Answered step by step

Verified Expert Solution

Question

1 Approved Answer

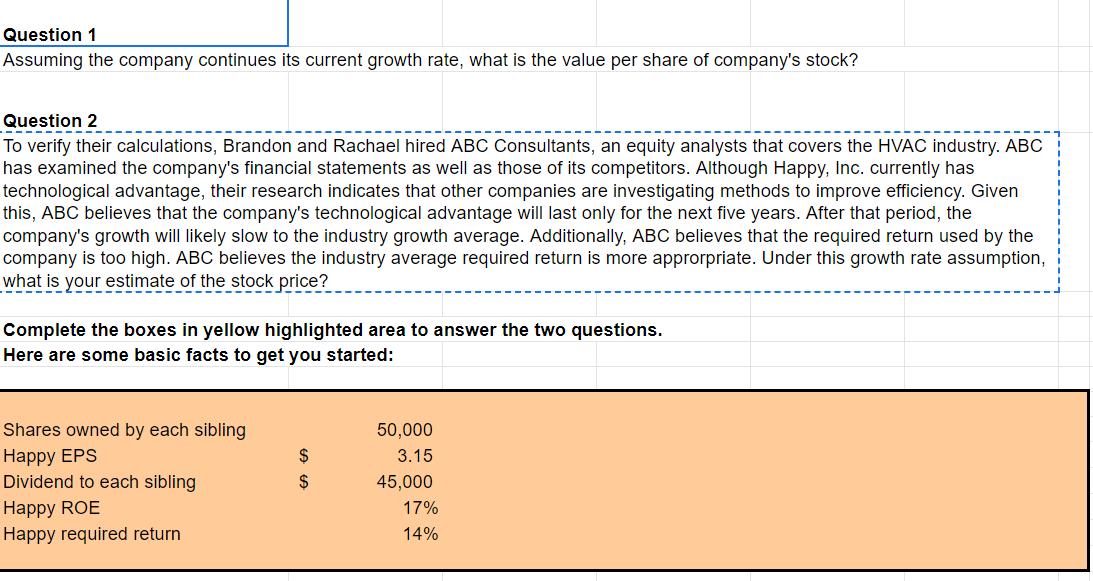

Question 1 Assuming the company continues its current growth rate, what is the value per share of company's stock? Question 2 To verify their

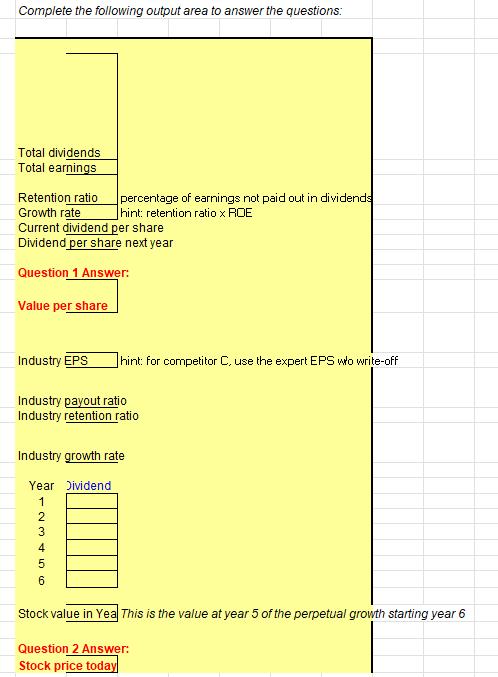

Question 1 Assuming the company continues its current growth rate, what is the value per share of company's stock? Question 2 To verify their calculations, Brandon and Rachael hired ABC Consultants, an equity analysts that covers the HVAC industry. ABC has examined the company's financial statements as well as those of its competitors. Although Happy, Inc. currently has technological advantage, their research indicates that other companies are investigating methods to improve efficiency. Given this, ABC believes that the company's technological advantage will last only for the next five years. After that period, the company's growth will likely slow to the industry growth average. Additionally, ABC believes that the required return used by the company is too high. ABC believes the industry average required return is more appropriate. Under this growth rate assumption, what is your estimate of the stock price? Complete the boxes in yellow highlighted area to answer the two questions. Here are some basic facts to get you started: Shares owned by each sibling 50,000 Happy EPS $ 3.15 Dividend to each sibling $ 45,000 Happy ROE 17% Happy required return 14% Complete the following output area to answer the questions: Total dividends Total earnings Retention ratio Growth rate percentage of earnings not paid out in dividends hint: retention ratio x ROE Current dividend per share Dividend per share next year Question 1 Answer: Value per share Industry EPS hint: for competitor C, use the expert EPS wo write-off Industry payout ratio Industry retention ratio Industry growth rate Year Dividend 1 2 3 4 5 6 Stock value in Yea This is the value at year 5 of the perpetual growth starting year 6 Question 2 Answer: Stock price today

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started