Question

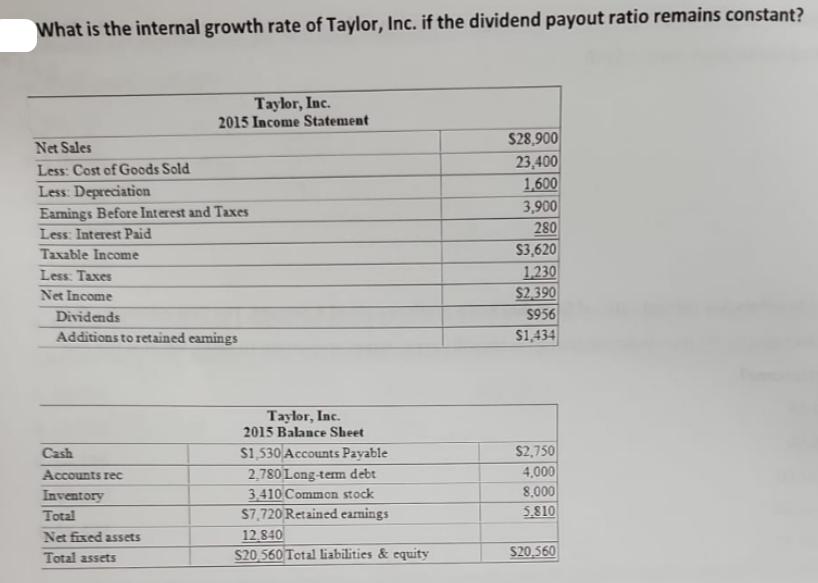

What is the internal growth rate of Taylor, Inc. if the dividend payout ratio remains constant? Taylor, Inc. 2015 Income Statement Net Sales $28,900

What is the internal growth rate of Taylor, Inc. if the dividend payout ratio remains constant? Taylor, Inc. 2015 Income Statement Net Sales $28,900 Less: Cost of Goods Sold 23,400 Less: Depreciation 1,600 Earnings Before Interest and Taxes 3,900 Less: Interest Paid 280 Taxable Income Less: Taxes Net Income Dividends Additions to retained eamings $3,620 1,230 $2,390 $956 $1,434 Taylor, Inc. 2015 Balance Sheet Cash $1,530 Accounts Payable $2,750 Accounts rec 2,780 Long-term debt 4,000 Inventory Total 3,410 Common stock 8,000 $7,720 Retained earnings 5.810 Net fixed assets 12.840 Total assets $20,560 Total liabilities & equity $20,560

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the internal growth rate IGR we need to use the following formula IGR fracRetention Rat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

16th Edition

0357517571, 978-0357517574

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App