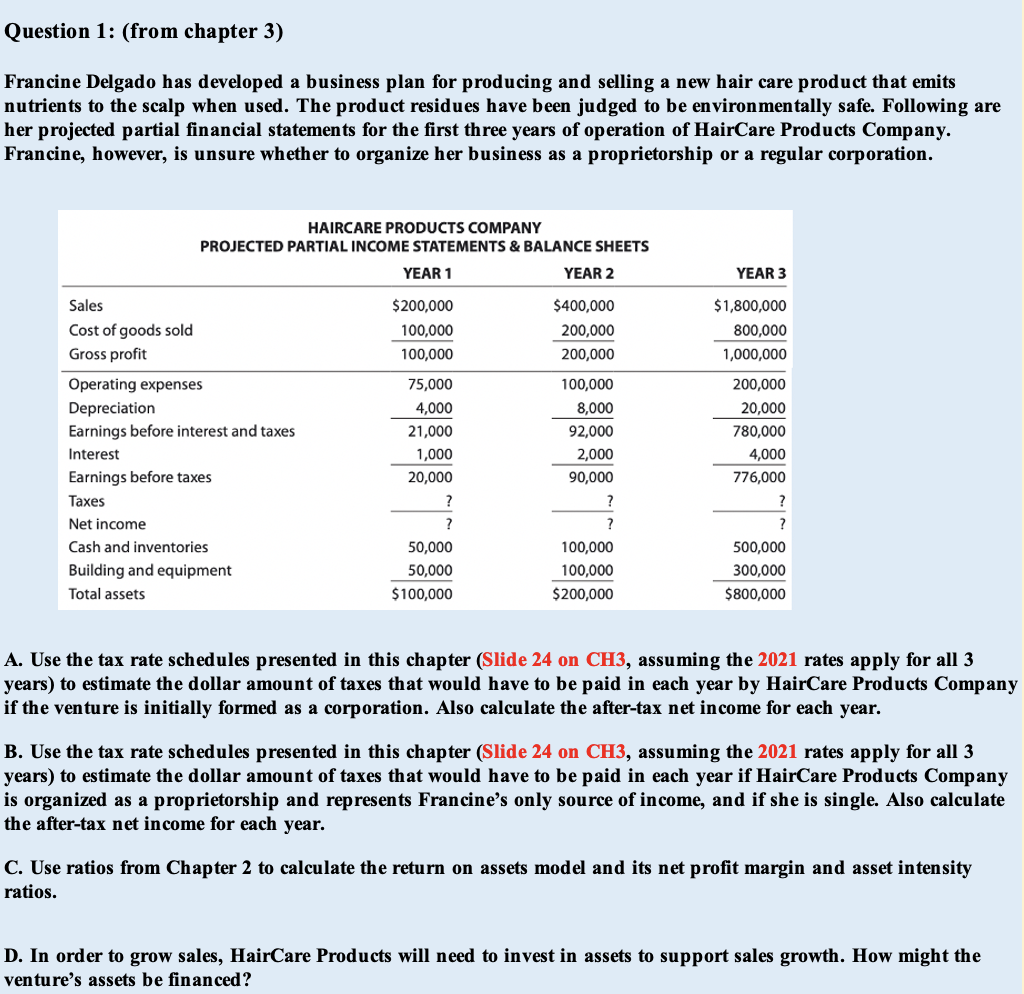

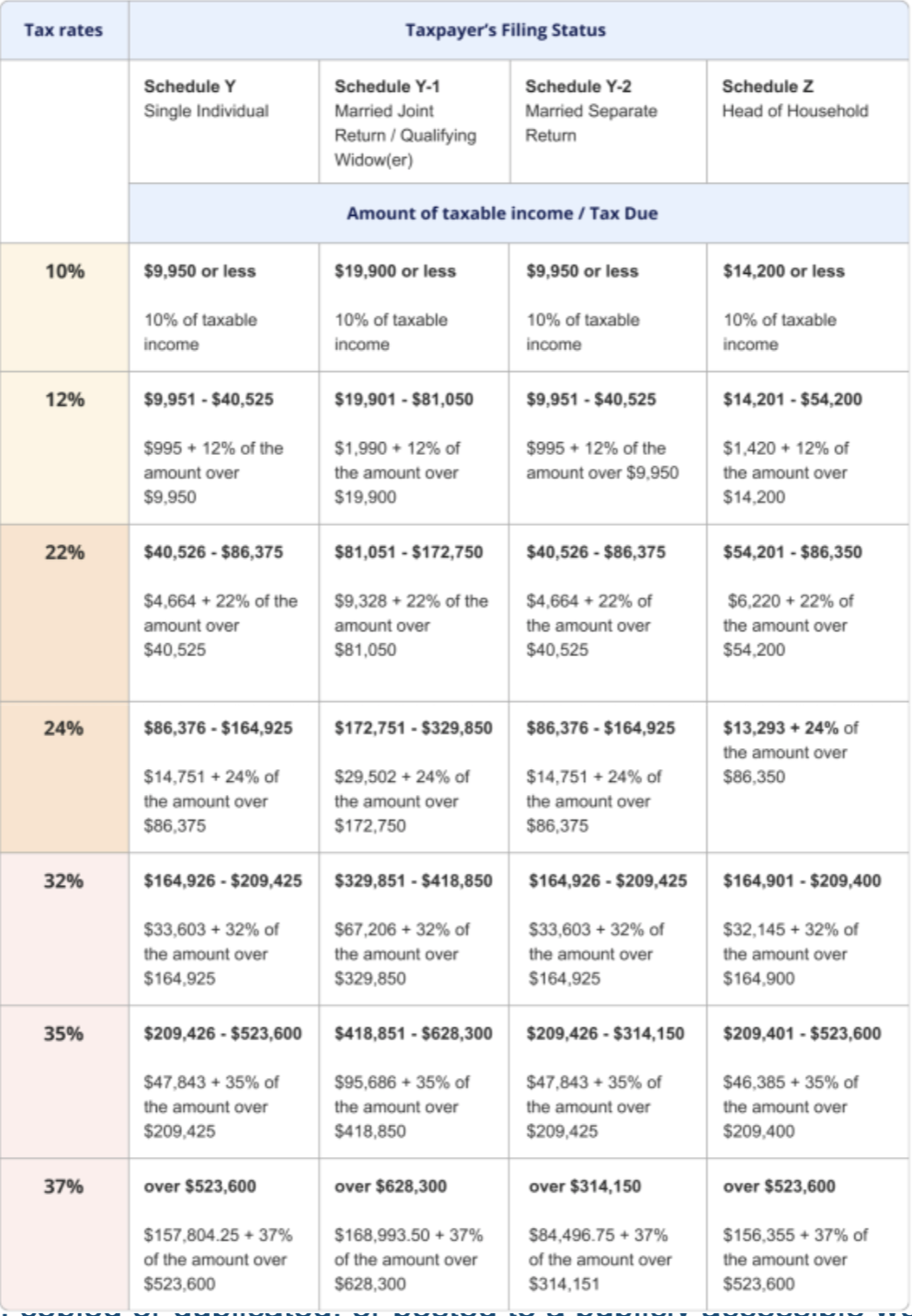

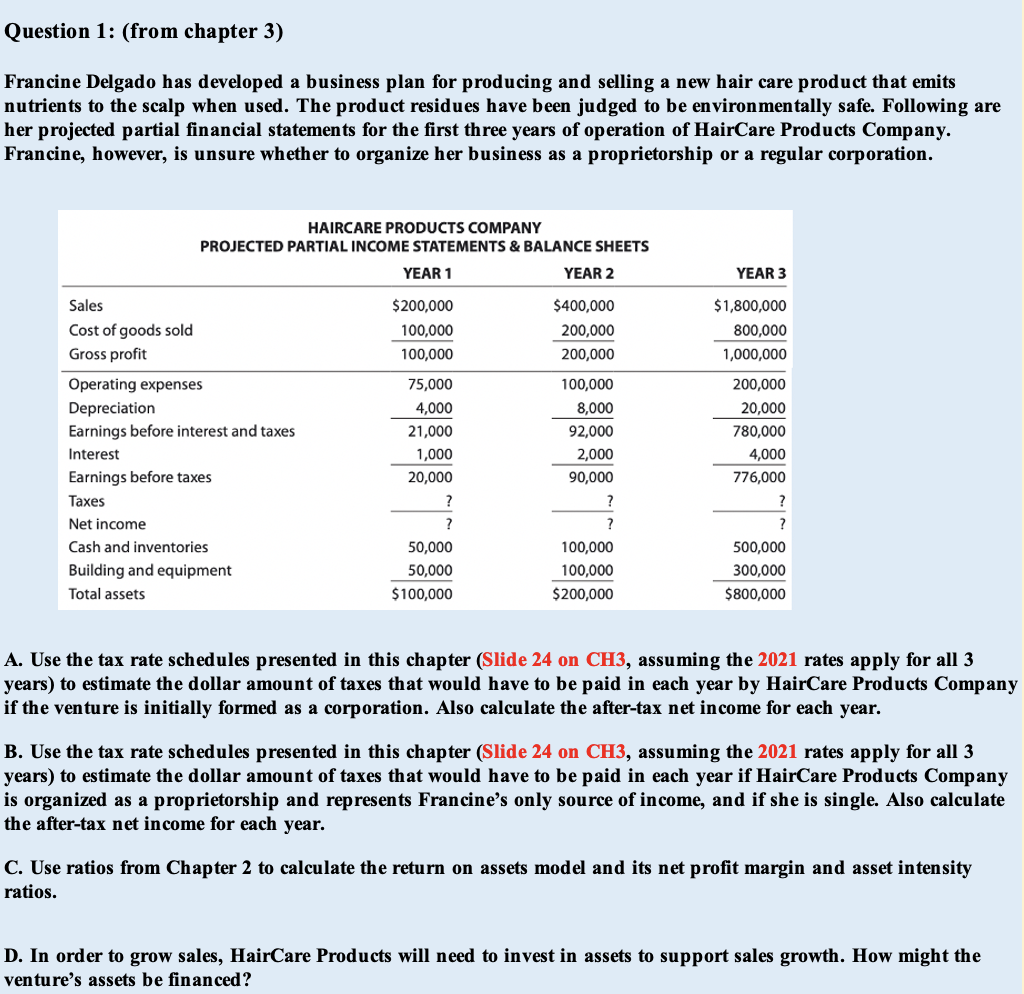

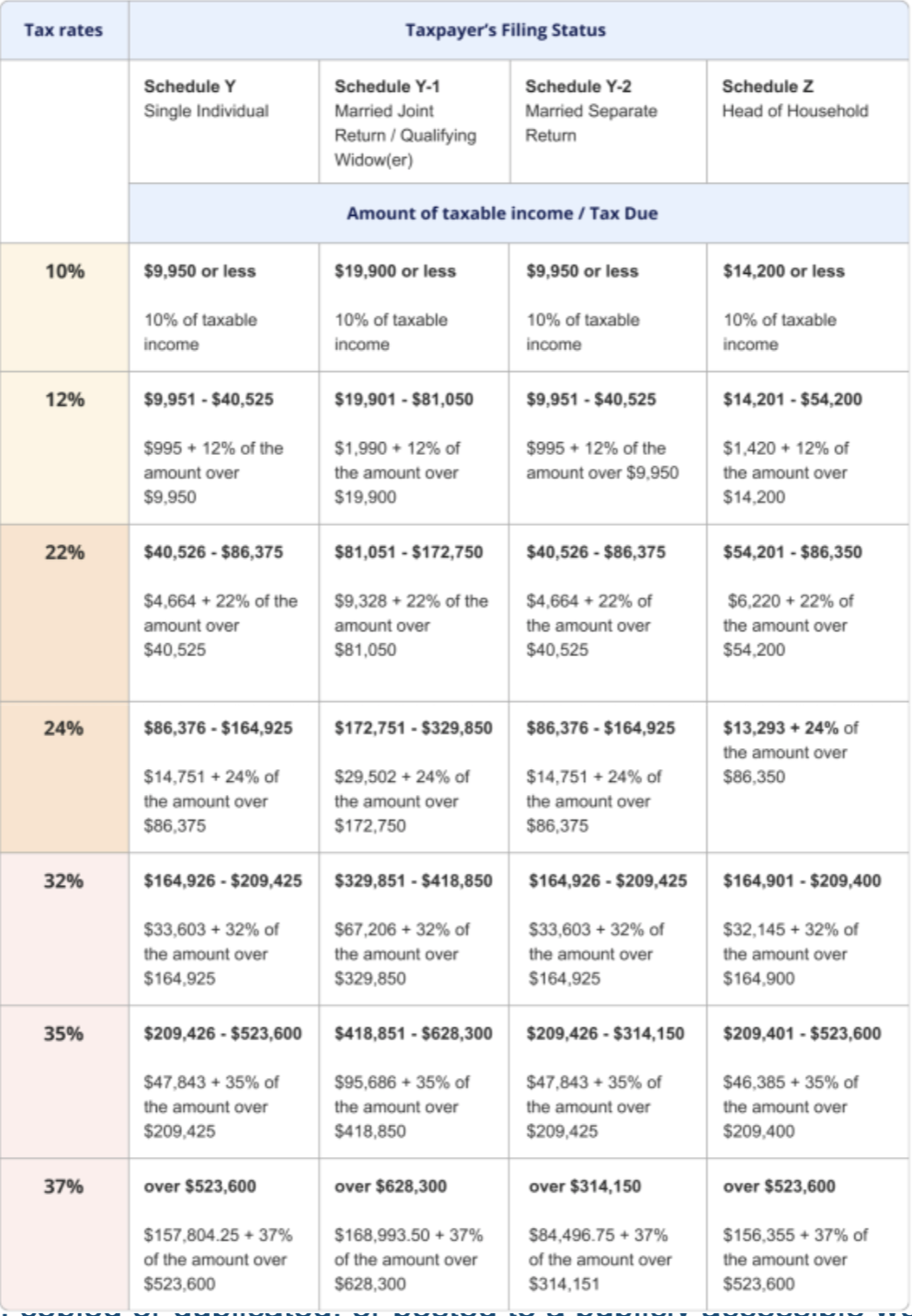

Question 1: (from chapter 3) Francine Delgado has developed a business plan for producing and selling a new hair care product that emits nutrients to the scalp when used. The product residues have been judged to be environmentally safe. Following are her projected partial financial statements for the first three years of operation of HairCare Products Company. Francine, however, is unsure whether to organize her business as a proprietorship or a regular corporation. HAIRCARE PRODUCTS COMPANY PROJECTED PARTIAL INCOME STATEMENTS & BALANCE SHEETS YEAR 1 YEAR 2 YEAR 3 $200,000 100,000 100,000 $400,000 200,000 200,000 $1,800,000 800,000 1,000,000 Sales Cost of goods sold Gross profit Operating expenses Depreciation Earnings before interest and taxes Interest Earnings before taxes Taxes Net income Cash and inventories Building and equipment Total assets 75,000 4,000 21,000 1,000 20,000 200,000 20,000 780,000 4,000 776,000 100,000 8,000 92,000 2,000 90,000 ? ? 