Answered step by step

Verified Expert Solution

Question

1 Approved Answer

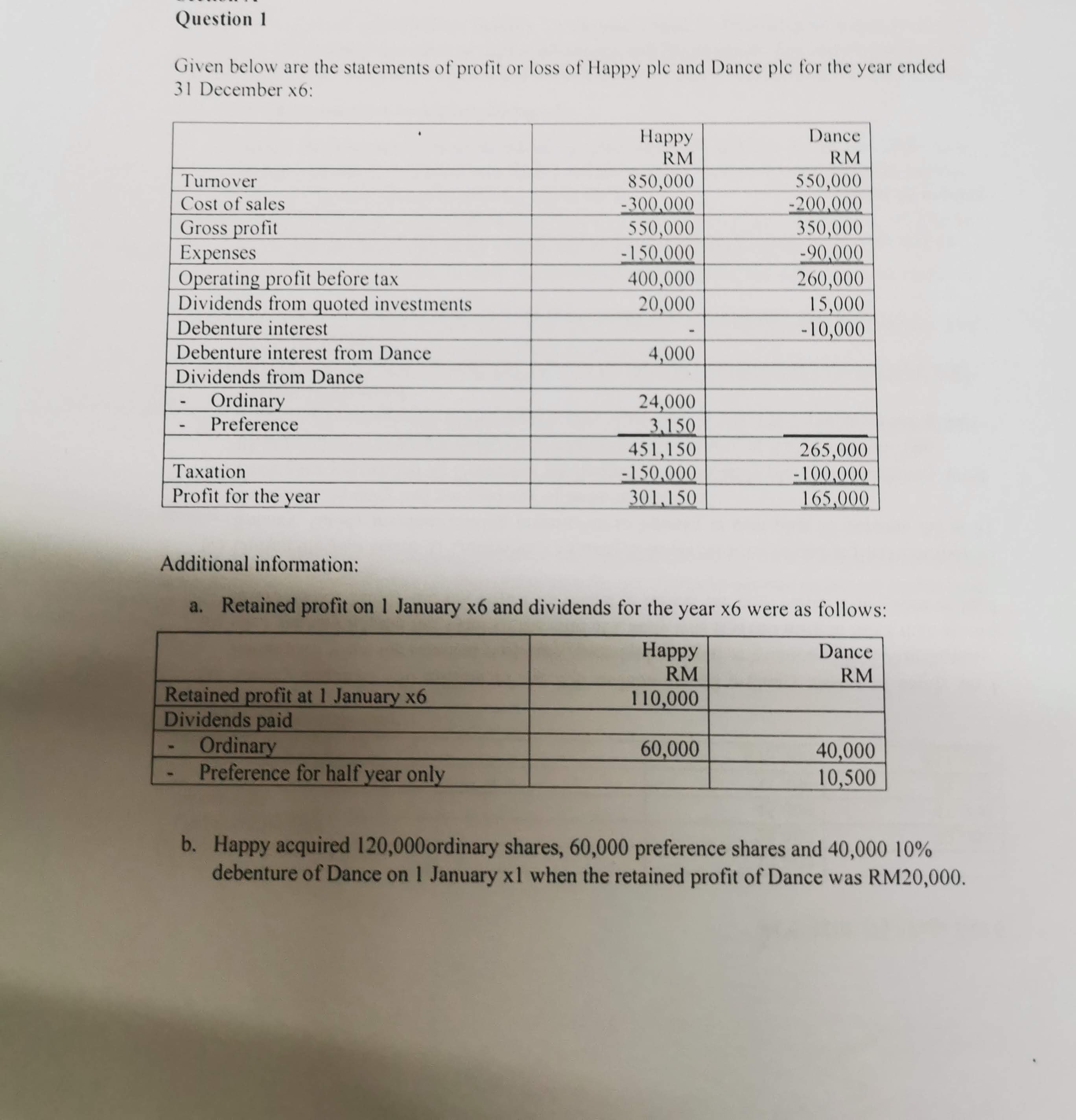

Question 1 Given below are the statements of profit or loss of Happy plc and Dance ple for the year ended 31 December 6 :

