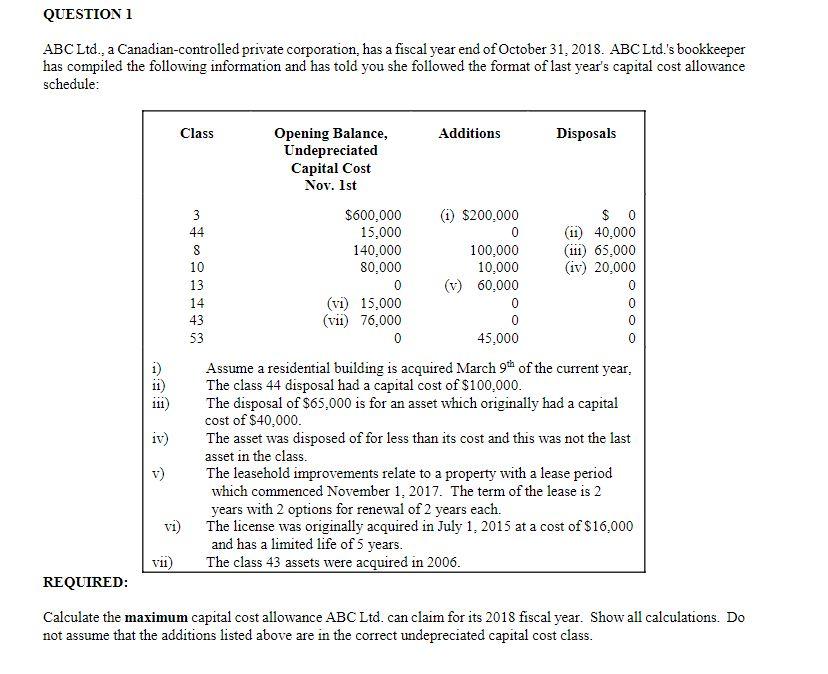

QUESTION 1 ABCL .., a Canadian-controlled private corporation, has a fiscal year end of October 31, 2018. ABC Ltd.'s bookkeeper has compiled the following

QUESTION 1 ABCL .., a Canadian-controlled private corporation, has a fiscal year end of October 31, 2018. ABC Ltd.'s bookkeeper has compiled the following information and has told you she followed the format of last year's capital schedule: cost allowance Class Disposals Opening Balance, Undepreciated Capital Cost Additions Nov. 1st $600,000 15,000 140,000 80,000 () $200,000 $ 0 (11) 40,000 (iii) 65,000 (iv) 20,000 3 44 0 8 100,000 10,000 (v) 60,000 10 13 0 0 (vi) 15,000 (vii) 76,000 14 0 0 43 0 0 53 0 45,000 0 Assume a residential building is acquired March 9 of the current year, The class 44 disposal had a capital cost of $100,000. The disposal of $65,000 is for an asset which originally had a capital cost of $40,000. The asset was disposed of for less than its cost and this was not the last asset in the class The leasehold improvements relate to a property with a lease period which commenced November 1, 2017. The term of the lease is 2 years with 2 options for renewal of 2 years each vi) iv) v) The license was originally acquired in July 1, 2015 at a cost of $16,000 and has a limited 1life of 5 years. The class 43 assets were acquired in 2006. vii) REQUIRED: Calculate the maximum capital cost allowance ABC Ltd. can claim for its 2018 fiscal year. Show all calculations. Do not assume that the additions listed above are in the correct undepreciated capital cost class.

Step by Step Solution

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Solution Available Machine hour 50000 Required machine hours Cost 10000 1 10000 hours Cost Blower ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started