Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Greenlays Bank Ltd recently implemented a mobile Banking technology on an internet application and USSD. The bank had hired Accurate of Bangalore

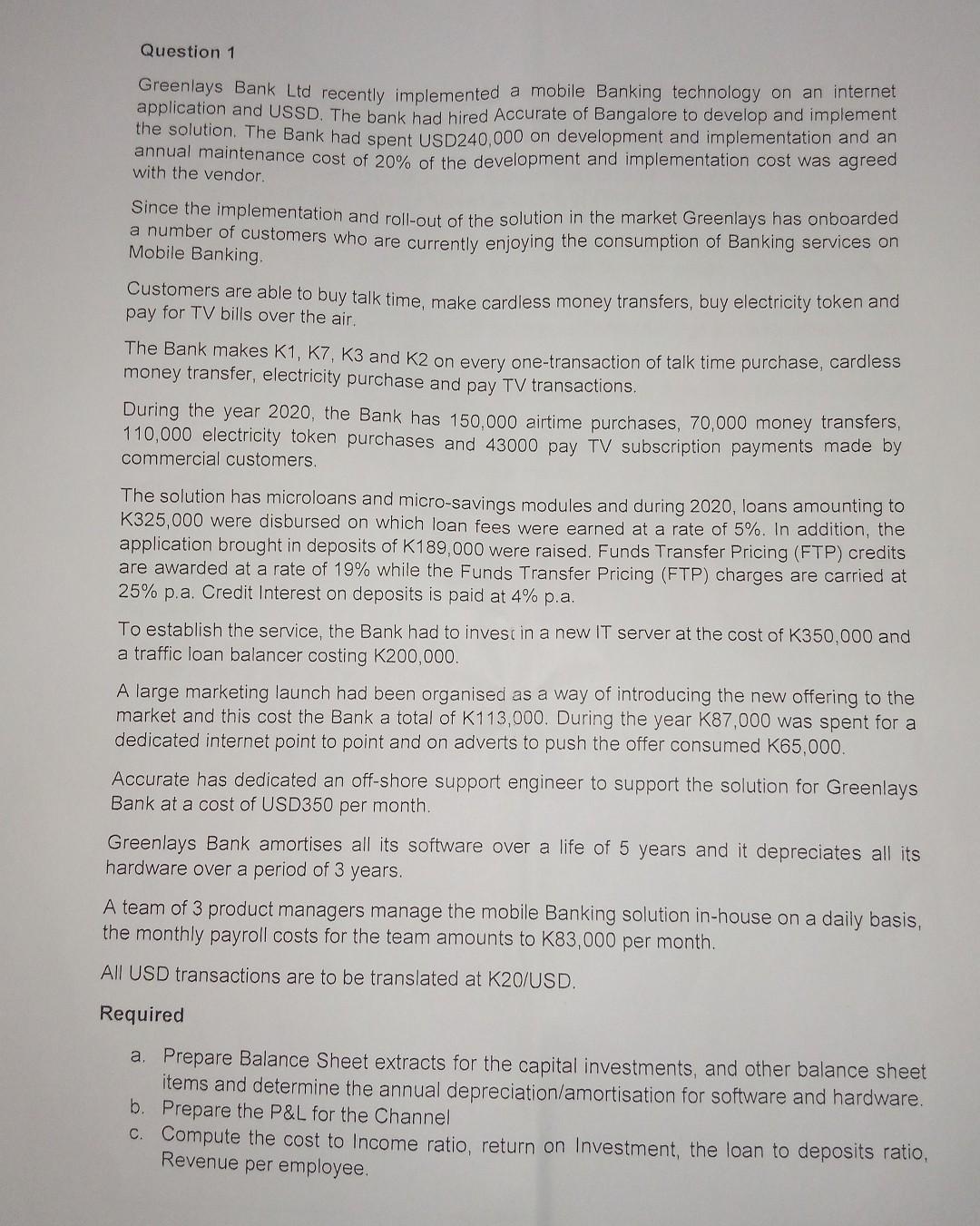

Question 1 Greenlays Bank Ltd recently implemented a mobile Banking technology on an internet application and USSD. The bank had hired Accurate of Bangalore to develop and implement the solution. The Bank had spent USD240,000 on development and implementation and an annual maintenance cost of 20% of the development and implementation cost was agreed with the vendor. Since the implementation and roll-out of the solution in the market Greenlays has onboarded a number of customers who are currently enjoying the consumption of Banking services on Mobile Banking. Customers are able to buy talk time, make cardless money transfers, buy electricity token and pay for TV bills over the air. The Bank makes K1, K7, K3 and K2 on every one-transaction of talk time purchase, cardless money transfer, electricity purchase and pay TV transactions. During the year 2020, the Bank has 150,000 airtime purchases, 70,000 money transfers, 110,000 electricity token purchases and 43000 pay TV subscription payments made by commercial customers. The solution has microloans and micro-savings modules and during 2020, loans amounting to K325,000 were disbursed on which loan fees were earned at a rate of 5%. In addition, the application brought in deposits of K189,000 were raised. Funds Transfer Pricing (FTP) credits are awarded at a rate of 19% while the Funds Transfer Pricing (FTP) charges are carried at 25% p.a. Credit Interest on deposits is paid at 4% p.a. To establish the service, the Bank had to invest in a new IT server at the cost of K350,000 and a traffic loan balancer costing K200,000. A large marketing launch had been organised as a way of introducing the new offering to the market and this cost the Bank a total of K113,000. During the year K87,000 was spent for a dedicated internet point to point and on adverts to push the offer consumed K65,000. Accurate has dedicated an off-shore support engineer to support the solution for Greenlays Bank at a cost of USD350 per month. Greenlays Bank amortises all its software over a life of 5 years and it depreciates all its hardware over a period of 3 years. A team of 3 product managers manage the mobile Banking solution in-house on a daily basis, the monthly payroll costs for the team amounts to K83,000 per month. All USD transactions are to be translated at K20/USD. Required a. Prepare Balance Sheet extracts for the capital investments, and other balance sheet items and determine the annual depreciation/amortisation for software and hardware. b. Prepare the P&L for the Channel c. Compute the cost to Income ratio, return on Investment, the loan to deposits ratio, Revenue per employee.

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Extracted Balance Sheet Assets IT server capital investment K350000 Traffic loan balancer K200000 De...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started