Answered step by step

Verified Expert Solution

Question

1 Approved Answer

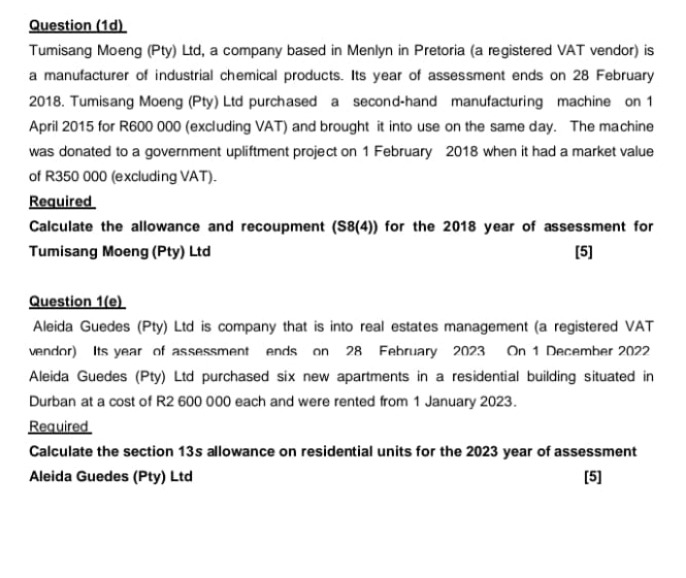

Question ( 1 d ) Tumisang Moeng ( Pty ) Ltd , a company based in Menlyn in Pretoria ( a registered VAT vendor )

Question d

Tumisang Moeng Pty Ltd a company based in Menlyn in Pretoria a registered VAT vendor is a manufacturer of industrial chemical products. Its year of assessment ends on February Tumisang Moeng Pty Ltd purchased a secondhand manufacturing machine on April for Rexcluding VAT and brought it into use on the same day. The machine was donated to a government upliftment project on February when it had a market value of Rexcluding VAT

Required

Calculate the allowance and recoupment S for the year of assessment for Tumisang Moeng Pty Ltd

Question e

Aleida Guedes Pty Ltd is company that is into real estates management a registered VAT vendor Its year of assessment ends on Fehruary On December Aleida Guedes Pty Ltd purchased six new apartments in a residential building situated in Durban at a cost of R each and were rented from January

Required

Calculate the section s allowance on residential units for the year of assessment Aleida Guedes Pty Ltd

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started