Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 a. Your company, PKP Berhad, wants to purchase a new network file server for its wide- area computer network. The server costs RM75,000.

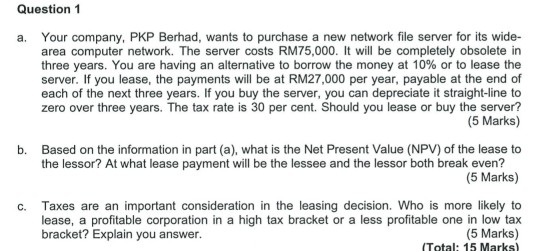

Question 1 a. Your company, PKP Berhad, wants to purchase a new network file server for its wide- area computer network. The server costs RM75,000. It will be completely obsolete in three years. You are having an alternative to borrow the money at 10% or to lease the server. If you lease, the payments will be at RM27,000 per year, payable at the end of each of the next three years. If you buy the server, you can depreciate it straight-line to zero over three years. The tax rate is 30 per cent. Should you lease or buy the server? (5 Marks) b. Based on the information in part (a), what is the Net Present Value (NPV) of the lease to the lessor? At what lease payment will be the lessee and the lessor both break even? (5 Marks) C. Taxes are an important consideration in the leasing decision. Who is more likely to lease, a profitable corporation in a high tax bracket or a less profitable one in low tax bracket? Explain you answer. (5 Marks) (Total: 15 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started