Question

Question 1: discuss the main risks that businesses and banks are facing in a financial setting with reference to the stock Coca cola Company by

Question 1:

discuss the main risks that businesses and banks are facing in a financial setting with reference to the stock Coca cola Company by writing a report. Explain the importance of the choice of Coca Cola Company and provide some background information for coca cola company's development.

Question 2:

Calculate the beta and errors of the valuation process reference to the Gordon growth model. Your stock is coca cola company, calculate its beta along with the comparison with the industry which is New York Stock Exchange index and analyses the stock (coca cola ) by using the Gordon growth model that should be essential.

Question 3:

Evaluate the measures that were proposed to balance or control financial risks for a potential investor for Coca cola company by using financial risk management techniques.

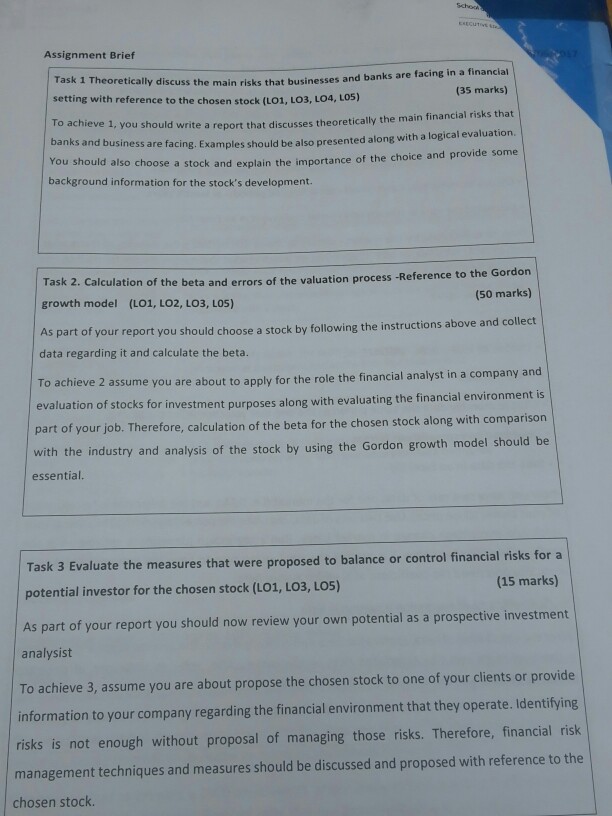

Assignment Brief y discuss the main risks that businesses and banks are facing in a financial (35 marks) Task 1 Theoreticall setting with reference to the chosen stock (L01, LO3, LO4, LO5) To achieve banks and busines 1, you should write a report that discusses theoretically the main financial risks that s are facing. Examples should be also presented along with a logical evaluation. also choose a stock and explain the importance of the choice and provide some You should background information for the stock's development. ation of the beta and errors of the valuation process -Reference to the Gordon (50 marks) Task 2. Calcul growth model (LO1, LO2, LO3, LOS) As pa data regarding it and calculate the beta. To achi evaluation of stocks for investment purposes a rt of your report you should choose a stock by following the instructions above and collect eve 2 assume you are about to apply for the role the financial analyst in a company and long with evaluating the financial environment is rt of your job. Therefore, calculation of the beta for the chosen stock along with comparison with the industry and analysis of the stock by using the Gordon growth model should be essential Task 3 Evaluate the measures that were proposed to balance or control financial risks for a potential investor for the chosen stock (LO1, LO3, LO5) (15 marks) As part of your report you should now review your own potential as a prospective investment analysist To achieve 3, assume you are about propose the chosen stock to one of your cients or provide information to your company regarding the financial environment that they operate. Identifying risks is not enough without proposal of managing those risks. Therefore, financial risk management techniques and measures should be discussed and proposed with reference to the chosen stock. Assignment Brief y discuss the main risks that businesses and banks are facing in a financial (35 marks) Task 1 Theoreticall setting with reference to the chosen stock (L01, LO3, LO4, LO5) To achieve banks and busines 1, you should write a report that discusses theoretically the main financial risks that s are facing. Examples should be also presented along with a logical evaluation. also choose a stock and explain the importance of the choice and provide some You should background information for the stock's development. ation of the beta and errors of the valuation process -Reference to the Gordon (50 marks) Task 2. Calcul growth model (LO1, LO2, LO3, LOS) As pa data regarding it and calculate the beta. To achi evaluation of stocks for investment purposes a rt of your report you should choose a stock by following the instructions above and collect eve 2 assume you are about to apply for the role the financial analyst in a company and long with evaluating the financial environment is rt of your job. Therefore, calculation of the beta for the chosen stock along with comparison with the industry and analysis of the stock by using the Gordon growth model should be essential Task 3 Evaluate the measures that were proposed to balance or control financial risks for a potential investor for the chosen stock (LO1, LO3, LO5) (15 marks) As part of your report you should now review your own potential as a prospective investment analysist To achieve 3, assume you are about propose the chosen stock to one of your cients or provide information to your company regarding the financial environment that they operate. Identifying risks is not enough without proposal of managing those risks. Therefore, financial risk management techniques and measures should be discussed and proposed with reference to the chosen stockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started