Question

Question 1 Fortress Paper Ltd. operates internationally in three distinct business segments: dissolving pulp, specialty papers, and security paper products. The consolidated statements of financial

Question 1

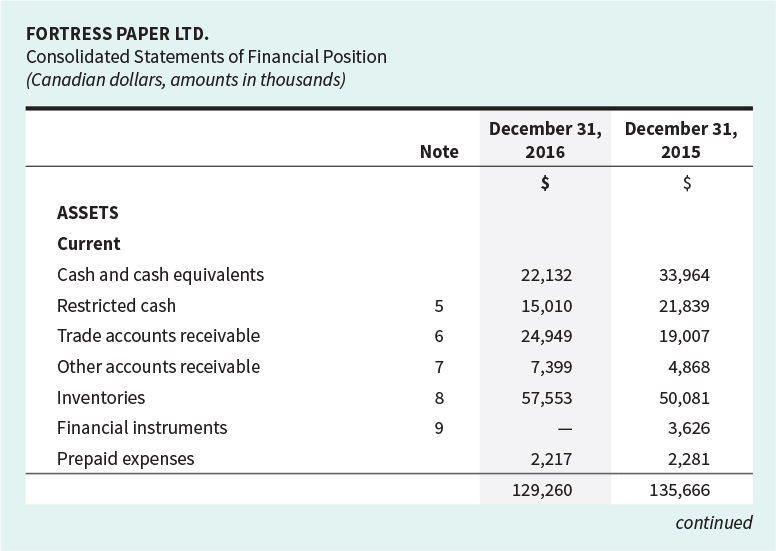

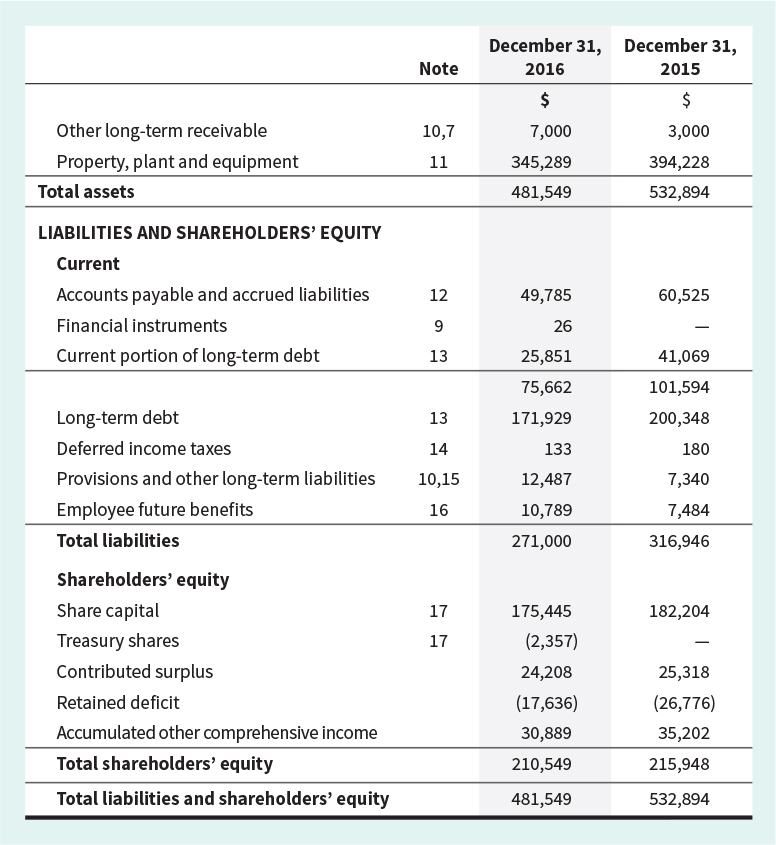

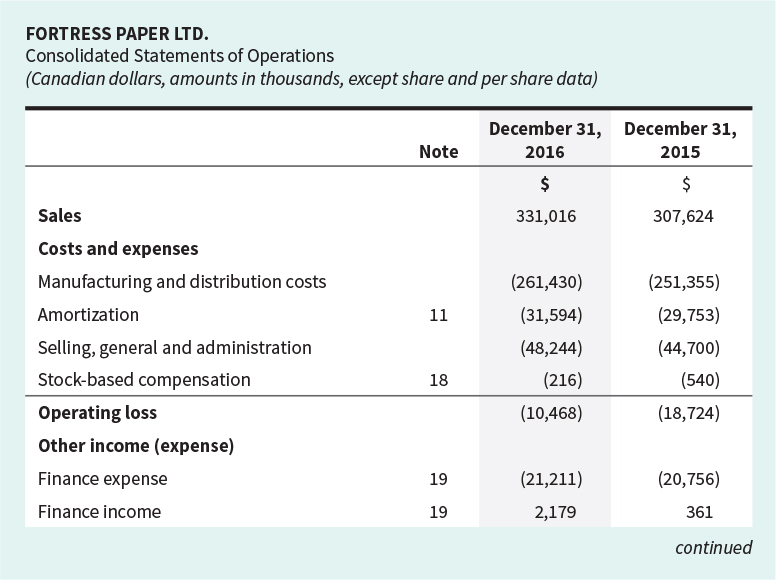

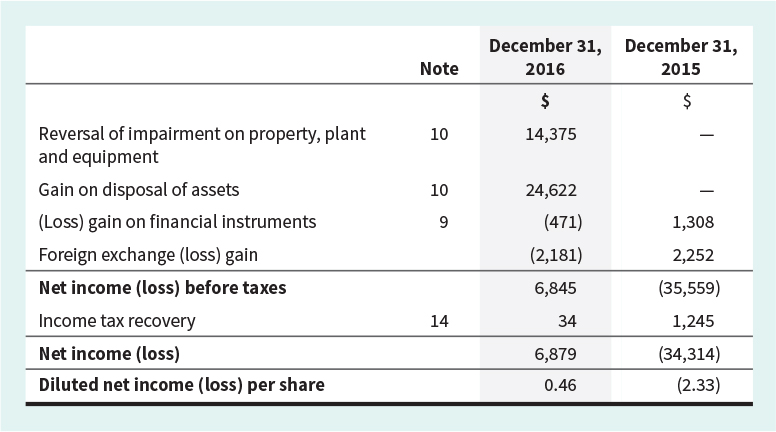

Fortress Paper Ltd. operates internationally in three distinct business segments: dissolving pulp, specialty papers, and security paper products. The consolidated statements of financial position and statement of income (statement of operations) from Fortresss 2016 annual report are presented in Exhibits 10.16A and 10.16B.

(a) Calculate the debt to equity ratio, the net debt as a percentage of total capitalization ratio, and the interest coverage ratio for 2016 and 2015. (Round interest coverage ratio to 1 decimal place, e.g. 15.7 and all other answers to 2 decimal places, e.g. 15.25. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

| 2016 | 2015 | |||||

| Debt to Equity Ratio | ||||||

| Net Debt as a Percentage of Total Capitalization | ||||||

| Interest Coverage Ratio | times | times | ||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started