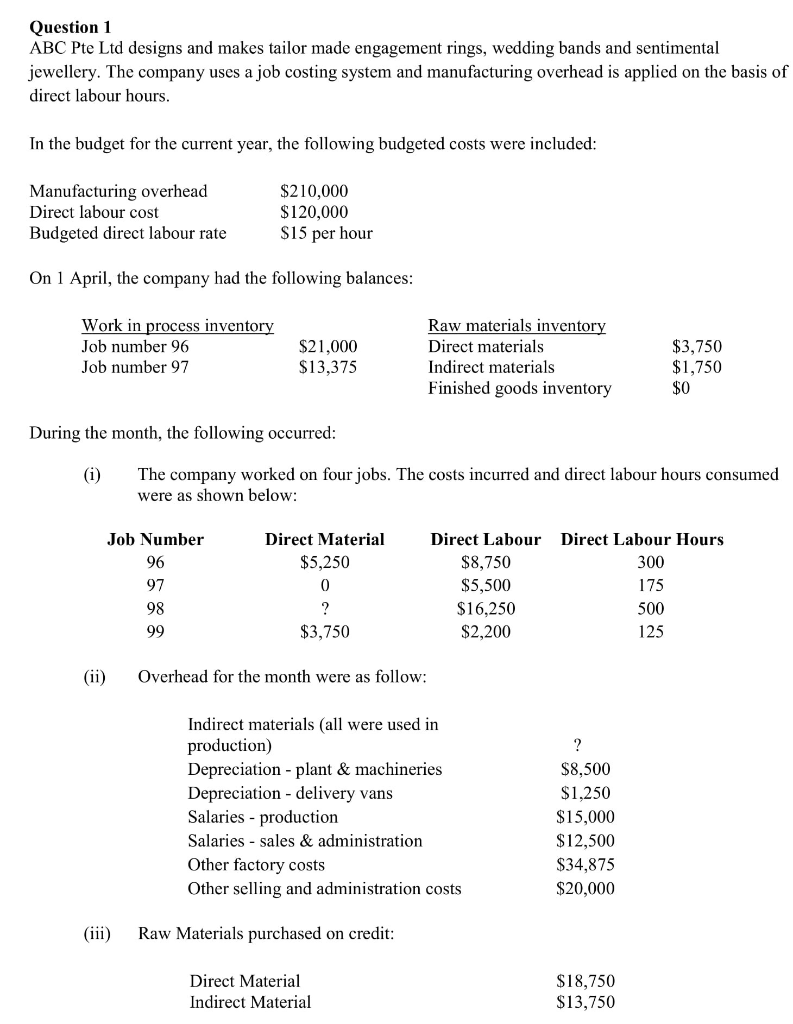

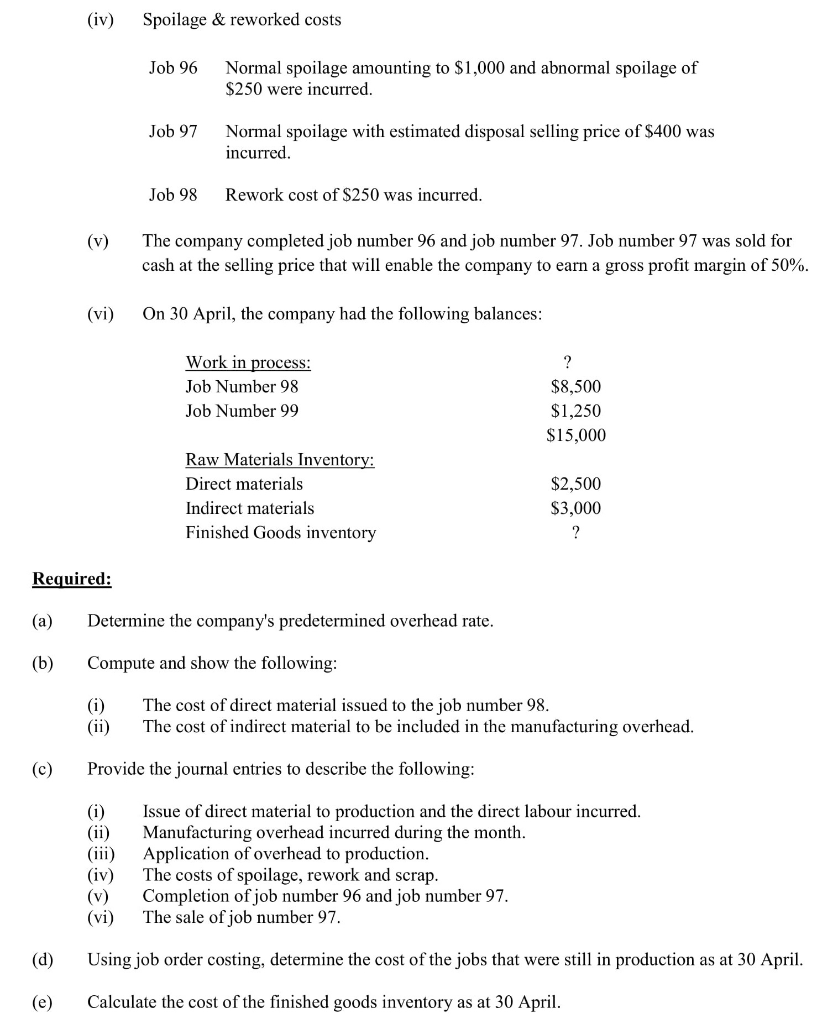

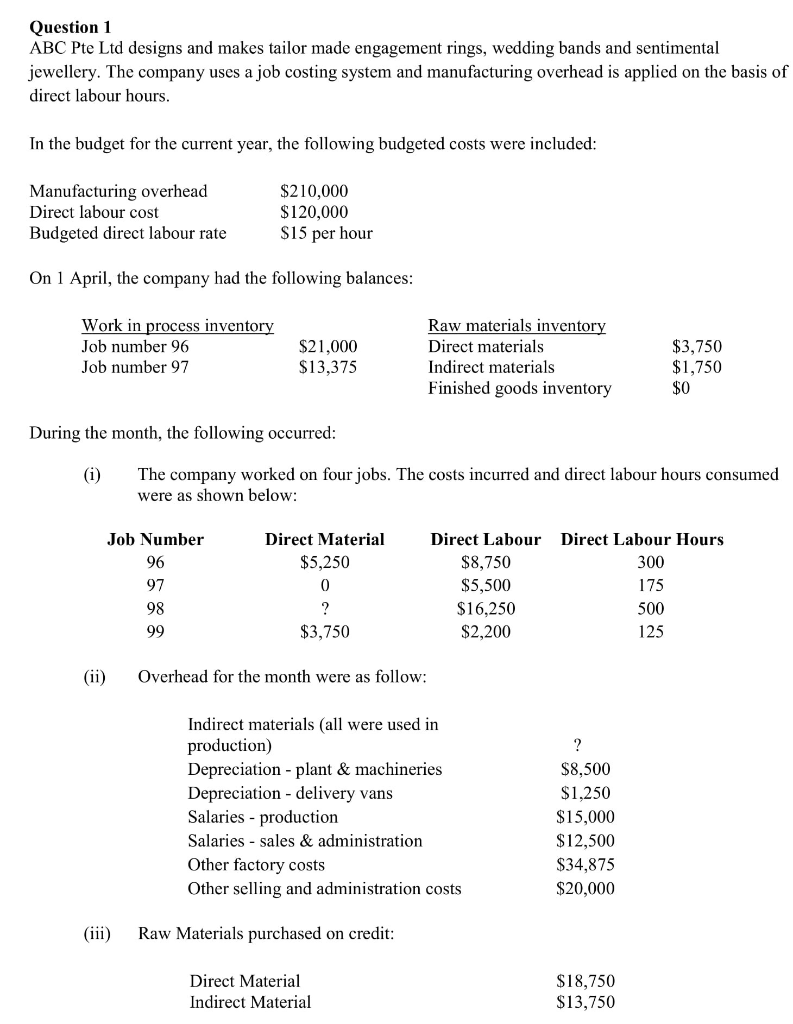

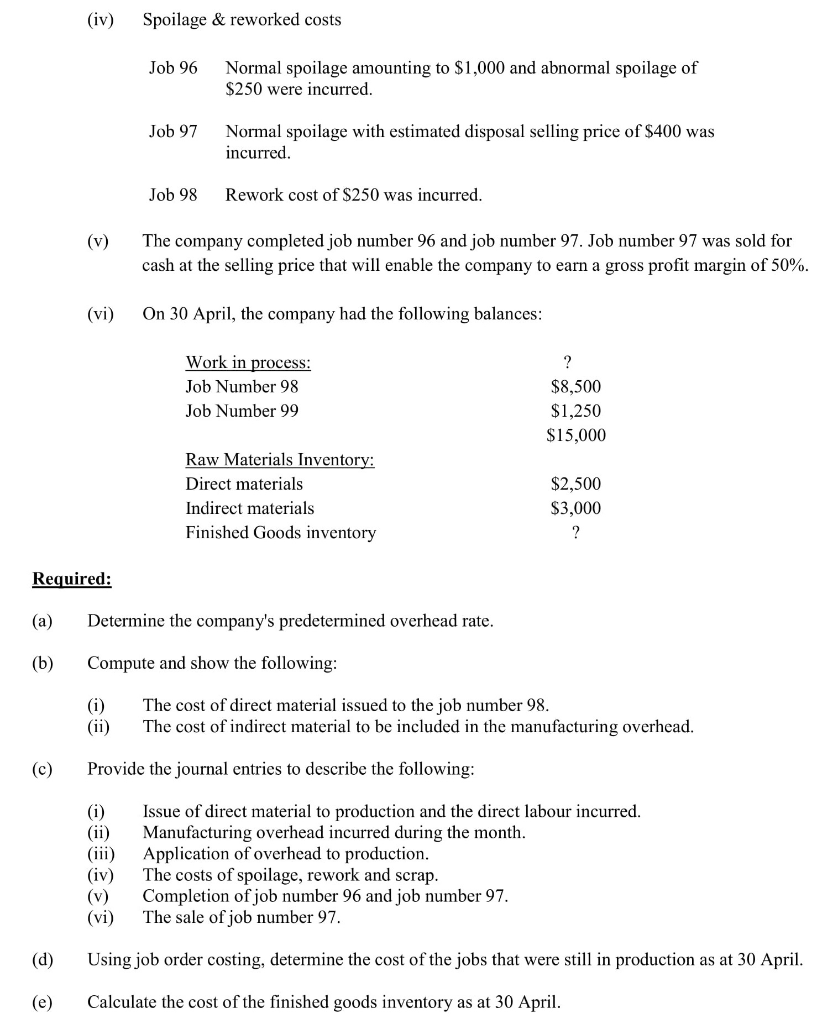

Question 1 ABC Pte Ltd designs and makes tailor made engagement rings, wedding bands and sentimental jewellery. The company uses a job costing system and manufacturing overhead is applied on the basis of direct labour hours In the budget for the current year, the following budgeted costs were included: Manufacturing overhead Direct labour cost Budgeted direct labour rate $210,000 $120,000 S15 per hour On 1 April, the company had the following balances Work in process invento Job number 96 Job number 97 Raw materials inventor Direct materials Indirect materials Finished goods inventory $21,000 $13,375 $3,750 $1,750 %0 During the month, the following occurred (i)The company worked on four jobs. The costs incurred and direct labour hours consumed were as shown below: Job Number 96 97 98 