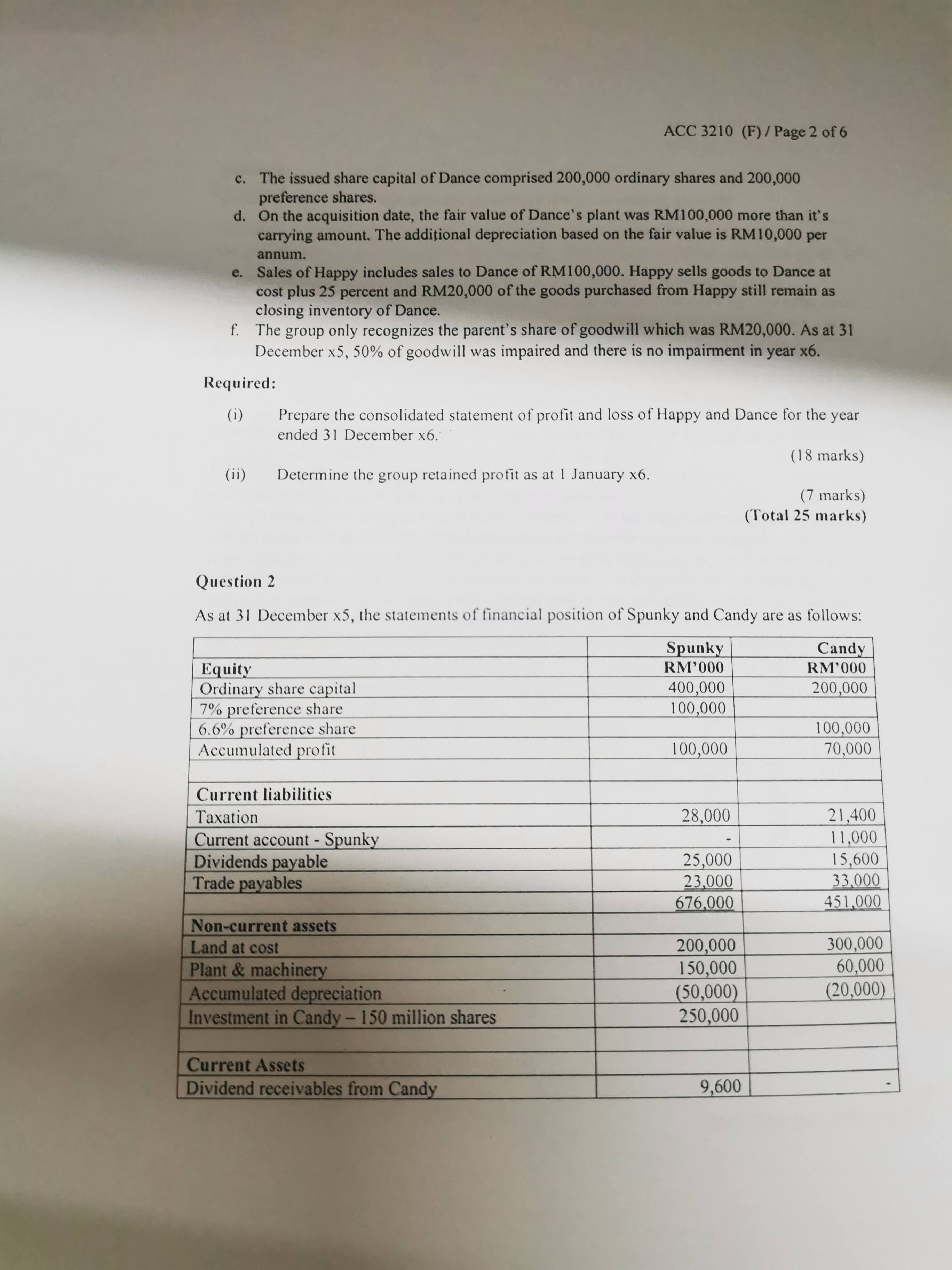

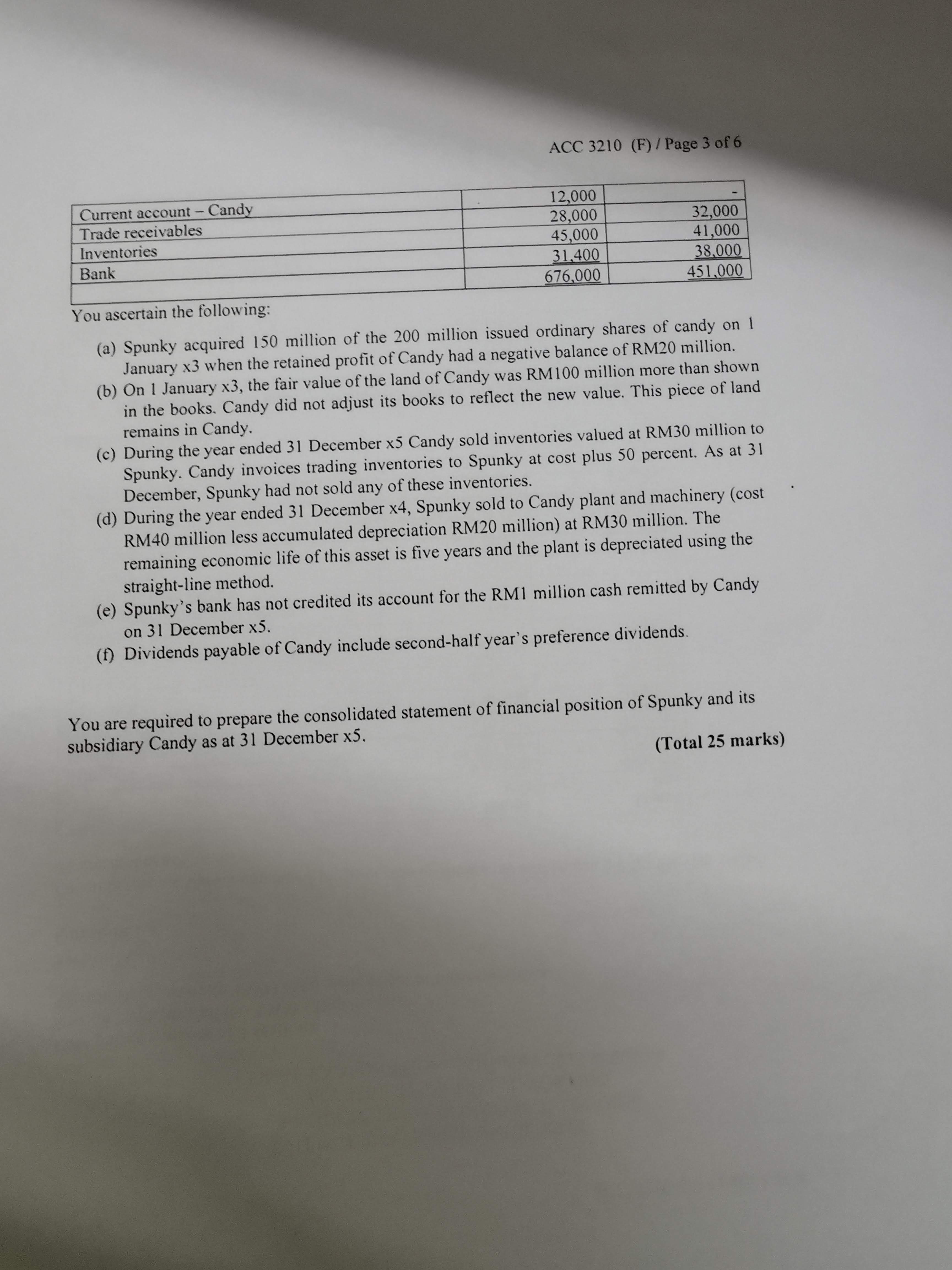

Question 1 Given below are the statements of profit or loss of Happy plc and Dance ple for the year ended 31 December 6 : Additional information: a. Retained profit on 1 January x6 and dividends for the year 6 were as follows: b. Happy acquired 120,000 ordinary shares, 60,000 preference shares and 40,00010% debenture of Dance on 1 January x1 when the retained profit of Dance was RM20,000. c. The issued share capital of Dance comprised 200,000 ordinary shares and 200,000 preference shares. d. On the acquisition date, the fair value of Dance's plant was RM100,000 more than it's carrying amount. The additional depreciation based on the fair value is RM10,000 per annum. e. Sales of Happy includes sales to Dance of RM100,000. Happy sells goods to Dance at cost plus 25 percent and RM20,000 of the goods purchased from Happy still remain as closing inventory of Dance. f. The group only recognizes the parent's share of goodwill which was RM20,000. As at 31 December 5,50% of goodwill was impaired and there is no impairment in year x6. Required: (i) Prepare the consolidated statement of profit and loss of Happy and Dance for the year ended 31 December 6. (18 marks) (ii) Determine the group retained profit as at 1 January 6. (7 marks) (Total 25 marks) Question 2 As at 31 December 5, the statements of financial position of Spunky and Candy are as follows: ACC 3210 (F)/Page 3 of 6 You ascertain the lunuwins (a) Spunky acquired 150 million of the 200 million issued ordinary shares of candy on 1 January 3 when the retained profit of Candy had a negative balance of RM20 million. (b) On 1 January 3, the fair value of the land of Candy was RM 100 million more than shown in the books. Candy did