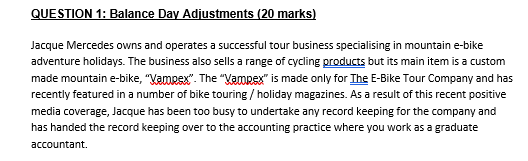

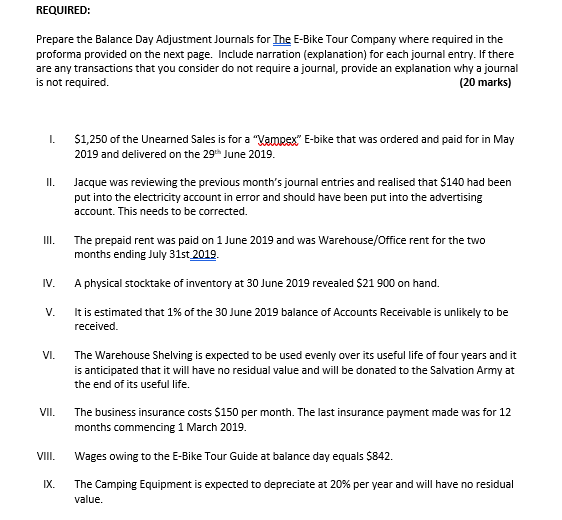

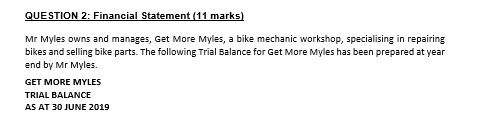

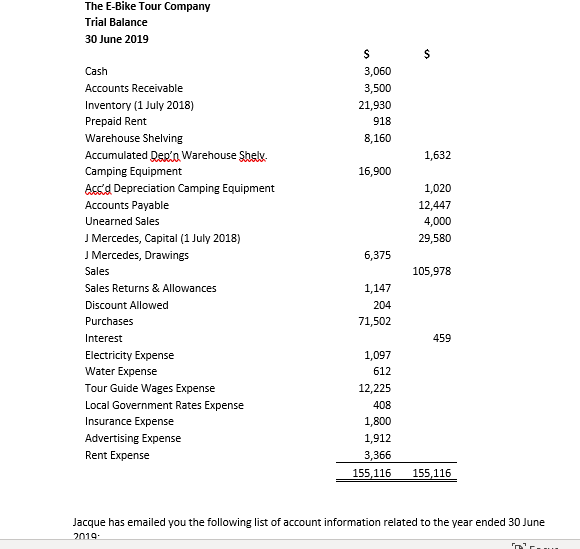

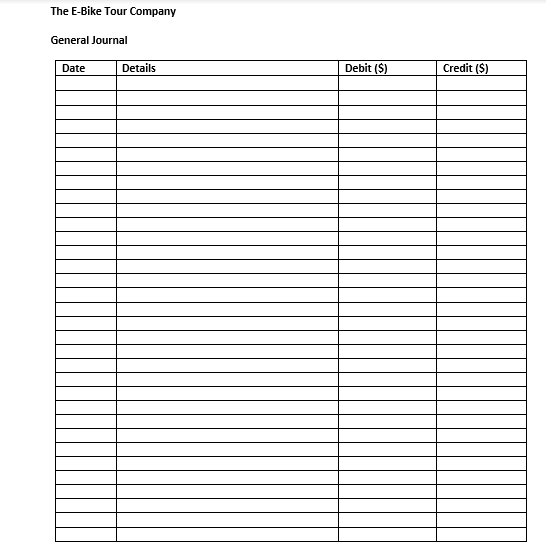

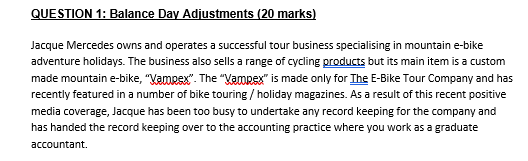

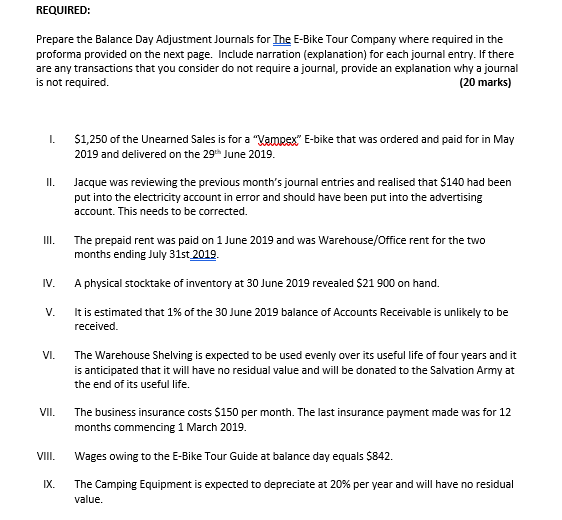

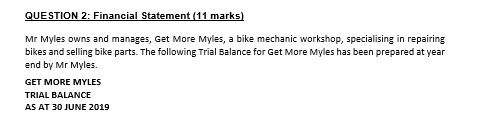

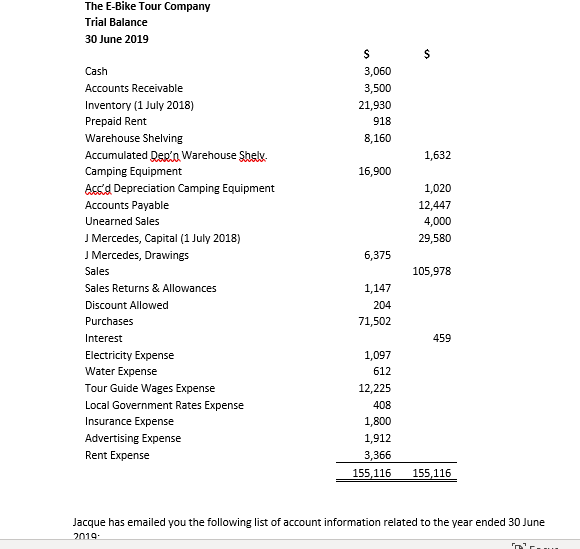

QUESTION 1: Balance Day Adjustments (20 marks) Jacque Mercedes owns and operates a successful tour business specialising in mountain e-bike adventure holidays. The business also sells a range of cycling products but its main item is a custom made mountain e-bike, "Vamrex". The "Vamorex" is made only for The E-Bike Tour Company and has recently featured in a number of bike touring / holiday magazines. As a result of this recent positive media coverage, Jacque has been too busy to undertake any record keeping for the company and has handed the record keeping over to the accounting practice where you work as a graduate accountant. REQUIRED: Prepare the Balance Day Adjustment Journals for The E-Bike Tour Company where required in the proforma provided on the next page. Include narration (explanation) for each journal entry. If there are any transactions that you consider do not require a journal, provide an explanation why a journal is not required. (20 marks) I $1,250 of the Unearned Sales is for a "Vampex" E-bike that was ordered and paid for in May 2019 and delivered on the 29 June 2019. II. Jacque was reviewing the previous month's journal entries and realised that $140 had been put into the electricity account in error and should have been put into the advertising account. This needs to be corrected. The prepaid rent was paid on 1 June 2019 and was Warehouse/Office rent for the two months ending July 31st 2019. A physical stocktake