Question

Question 1: B. At the end of the year, management has determined that the current net realizable value (market value) has increased to $13. For

Question 1:

B. At the end of the year, management has determined that the current net realizable value (market value) has increased to $13. For both FIFO and LIFO, record the journal entry for the current year (3 points).

C. Briefly describe the income statement effects of liquidating LIFO layers when the cost of inventory is decreasing over time (3 points).

Question 2:

Consider the following information related to the production of chairs at ABC corporation during 2020. (Note: ABC corporation makes chairs and makes other office supplies.) Balances at December 30, 2020 (Assume all amounts are in $ dollars)

Direct Labor (chairs) 10,000 Direct Manufacturing (chairs) 15,000 Manufacturing Supervisor Salary (total) 60,000 Manufacturing Machine Depreciation (total) 100,000 Manufacturing Machine Maintenance (total) 25,000

Additional Information: DL Hours (chairs) 50 DL Hours (total) 200 Machine Hours (chairs) 10 Machine Hours (total) 100 Total Chairs Produced 10

(Note: Depreciation is a fixed cost and maintenance is a variable cost in this example)

A. Calculate the cost for each chair using both the full and variable costing methods. Assume supervisor salary is allocated using DL hours and machine depreciation and maintenance are allocated using machine hours (7 points).

B. At what price does ABC Corporation have to sell under each method to breakeven if they can only sell 9 units (5 points)?

C. Explain the difference in breakeven prices (3 points).

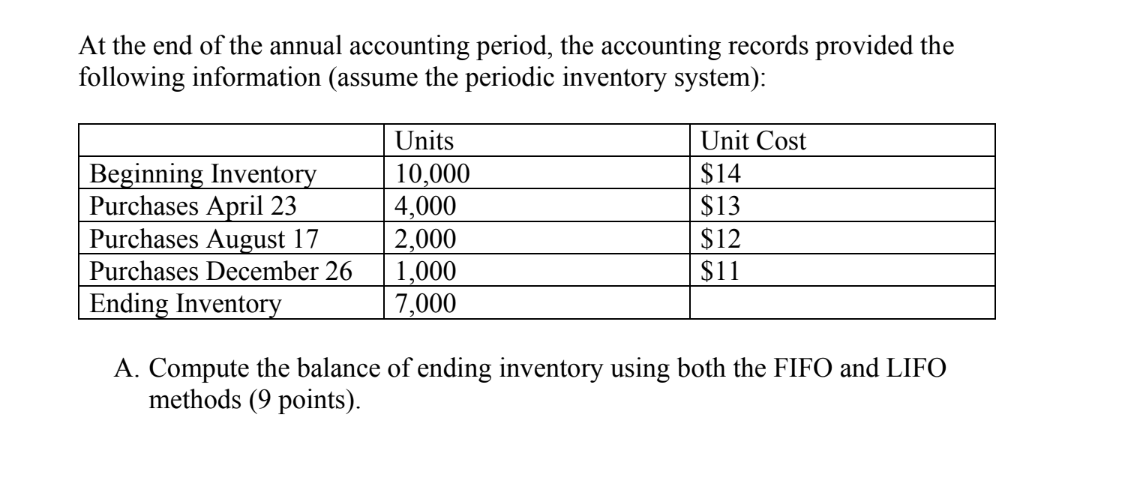

At the end of the annual accounting period, the accounting records provided the following information (assume the periodic inventory system): A. Compute the balance of ending inventory using both the FIFO and LIFO methods ( 9 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started