Answered step by step

Verified Expert Solution

Question

1 Approved Answer

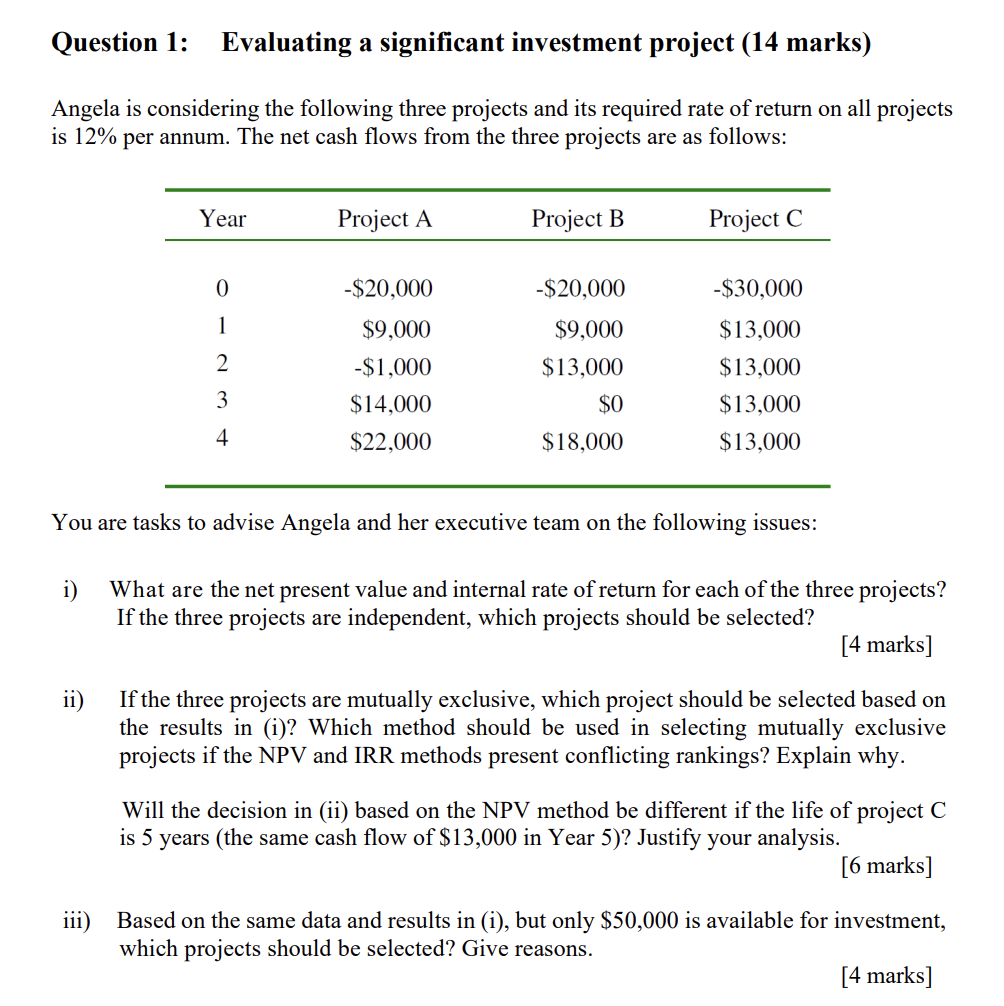

Question 1: Evaluating a significant investment project (14 marks) Angela is considering the following three projects and its required rate of return on all projects

Question 1: Evaluating a significant investment project (14 marks) Angela is considering the following three projects and its required rate of return on all projects is 12% per annum. The net cash flows from the three projects are as follows: You are tasks to advise Angela and her executive team on the following issues: i) What are the net present value and internal rate of return for each of the three projects? If the three projects are independent, which projects should be selected? [4 marks] ii) If the three projects are mutually exclusive, which project should be selected based on the results in (i)? Which method should be used in selecting mutually exclusive projects if the NPV and IRR methods present conflicting rankings? Explain why. Will the decision in (ii) based on the NPV method be different if the life of project C is 5 years (the same cash flow of $13,000 in Year 5)? Justify your analysis. [6 marks] iii) Based on the same data and results in (i), but only $50,000 is available for investment, which projects should be selected? Give reasons. [4 marks]

Question 1: Evaluating a significant investment project (14 marks) Angela is considering the following three projects and its required rate of return on all projects is 12% per annum. The net cash flows from the three projects are as follows: You are tasks to advise Angela and her executive team on the following issues: i) What are the net present value and internal rate of return for each of the three projects? If the three projects are independent, which projects should be selected? [4 marks] ii) If the three projects are mutually exclusive, which project should be selected based on the results in (i)? Which method should be used in selecting mutually exclusive projects if the NPV and IRR methods present conflicting rankings? Explain why. Will the decision in (ii) based on the NPV method be different if the life of project C is 5 years (the same cash flow of $13,000 in Year 5)? Justify your analysis. [6 marks] iii) Based on the same data and results in (i), but only $50,000 is available for investment, which projects should be selected? Give reasons. [4 marks] Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started