of inventory at 30 June 2019 revealed $21 900 on hand. It is estimated that 1% of the 30 June 2019 balance of Accounts Receivable is unlikely to be received VI. The Warehouse Shelving is expected to be used evenly over its useful life of four years and it is anticipated that it will have no residual value and will be donated to the Salvation Army at the end of its useful life. VII. The business insurance costs $150 per month. The last insurance payment made was for 12 months commencing 1 March 2019. VIII. Wages owing to the E-Bike Tour Guide at balance day equals 5842. IX. The Camping Equipment is expected to depreciate at 20% per year and will have no residual value. QUESTION 2: Financial Statement (11 marks) Mr Myles owns and manages, Get More Myles, a bike mechanic workshop, specialising in repairing bikes and selling bike parts. The following Trial Balance for Get More Myles has been prepared at year end by Mr Myles. GET MORE MYLES TRIAL BALANCE AS AT 30 JUNE 2019 The E-Bike Tour Company Trial Balance 30 June 2019 3,060 3,500 21,930 918 8,160 1,632 16,900 1,020 12,447 4,000 29,580 6,375 Cash Accounts Receivable Inventory (1 July 2018) Prepaid Rent Warehouse Shelving Accumulated Dep'n Warehouse Shelv. Camping Equipment Acid Depreciation Camping Equipment Accounts Payable Unearned Sales J Mercedes, Capital (1 July 2018) J Mercedes, Drawings Sales Sales Returns & Allowances Discount Allowed Purchases Interest Electricity Expense Water Expense Tour Guide Wages Expense Local Government Rates Expense Insurance Expense Advertising Expense Rent Expense 105,978 1,147 204 71,502 459 1,097 612 12,225 408 1,800 1,912 3,366 155,116 155,116 Jacque has emailed you the following list of account information related to the year ended 30 June 2019 The E-Bike Tour Company General Journal Date Details Debit ($) Credit ($)