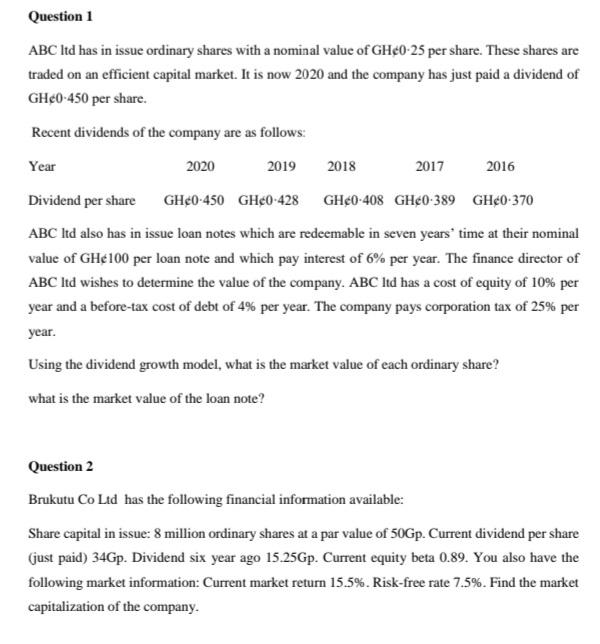

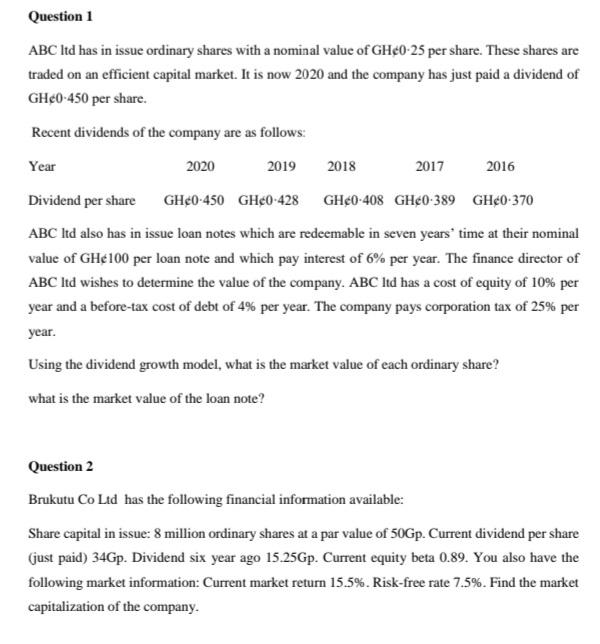

Question 1 ABC ltd has in issue ordinary shares with a nominal value of GH0-25 per share. These shares are traded on an efficient capital market. It is now 2020 and the company has just paid a dividend of GHc0-450 per share. Recent dividends of the company are as follows: Year 2020 2019 2018 2017 2016 Dividend per share GH0-450 GH0-428 GH0-408 GH0-389 GH0-370 ABC ltd also has in issue loan notes which are redeemable in seven years' time at their nominal value of GH100 per loan note and which pay interest of 6% per year. The finance director of ABC Itd wishes to determine the value of the company. ABC ltd has a cost of equity of 10% per year and a before-tax cost of debt of 4% per year. The company pays corporation tax of 25% per year. Using the dividend growth model, what is the market value of each ordinary share? what is the market value of the loan note? Question 2 Brukutu Co Ltd has the following financial information available: Share capital in issue: 8 million ordinary shares at a par value of 50Gp. Current dividend per share (just paid) 34Gp. Dividend six year ago 15.25Gp. Current equity beta 0.89. You also have the following market information: Current market return 15.5%. Risk-free rate 7.5%. Find the market capitalization of the company. Question 1 ABC ltd has in issue ordinary shares with a nominal value of GH0-25 per share. These shares are traded on an efficient capital market. It is now 2020 and the company has just paid a dividend of GHc0-450 per share. Recent dividends of the company are as follows: Year 2020 2019 2018 2017 2016 Dividend per share GH0-450 GH0-428 GH0-408 GH0-389 GH0-370 ABC ltd also has in issue loan notes which are redeemable in seven years' time at their nominal value of GH100 per loan note and which pay interest of 6% per year. The finance director of ABC Itd wishes to determine the value of the company. ABC ltd has a cost of equity of 10% per year and a before-tax cost of debt of 4% per year. The company pays corporation tax of 25% per year. Using the dividend growth model, what is the market value of each ordinary share? what is the market value of the loan note? Question 2 Brukutu Co Ltd has the following financial information available: Share capital in issue: 8 million ordinary shares at a par value of 50Gp. Current dividend per share (just paid) 34Gp. Dividend six year ago 15.25Gp. Current equity beta 0.89. You also have the following market information: Current market return 15.5%. Risk-free rate 7.5%. Find the market capitalization of the company