Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1. a) The one-year and two-year zero rates are 1% and 2% respectively. What is the one-year forward one-year rate (that is, f?

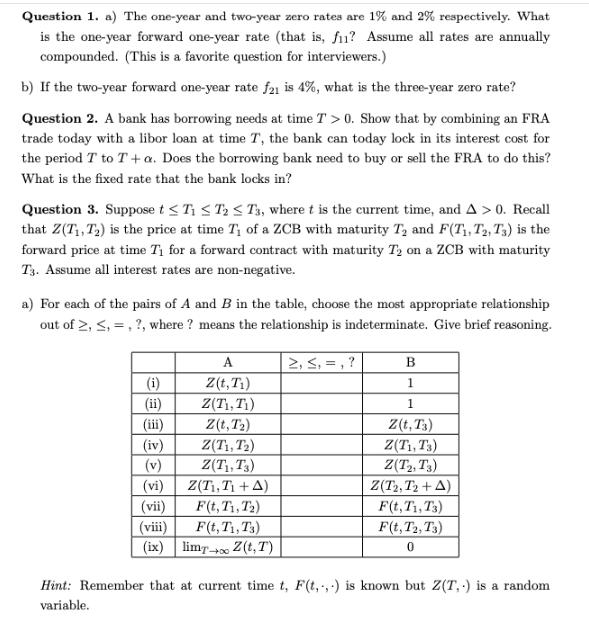

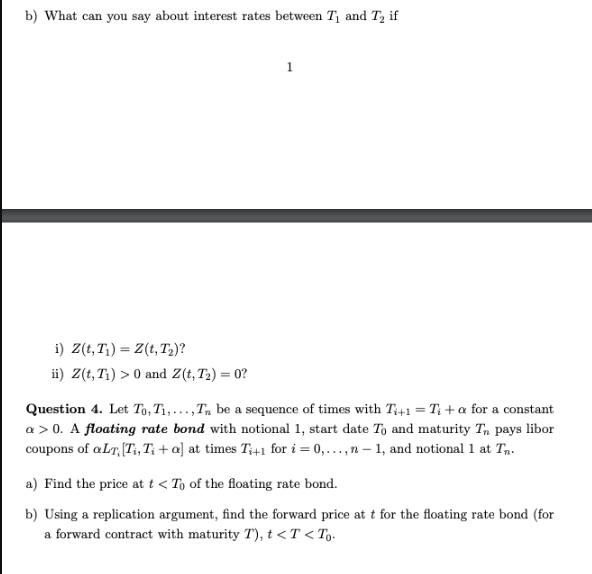

Question 1. a) The one-year and two-year zero rates are 1% and 2% respectively. What is the one-year forward one-year rate (that is, f? Assume all rates are annually compounded. (This is a favorite question for interviewers.) b) If the two-year forward one-year rate f21 is 4%, what is the three-year zero rate? Question 2. A bank has borrowing needs at time T > 0. Show that by combining an FRA trade today with a libor loan at time T, the bank can today lock in its interest cost for the period T to T+a. Does the borrowing bank need to buy or sell the FRA to do this? What is the fixed rate that the bank locks in? Question 3. Suppose t b) What can you say about interest rates between T and T if 1 i) Z(t,T) Z(t, T)? ii) Z(t,Ti) > 0 and Z(t, T) = 0? Question 4. Let To, T,..., T be a sequence of times with Ti+1 = Ti+a for a constant a > 0. A floating rate bond with notional 1, start date To and maturity Tn pays libor coupons of aLT, [Ti, Ti + a] at times T+1 for i = 0,...,n-1, and notional 1 at T. a) Find the price at t < < To of the floating rate bond. b) Using a replication argument, find the forward price at t for the floating rate bond (for a forward contract with maturity T), t

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started