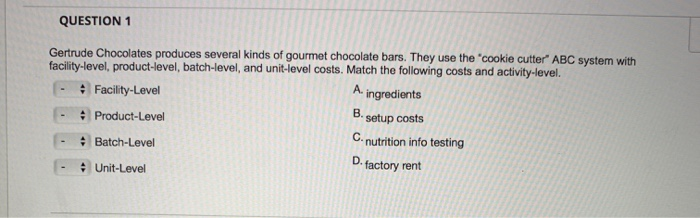

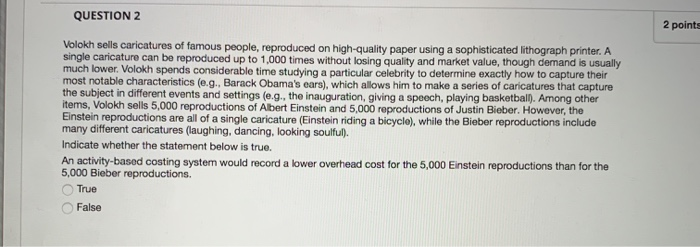

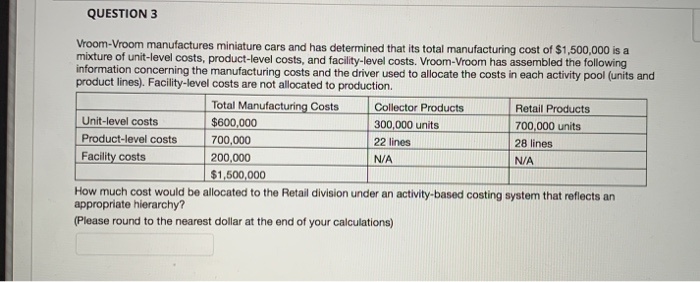

QUESTION 1 Gertrude Chocolates produces several kinds of gourmet chocolate bars. They use the "cookie cutter ABC system with facility-level, product-level, batch-level, and unit-level costs. Match the following costs and activity-level. A. ingredients Facility-Level B. setup costs Product-Level C.nutrition info testing Batch-Level D. factory rent : Unit-Level QUESTION 2 2 points Volokh sells caricatures of famous people, reproduced on high-quality paper using a sophisticated lithograph printer. A single caricature can be reproduced up to 1,000 times without losing quality and market value, though demand is usually much lower. Volokh spends considerable time studying a particular celebrity to determine exactly how to capture their most notable characteristics (e.g., Barack Obama's ears), which allows him to make a series of caricatures that capture the subject in different events and settings (e.g., the inauguration, giving a speech, playing basketbal). Among other items, Volokh sells 5,000 reproductions of Albert Einstein and 5,000 reproductions of Justin Bieber. However, the Einstein reproductions are all of a single caricature (Einstein riding a bicycle), while the Bieber reproductions include many different caricatures (laughing, dancing, looking soulful). Indicate whether the statement below is true. An activity-based costing system would record a lower overhead cost for the 5,000 Einstein reproductions than for the 5,000 Bieber reproductions. True False QUESTION 3 Vroom-Vroom manufactures miniature cars and has determined that its total manufacturing cost of $1,500,000 is a mixture of unit-level costs, product-level costs, and facility-level costs. Vroom-Vroom has assembled the following information concerning the manufacturing costs and the driver used to allocate the costs in each activity pool (units and product lines). Facility-level costs are not allocated to production. Total Manufacturing Costs $600,000 Collector Products Retail Products Unit-level costs Product-level costs Facility costs 300,000 units 700,000 units 700,000 200,000 $1,500,000 22 lines 28 lines N/A N/A How much cost would be allocated to the Retail division under an activity-based costing system that reflects an appropriate hierarchy? (Please round to the nearest dollar at the end of your calculations)