not adjust its books to reflect the new value. This piece of land remains in Candy. (c) During the year ended 31 December x5 Candy sold inventories valued at RM30 million to Spunky. Candy invoices trading inventories to Spunky at cost plus 50 percent. As at 31 December, Spunky had not sold any of these inventories. (d) During the year ended 31 December x4, Spunky sold to Candy plant and machinery (cost RM40 million less accumulated depreciation RM20 million) at RM30 million. The remaining economic life of this asset is five years and the plant is depreciated using the straight-line method. (e) Spunky's bank has not credited its account for the RM1 million cash remitted by Candy on 31 December x5. (f) Dividends payable of Candy include second-half year's preference dividends. You are required to prepare the consolidated statement of financial position of Spunky and its subsidiary Candy as at 31 December 5. (Total 25 marks) Question 1 Given below are the statements of profit or loss of Happy plc and Dance ple for the year ended 31 December 6 : Additional information: a. Retained profit on 1 January x6 and dividends for the year 6 were as follows: b. Happy acquired 120,000 ordinary shares, 60,000 preference shares and 40,00010% debenture of Dance on 1 January x1 when the retained profit of Dance was RM20,000. c. The issued share capital of Dance comprised 200,000 ordinary shares and 200,000 preference shares. d. On the acquisition date, the fair value of Dance's plant was RM100,000 more than it's carrying amount. The additional depreciation based on the fair value is RM10,000 per annum. e. Sales of Happy includes sales to Dance of RM100,000. Happy sells goods to Dance at cost plus 25 percent and RM20,000 of the goods purchased from Happy still remain as closing