Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 1. Assume that a 20-year, $1,000 par value bond pays an annual coupon of $80 ($40 every six months) and has an annual yield

question 1.

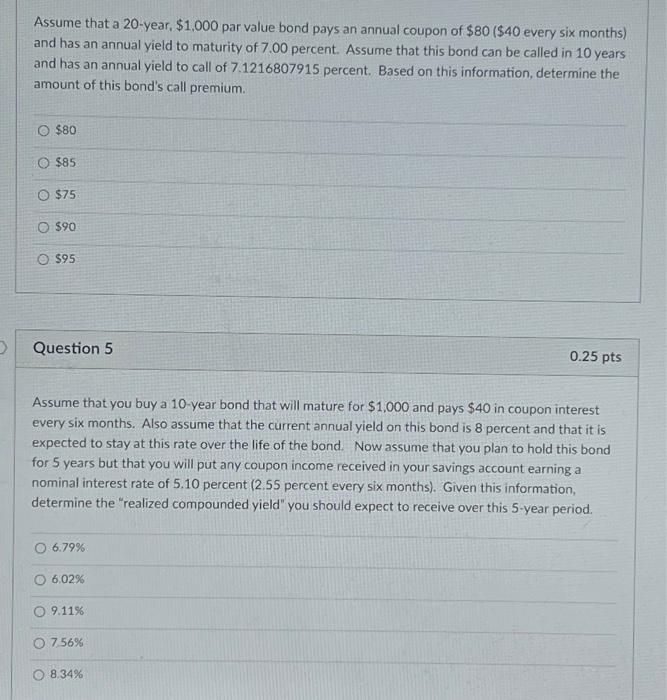

Assume that a 20-year, $1,000 par value bond pays an annual coupon of $80 ($40 every six months) and has an annual yield to maturity of 7.00 percent. Assume that this bond can be called in 10 years and has an annual yield to call of 7.1216807915 percent. Based on this information, determine the amount of this bond's call premium. $80 $85 $75 $90 $95

Question 2

Assume that you buy a 10-year bond that will mature for $1,000 and pays $40 in coupon interest every six months. Also assume that the current annual yield on this bond is 8 percent and that it is expected to stay at this rate over the life of the bond. Now assume that you plan to hold this bond for 5 years but that you will put any coupon income received in your savings account earning a nominal interest rate of 5.10 percent (2.55 percent every six months). Given this information, determine the "realized compounded yield" you should expect to receive over this 5-year period. O 6.79% O6.02% O9.11% O 7.56% 0.25 pts 8.34%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started