100,000 100,000 $200,000 ? ? ? 50,000 50,000 $100,000 500,000 300,000 $800,000 A. Use the tax rate schedules presented in this chapter (Slide 24 on CH3, assuming the 2021 rates apply for all 3 years) to estimate the dollar amount of taxes that would have to be paid in each year by HairCare Products Company if the venture is initially formed as a corporation. Also calculate the after-tax net income for each year. B. Use the tax rate schedules presented in this chapter (Slide 24 on CH3, assuming the 2021 rates apply for all 3 years) to estimate the dollar amount of taxes that would have to be paid in each year if HairCare Products Company is organized as a proprietorship and represents Francine's only source of income, and if she is single. Also calculate the after-tax net income for each year. C. Use ratios from Chapter 2 to calculate the return on assets model and its net profit margin and asset intensity ratios. D. In order to grow sales, HairCare Products will need to invest in assets to support sales growth. How might the venture's assets be financed? Tax rates Taxpayer's Filing Status Schedule Y Single Individual Schedule Y-1 Married Joint Return / Qualifying Widow(er) Schedule Y-2 Married Separate Return Schedule z Head of Household Amount of taxable income / Tax Due 10% $9,950 or less $19,900 or less $9,950 or less $14,200 or less 10% of taxable income 10% of taxable income 10% of taxable income 10% of taxable income 12% $9,951 - $40,525 $19,901 - $81,050 $9,951 - $40,525 $14,201 - $54,200 $995 + 12% of the amount over $9.950 $1,990 + 12% of the amount over $19,900 $995 + 12% of the amount over $9.950 $1,420 + 12% of the amount over $14,200 22% $40,526 - $86,375 $81,051 - $172,750 $40,526 - $86,375 $54,201 - $86,350 $4,664 +22% of the amount over $40,525 $9,328 + 22% of the amount over $81,050 $4,664 +22% of the amount over $40,525 $6,220 +22% of the amount over $54,200 24% $86,376 - $164,925 $172,751 - $329,850 $86,376 - $164,925 $13,293 +24% of the amount over $86,350 $14,751 +24% of the amount over $86,375 $29,502 +24% of the amount over $172,750 $14.751 +24% of the amount over $86,375 32% $164,926 - $209,425 $329,851 - $418,850 $164,926 - $209,425 $164,901 - $209,400 $33,603 + 32% of the amount over $164,925 $67,206 + 32% of the amount over $329,850 $33,603 + 32% of the amount over $164,925 $32,145 + 32% of the amount over $164.900 35% $209,426 - $523,600 $418,851 - $628,300 $209,426 - $314,150 $209,401 - $523,600 $47,843 + 35% of the amount over $209,425 $95,686 + 35% of the amount over $418,850 $47,843 + 35% of the amount over $209,425 $46,385 + 35% of the amount over $209,400 37% over $523,600 over $628,300 over $314,150 over $523,600 $157,804.25 + 37% of the amount over $523,600 $168.993.50 +37% of the amount over 5628,300 $84,496.75 + 37% of the amount over $314,151 $156,355 +37% of the amount over $523,600