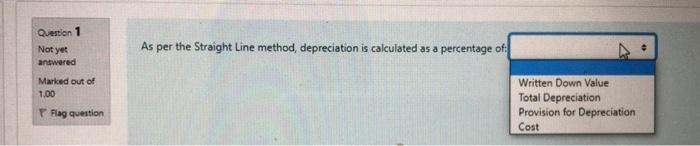

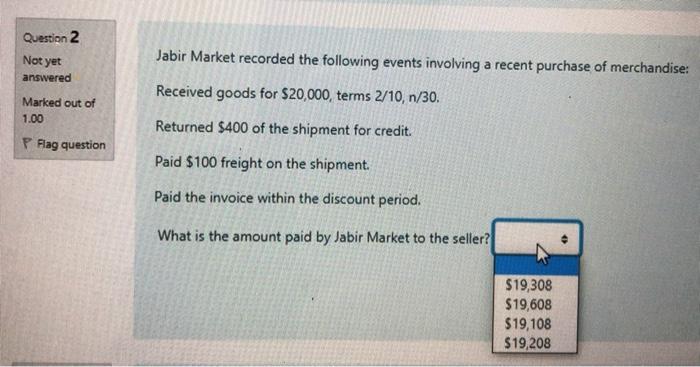

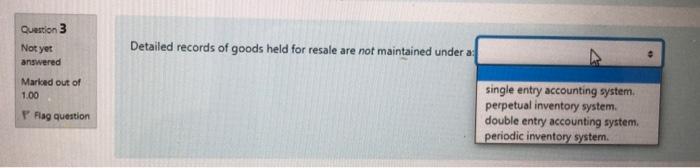

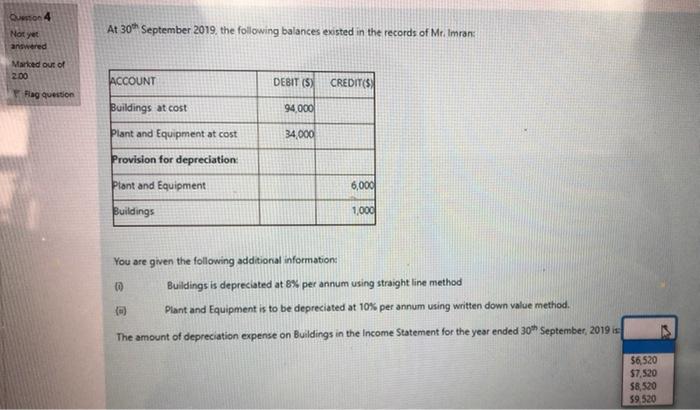

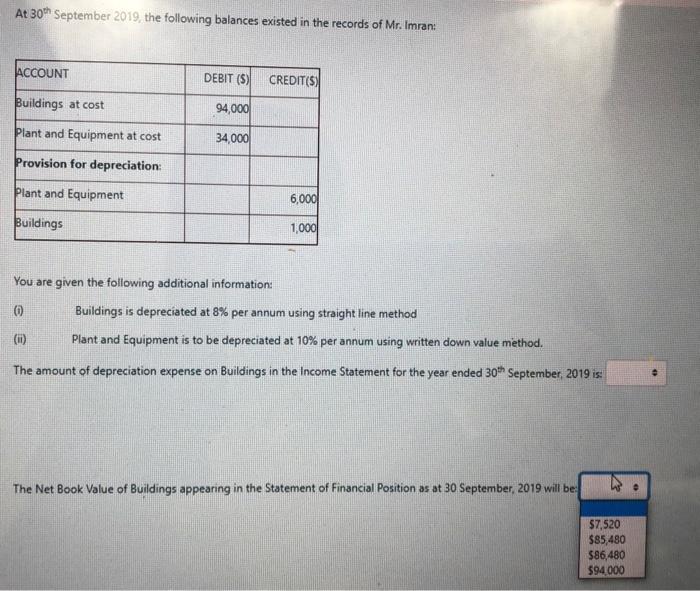

Question 1 As per the Straight Line method, depreciation is calculated as a percentage of: Not yet answered Marked out of 1.00 Written Down Value Total Depreciation Provision for Depreciation Cost Flag question Question 2 Not yet Jabir Market recorded the following events involving a recent purchase of merchandise: answered Received goods for $20,000, terms 2/10, n/30. Marked out of 1.00 Returned $400 of the shipment for credit. P Flag question Paid $100 freight on the shipment. Paid the invoice within the discount period. What is the amount paid by Jabir Market to the seller? $19,308 $19,608 $19,108 $19,208 Question 3 Not yet answered Detailed records of goods held for resale are not maintained under a Marked out of 1.00 P Flag question single entry accounting system perpetual inventory system. double entry accounting system periodic inventory system. ution 4 At 30th September 2019, the following balances existed in the records of Mr. Imran: Not yet answered Marked out of 200 Flag question ACCOUNT DEBIT (S) CREDITS Buildings at cost 94.000 plant and Equipment at cost 34,000 Provision for depreciation: plant and Equipment 6,000 Buildings 1,000 You are given the following additional information: Buildings is depreciated at 8% per annum using straight line method Plant and Equipment is to be depreciated at 10% per annum using written down value method. The amount of depreciation expense on Buildings in the Income Statement for the year ended 30th September, 2019 is 56,520 $7520 $8,520 59.520 At 30th September 2019, the following balances existed in the records of Mr. Imran: ACCOUNT DEBIT (5) CREDIT(5) Buildings at cost 94,000 plant and Equipment at cost 34,000 Provision for depreciation: plant and Equipment 6,000 Buildings 1,000 You are given the following additional information: 0 Buildings is depreciated at 8% per annum using straight line method (1) Plant and Equipment is to be depreciated at 10% per annum using written down value method. The amount of depreciation expense on Buildings in the Income Statement for the year ended 30th September, 2019 is: The Net Book Value of Buildings appearing in the Statement of Financial Position as at 30 September, 2019 will be $7,520 $85 480 $86,480 $94.000