Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 An investor is considering the purchase of an income property for $4,500,000. The property is expected to generate $5,000 per year for

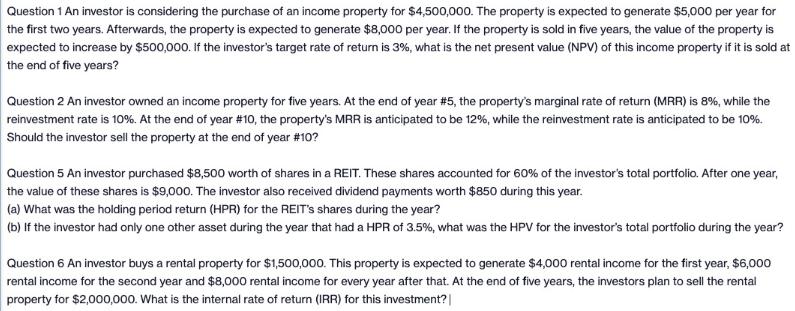

Question 1 An investor is considering the purchase of an income property for $4,500,000. The property is expected to generate $5,000 per year for the first two years. Afterwards, the property is expected to generate $8,000 per year. If the property is sold in five years, the value of the property is expected to increase by $500,000. If the investor's target rate of return is 3%, what is the net present value (NPV) of this income property if it is sold at the end of five years? Question 2 An investor owned an income property for five years. At the end of year #5, the property's marginal rate of return (MRR) is 8%, while the reinvestment rate is 10%. At the end of year #10, the property's MRR is anticipated to be 12%, while the reinvestment rate is anticipated to be 10%. Should the investor sell the property at the end of year #10? Question 5 An investor purchased $8,500 worth of shares in a REIT. These shares accounted for 60% of the investor's total portfolio. After one year, the value of these shares is $9,000. The investor also received dividend payments worth $850 during this year. (a) What was the holding period return (HPR) for the REIT's shares during the year? (b) If the investor had only one other asset during the year that had a HPR of 3.5%, what was the HPV for the investor's total portfolio during the year? Question 6 An investor buys a rental property for $1,500,000. This property is expected to generate $4,000 rental income for the first year, $6,000 rental income for the second year and $8,000 rental income for every year after that. At the end of five years, the investors plan to sell the rental property for $2,000,000. What is the internal rate of return (IRR) for this investment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A answer To solve these finance questions we can use the concepts of net present value NPV marginal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started