Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 1 and 2 Mohr Company purchases a machine at the beginning of the year at a cost of $42,000. The machine is depreciated using

question 1 and 2

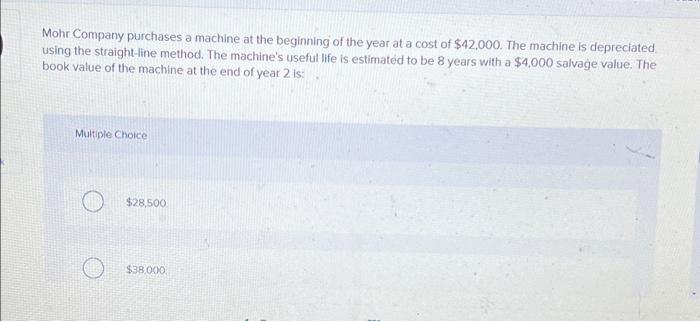

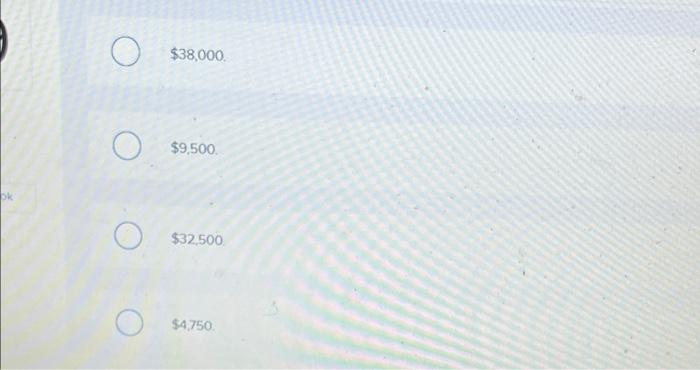

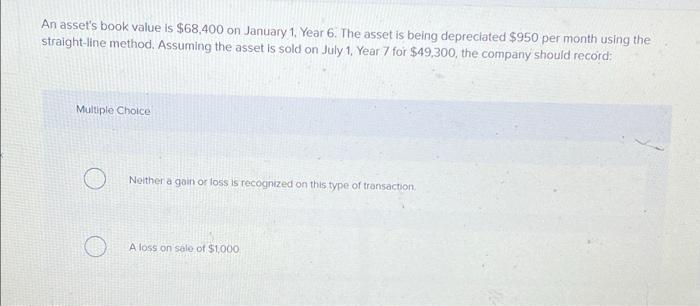

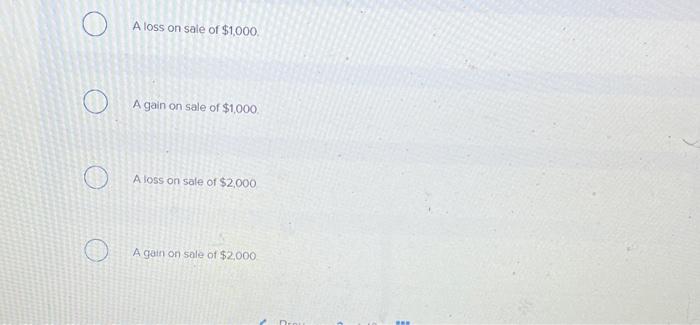

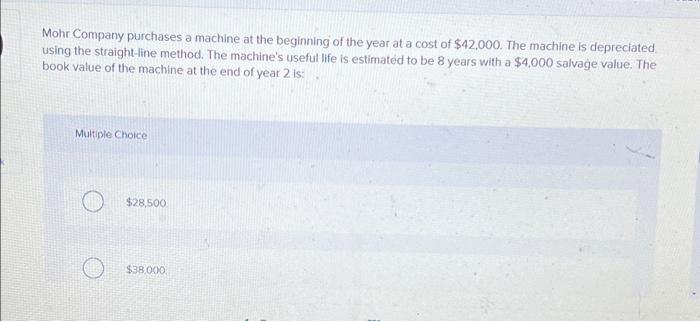

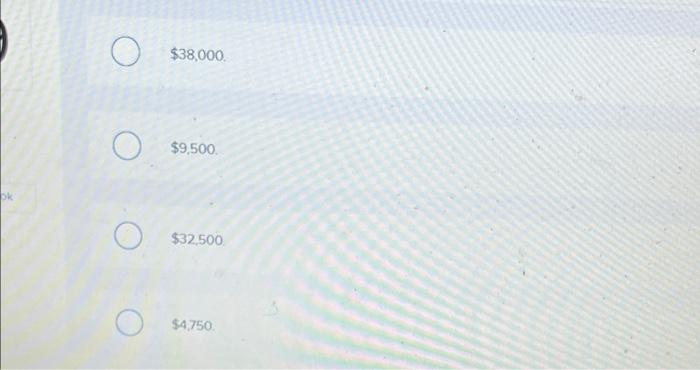

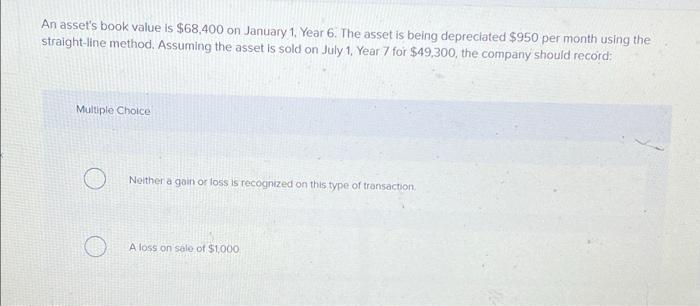

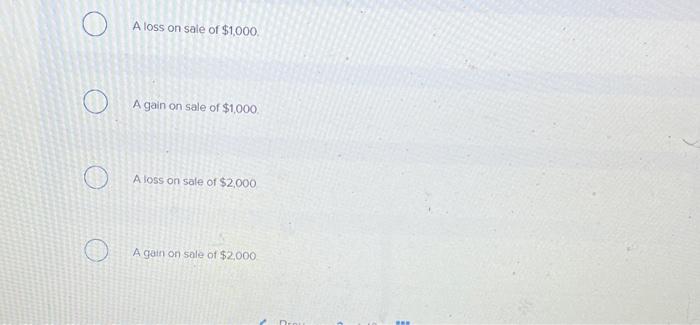

Mohr Company purchases a machine at the beginning of the year at a cost of $42,000. The machine is depreciated using the straight-line method. The machine's useful life is estimated to be 8 years with a $4,000 salvage value. The book value of the machine at the end of year 2 is: Multiple Choice $28.500 $38.000 $38,000 $9,500 OK $32.500 $4,750 An asset's book value is $68,400 on January 1. Year 6. The asset is being depreciated $950 per month using the straight-line method. Assuming the asset is sold on July 1. Year 7 for $49,300, the company should record: Multiple Choice Neither a gain or loss is recognized on this type of transaction A loss on sale of $1000 A loss on sale of $1,000 O A gain on sale of $1.000 A loss on sale of $2,000 A gain on sale of $2,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started