Answered step by step

Verified Expert Solution

Question

1 Approved Answer

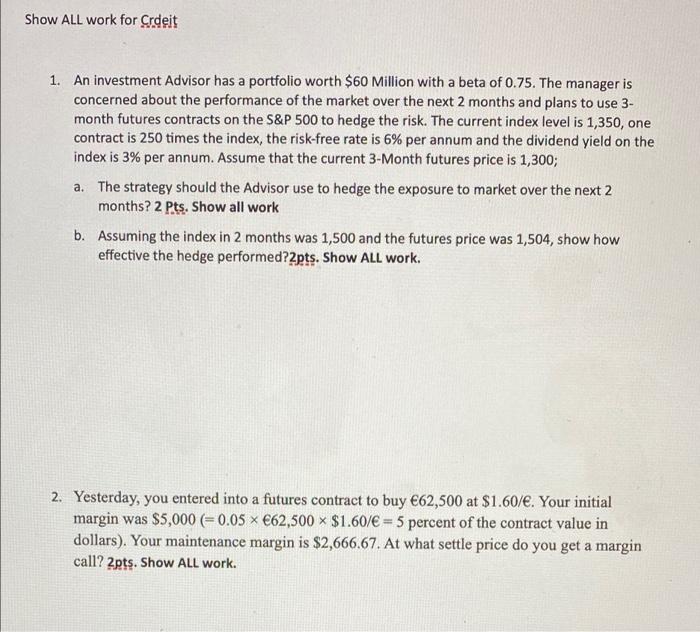

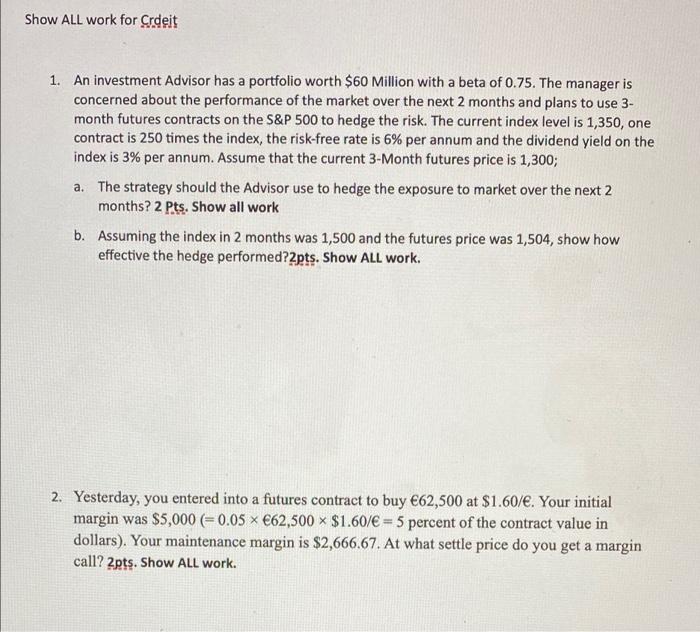

question 1 and 2 Show ALL work for Crdeit 1. An investment Advisor has a portfolio worth $60 Million with a beta of 0.75. The

question 1 and 2

Show ALL work for Crdeit 1. An investment Advisor has a portfolio worth $60 Million with a beta of 0.75. The manager is concerned about the performance of the market over the next 2 months and plans to use 3- month futures contracts on the S&P 500 to hedge the risk. The current index level is 1,350, one contract is 250 times the index, the risk-free rate is 6% per annum and the dividend yield on the index is 3% per annum. Assume that the current 3-Month futures price is 1,300; a. The strategy should the Advisor use to hedge the exposure to market over the next 2 months? 2 Pts. Show all work b. Assuming the index in 2 months was 1,500 and the futures price was 1,504, show how effective the hedge performed?2pts. Show ALL work. 2. Yesterday, you entered into a futures contract to buy 62,500 at $1.60/. Your initial margin was $5,000 (0.05 62,500 $1.60/ = 5 percent of the contract value in dollars). Your maintenance margin is $2,666.67. At what settle price do you get a margin call? 2pts. Show ALL work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started