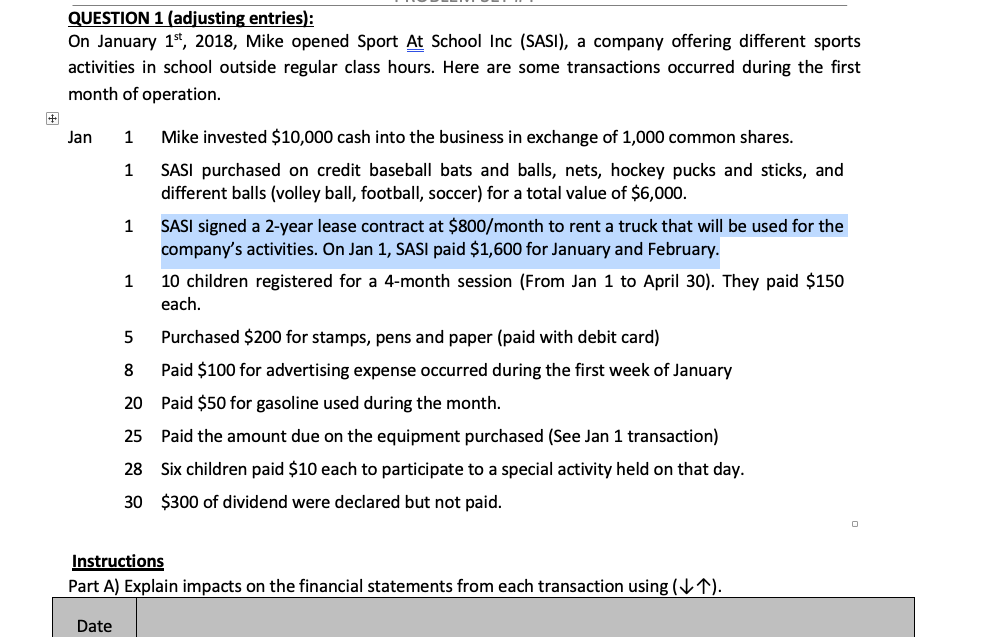

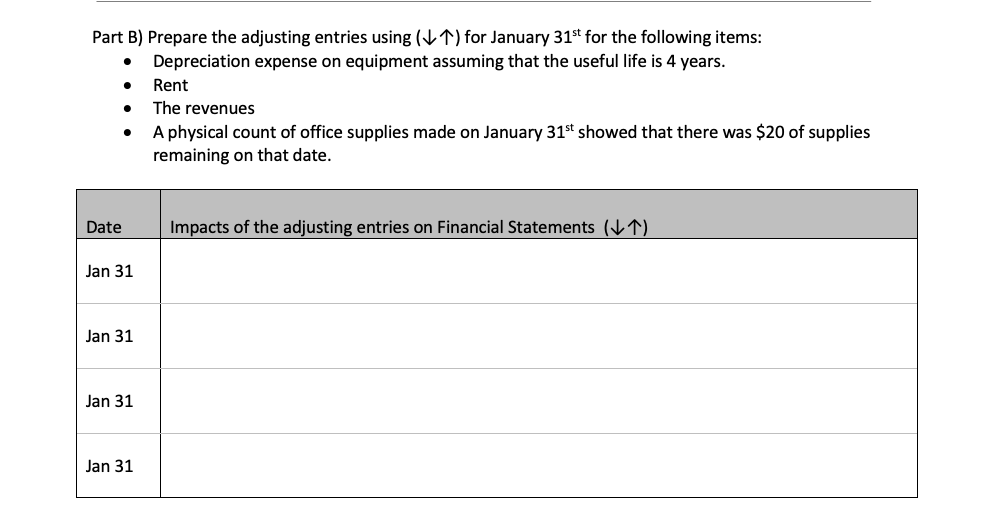

QUESTION 1 (adjusting entries): On January 1st, 2018, Mike opened Sport At School Inc (SASI), a company offering different sports activities in school outside regular class hours. Here are some transactions occurred during the first month of operation. Jan 1 Mike invested $10,000 cash into the business in exchange of 1,000 common shares. 1 SASI purchased on credit baseball bats and balls, nets, hockey pucks and sticks, and different balls (volley ball, football, soccer) for a total value of $6,000. 1 SASI signed a 2-year lease contract at $800/month to rent a truck that will be used for the company's activities. On Jan 1, SASI paid $1,600 for January and February. 1 10 children registered for a 4-month session (From Jan 1 to April 30). They paid $150 each. 5 Purchased $200 for stamps, pens and paper (paid with debit card) 8 Paid $100 for advertising expense occurred during the first week of January 20 Paid $50 for gasoline used during the month. 25 Paid the amount due on the equipment purchased (See Jan 1 transaction) 28 Six children paid $10 each to participate to a special activity held on that day. 30 $300 of dividend were declared but not paid. Instructions Part A) Explain impacts on the financial statements from each transaction using ( 1). Date Part B) Prepare the adjusting entries using ( 1) for January 31st for the following items: Depreciation expense on equipment assuming that the useful life is 4 years. Rent The revenues A physical count of office supplies made on January 31st showed that there was $20 of supplies remaining on that date. Date Impacts of the adjusting entries on Financial Statements (1) Jan 31 Jan 31 Jan 31 Jan 31 QUESTION 1 (adjusting entries): On January 1st, 2018, Mike opened Sport At School Inc (SASI), a company offering different sports activities in school outside regular class hours. Here are some transactions occurred during the first month of operation. Jan 1 Mike invested $10,000 cash into the business in exchange of 1,000 common shares. 1 SASI purchased on credit baseball bats and balls, nets, hockey pucks and sticks, and different balls (volley ball, football, soccer) for a total value of $6,000. 1 SASI signed a 2-year lease contract at $800/month to rent a truck that will be used for the company's activities. On Jan 1, SASI paid $1,600 for January and February. 1 10 children registered for a 4-month session (From Jan 1 to April 30). They paid $150 each. 5 Purchased $200 for stamps, pens and paper (paid with debit card) 8 Paid $100 for advertising expense occurred during the first week of January 20 Paid $50 for gasoline used during the month. 25 Paid the amount due on the equipment purchased (See Jan 1 transaction) 28 Six children paid $10 each to participate to a special activity held on that day. 30 $300 of dividend were declared but not paid. Instructions Part A) Explain impacts on the financial statements from each transaction using ( 1). Date Part B) Prepare the adjusting entries using ( 1) for January 31st for the following items: Depreciation expense on equipment assuming that the useful life is 4 years. Rent The revenues A physical count of office supplies made on January 31st showed that there was $20 of supplies remaining on that date. Date Impacts of the adjusting entries on Financial Statements (1) Jan 31 Jan 31 Jan 31 Jan 31