) 14%, corrAB Estimate the portfolio standard deviation if 50% of the wealth is invested in each stock -0.9 c). Your portfolio is comprised of 20 percent of stock X, 60 percent of stock Y, and 20 percent of stock Z. Stock X has a beta of .67, stock Y has a beta of 1.8, and stock Z has a beta of 1.04. What is the beta of your portfolio? d). The common stock of Flavorful Teas has an expected return of 16.4 percent. The return on the market is 12 percent and the risk-free rate of return is 3.8 percent. What is the beta of this stock? e). Which one of the following stocks is correctly priced if the risk-free rate of return is 2.5 percent and the market risk premium is 8 percent? Stock Beta Expected Retur 8.2% 13.9% 11 .8% 12.6% 9.7% 68 B 1.42 1.23 D 1.31 E 0.94 f). Consider the following information State Probability X 10% 10% 5% 10% I 5% 10% 20 Boom Normal45 Recession 35 What is the expected return and standard deviation for a portfolio with an investment of 54000 in asset X and $6000 in asset Z? Question 1 (a) Skyline Acres Inn is considering the refunding of its present $40,000,000 issue of outstanding bonds. The bonds, which were issued 5 years ago, with a coupon rate of 11%, have a remaining term to maturity of 15 years but can be called at face value with a premium of I year's interest. The floatation costs of the original issue were $600.000. These costs were amortized over five years. The bonds will be replaced with $40,000,000 of 8.5% coupon rate bonds, which will be issued at par. The floatation costs of these new bonds, which will mature in 15 years, are expected to be $775,000. To ensure that funds will be available when needed, there will be a one month overlap, and net proceeds from the new issue will be invested at 5%. Skyline's tax rate is 30%. Should the firm refund its existing debt? Question 1 (b) a). Consider the following information Invest 50% of your money in Asset A State Boom Bust Probability A 40 60 40% -15% 5% 20% i. What are the expected return and standard deviation for each asset? i. What are the expected return and standard deviation for the portfolio? b). E(RA)= 6%; Std. Dev(A) = 19%; E(R) 0% std. Dex(B) 14%, corrAB Estimate the portfolio standard deviation if 50% of the wealth is invested in each stock -0.9 c). Your portfolio is comprised of 20 percent of stock X, 60 percent of stock Y, and 20 percent of stock Z. Stock X has a beta of .67, stock Y has a beta of 1.8, and stock Z has a beta of 1.04. What is the beta of your portfolio? d). The common stock of Flavorful Teas has an expected return of 16.4 percent. The return on the market is 12 percent and the risk-free rate of return is 3.8 percent. What is the beta of this stock? e). Which one of the following stocks is correctly priced if the risk-free rate of return is 2.5 percent and the market risk premium is 8 percent? Stock Beta Expected Retur 8.2% 13.9% 11 .8% 12.6% 9.7% 68 B 1.42 1.23 D 1.31 E 0.94 f). Consider the following information State Probability X 10% 10% 5% 10% I 5% 10% 20 Boom Normal45 Recession 35 What is the expected return and standard deviation for a portfolio with an investment of 54000 in asset X and $6000 in asset Z