Question

Question 1: Arthur Blanderson is a highly respected accounting firm. Their Very Small Businesses Unit (VSBU) provides tax and accounting advice to small enterprises. In

Question 1: Arthur Blanderson is a highly respected accounting firm. Their Very Small Businesses Unit (VSBU) provides tax and accounting advice to small enterprises. In 2020, VSBU performed 10,000 jobs in total. The resulting revenue was $14M. VSBU incurred 40,000 direct labor (DL) hours and an hourly cost of $100. Variable overhead (OH) was $2M, and fixed OH was $4M (direct material costs are negligible).

VSBU's static budget for each year is passively set equal to the actual data from the preceding year. That is, the static budget for 2021 just equals the date above. Actual data at the end of Year 2021 is as follows: Revenues of $13.5M were collected at an average of $1,500 per job performed. Total variable DL was $3.55M, total variable OH was $1.9M, and total fixed cost $3.92M.

Required:

a.

Calculate sales-volume variances and flexible-budget variances for:

- Revenues, - Direct Labor, - Variable OH.

b.

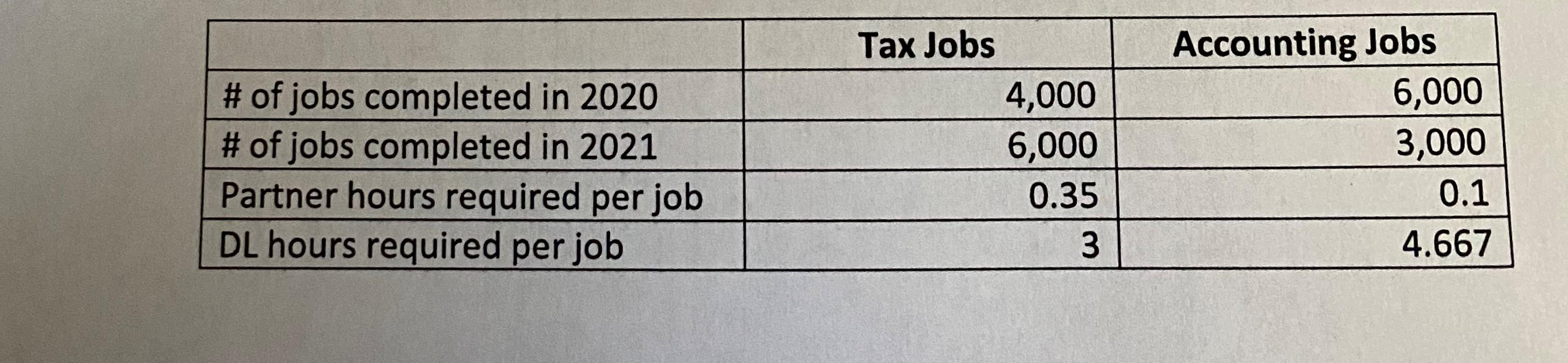

VSBU's CFO recently implemented an ABC system. Variable OH is now divided into two cost pools: variable back office-related (Back Office") and Other VOH. The respective cost drivers are: partner time for Back Office, and direct labor hours (DLH) for Other VOH. In 2020, the $2M variable OH was equally split between Back Office and Other VOH (i.e., $1M each).

At the same time, the ABC system now differentiates between Tax Jobs and Accounting Jobs as cost objects. These jobs put different demands on labor and partner time. Use the data in the table below to calculate cost pool-specific driver rates and then apply those to compute revised flexible budget variances for variable OH and direct labor, only.

C.

Interpret your findings.

Tax Jobs # of jobs completed in 2020 # of jobs completed in 2021 Partner hours required per job DL hours required per job 4,000 6,000 0.35 3 Accounting Jobs 6,000 3,000 0.1 4.667 Tax Jobs # of jobs completed in 2020 # of jobs completed in 2021 Partner hours required per job DL hours required per job 4,000 6,000 0.35 3 Accounting Jobs 6,000 3,000 0.1 4.667Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started