Direct Material $5,250 Direct Labour $8,750 $5,500 $16,250 $2,200 Direct Labour Hours 300 175 500 125 $3,750 (ii) Overhead for the month were as follow: Indirect materials (all were used in production) Depreciation - plant & machineries Depreciation - delivery vans Salaries - production Salaries - sales & administration Other factory costs Other selling and administration costs $8,500 $1,250 $15,000 $12,500 S34,875 $20,000 (iii) Raw Materials purchased on credit Direct Material Indirect Material S18,750 S13,750 (iv) Spoilage & reworked costs Job 96 Normal spoilage amounting to $1,000 and abnormal spoilage of $250 were incurred Job 97 Normal spoilage with estimated disposal selling price of $400 was incurred Job 98 Rework cost of $250 was incurred (v)The company completed job number 96 and job number 97. Job number 97 was sold for cash at the selling price that will enable the company to earn a gross profit margin of 50% (vi) On 30 Apri, the company had the following balances: Work in process: Job Number 98 Job Number 99 $8,500 $1,250 S15,000 Raw Materials Inventor Direct materials Indirect materials Finished Goods inventory $2,500 S3,000 Required: (a)Determine the company's predetermined overhead rate (b) Compute and show the following (i)The cost of direct material issued to the job number 98 (ii) The cost of indirect material to be included in the manufacturing overhead (c) Provide the journal entries to describe the following: (i)Issue of direct material to production and the direct labour incurred. (ii)Manufacturing overhead incurred during the month (iii) Application of overhead to production (iv) The costs of spoilage, rework and scrap (v) Completion of job number 96 and job number 97. (vi) The sale of job number 97. (d) Using job order costing, determine the cost of the jobs that were still in production as at 30 April (e) Calculate the cost of the finished goods inventory as at 30 April