inventory of Dance. f. The group only recognizes the parent's share of goodwill which was RM20,000. As at 31 December 5,50% of goodwill was impaired and there is no impairment in year x6. Required: (i) Prepare the consolidated statement of profit and loss of Happy and Dance for the year ended 31 December 6. (18 marks) (ii) Determine the group retained profit as at 1 January 6. (7 marks) (Total 25 marks) Question 2 As at 31 December 5, the statements of financial position of Spunky and Candy are as follows: ACC 3210 (F)/Page 3 of 6 You ascertain the lunuwins (a) Spunky acquired 150 million of the 200 million issued ordinary shares of candy on 1 January 3 when the retained profit of Candy had a negative balance of RM20 million. (b) On 1 January 3, the fair value of the land of Candy was RM 100 million more than shown in the books. Candy did not adjust its books to reflect the new value. This piece of land remains in Candy. (c) During the year ended 31 December x5 Candy sold inventories valued at RM30 million to Spunky. Candy invoices trading inventories to Spunky at cost plus 50 percent. As at 31 December, Spunky had not sold any of these inventories. (d) During the year ended 31 December x4, Spunky sold to Candy plant and machinery (cost RM40 million less accumulated depreciation RM20 million) at RM30 million. The remaining economic life of this asset is five years and the plant is depreciated using the straight-line method. (e) Spunky's bank has not credited its account for the RM1 million cash remitted by Candy on 31 December x5. (f) Dividends payable of Candy include second-half year's preference dividends. You are required to prepare the consolidated statement of financial position of Spunky and its subsidiary Candy as at 31 December 5. (Total 25 marks)

