Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Global Company has 150,000 bonds outstanding, each with a $1,000 par value and a current market price of $980. Global also has 3

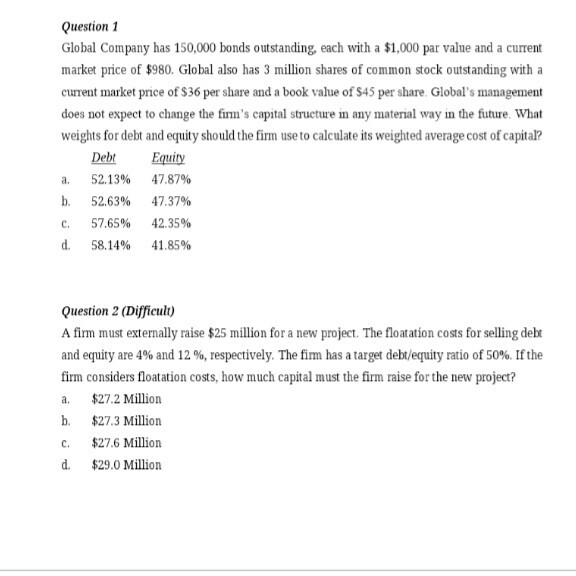

Question 1 Global Company has 150,000 bonds outstanding, each with a $1,000 par value and a current market price of $980. Global also has 3 million shares of common stock outstanding with a current market price of $36 per share and a book value of $45 per share. Global's management does not expect to change the firm's capital structure in any material way in the future. What weights for debt and equity should the firm use to calculate its weighted average cost of capital a. b. C. d. Debt 52.13% 52.63% 57.65% 58.14% Equity 47.87% 47.37% 42.35% 41.85% Question 2 (Difficult) A firm must externally raise $25 million for a new project. The floatation costs for selling debt and equity are 4% and 12 %, respectively. The firm has a target debt/equity ratio of 50%. If the firm considers floatation costs, how much capital must the firm raise for the new project? a. $27.2 Million b. $27.3 Million C. $27.6 Million d. $29.0 Million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started