Question 1 Given below are the statements of profit or loss of Happy plc and Dance ple for the year ended 31 December 6 : Additional information: a. Retained profit on 1 January x6 and dividends for the year 6 were as follows: b. Happy acquired 120,000 ordinary shares, 60,000 preference shares and 40,00010% debenture of Dance on 1 January x1 when the retained profit of Dance was RM20,000. c. The issued share capital of Dance comprised 200,000 ordinary shares and 200,000 preference shares. d. On the acquisition date, the fair value of Dance's plant was RM100,000 more than it's carrying amount. The additional depreciation based on the fair value is RM10,000 per annum. e. Sales of Happy includes sales to Dance of RM100,000. Happy sells goods to Dance at cost plus 25 percent and RM20,000 of the goods purchased from Happy still remain as closing inventory of Dance. f. The group only recognizes the parent's share of goodwill which was RM20,000. As at 31 December 5,50% of goodwill was impaired and there is no impairment in year x6. Required: (i) Prepare the consolidated statement of profit and loss of Happy and Dance for the year ended 31 December 6. (18 marks) (ii) Determine the group retained profit as at 1 January 6. (7 marks) (Total 25 marks) Question 2 As at 31 December 5, the statements of financial position of Spunky and Candy are as follows: ACC 3210 (F)/Page 3 of 6 You ascertain the lunuwins (a) Spunky acquired 150 million of the 200 million issued ordinary shares of candy on 1 January 3 when the retained profit of Candy had a negative balance of RM20 million. (b) On 1 January 3, the fair value of the land of Candy was RM 100 million more than shown in the books. Candy did not adjust its books to reflect the new value. This piece of land remains in Candy. (c) During the year ended 31 December x5 Candy sold inventories valued at RM30 million to Spunky. Candy invoices trading inventories to Spunky at cost plus 50 percent. As at 31 December, Spunky had not sold any of these inventories. (d) During the year ended 31 December x4, Spunky sold to Candy plant and machinery (cost RM40 million less accumulated depreciation RM20 million) at RM30 million. The remaining economic life of this asset is five years and the plant is depreciated using the straight-line method. (e) Spunky's bank has not credited its account for the RM1 million cash remitted by Candy on 31 December x5. (f) Dividends payable of Candy include second-half year's preference dividends. You are required to prepare the consolidated statement of financial position of Spunky and its subsidiary Candy as at 31 December 5. (Total 25 marks) Question 1 Given below are the statements of profit or loss of Happy plc and Dance ple for the year ended 31 December 6 : Additional information: a. Retained profit on 1 January x6 and dividends for the year 6 were as follows: b. Happy acquired 120,000 ordinary shares, 60,000 preference shares and 40,00010% debenture of Dance on 1 January x1 when the retained profit of Dance was RM20,000. c. The issued share capital of Dance comprised 200,000 ordinary shares and 200,000 preference shares. d. On the acquisition date, the fair value of Dance's plant was RM100,000 more than it's carrying amount. The additional depreciation based on the fair value is RM10,000 per annum. e. Sales of Happy includes sales to Dance of RM100,000. Happy sells goods to Dance at cost plus 25 percent and RM20,000 of the goods purchased from Happy still remain as closing inventory of Dance. f. The group only recognizes the parent's share of goodwill which was RM20,000. As at 31 December 5,50% of goodwill was impaired and there is no impairment in year x6. Required: (i) Prepare the consolidated statement of profit and loss of Happy and Dance for the year ended 31 December 6. (18 marks) (ii) Determine the group retained profit as at 1 January 6. (7 marks) (Total 25 marks) Question 2 As at 31 December 5, the statements of financial position of Spunky and Candy are as follows: ACC 3210 (F)/Page 3 of 6 You ascertain the lunuwins (a) Spunky acquired 150 million of the 200 million issued ordinary shares of candy on 1 January 3 when the retained profit of Candy had a negative balance of RM20 million. (b) On 1 January 3, the fair value of the land of Candy was RM 100 million more than shown in the books. Candy did not adjust its books to reflect the new value. This piece of land remains in Candy. (c) During the year ended 31 December x5 Candy sold inventories valued at RM30 million to Spunky. Candy invoices trading inventories to Spunky at cost plus 50 percent. As at 31 December, Spunky had not sold any of these inventories. (d) During the year ended 31 December x4, Spunky sold to Candy plant and machinery (cost RM40 million less accumulated depreciation RM20 million) at RM30 million. The remaining economic life of this asset is five years and the plant is depreciated using the straight-line method. (e) Spunky's bank has not credited its account for the RM1 million cash remitted by Candy on 31 December x5. (f) Dividends payable of Candy include second-half year's preference dividends. You are required to prepare the consolidated statement of financial position of Spunky and its subsidiary Candy as at 31 December 5. (Total 25 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started