Question

Has company produces a single product and produces 80,000 products per year and sells its unit for 160 TL. The unit expenses (TL) of the

Has company produces a single product and produces 80,000 products per year and sells its unit for 160 TL. The unit expenses (TL) of the business in this activity volume are as follows:

Direct raw material and material expenses 38

Direct labor costs 40

Variable production overheads 11.20

Fixed general production expenses 20.00 (Total 1.600.000)

Variable marketing, selling and distribution expenses 6.80

Fixed marketing, selling and distribution expenses 18.00 (Total 1.440.000)

Total unit cost: 134 TL.

WANTED: Has company has the capacity to increase its production by 25% without causing an increase in fixed general production expenses. In case the capacity is increased at the specified rate, fixed marketing, sales and distribution expenses will increase by 600.000 TL. Calculate the effect of the increase in fixed marketing, selling and distribution expenses on the profit for the period if the business increases its production.

Question 2. Kadir Enterprise is an enterprise that renews its cars every year. 280.000 TL obtained from the sale of the last car in the bank. has. An automobile company submitted an offer to the enterprise. The gasoline turnkey price of the new model Pega brand X35 model car, which attracts the attention of business managers, is 540,000 TL.

After congratulating Mehmet Bey, the purchasing manager who went to the Pega sales office, for the selection they made, the salesperson offered an alternative to the Pega X35. He said that there is an XDT diesel model. He stated that there is no difference between him and the X35 in terms of performance, comfort and equipment. He emphasized that the cost of using is the same, excluding fuel. However, he stated that it provided significant savings in fuel costs. While the X35 model burns 9 liters of gasoline per 100 km; The fuel cost of the XDT is 6 liters. The liter price of unleaded gasoline is 12.97 TL. while; The liter price of diesel diesel is 12.79 TL. and recommended the diesel model.

The turnkey sales price of the Diesel XDT vehicle is 590.000 TL. These vehicles, which are in the use of managers in the enterprise, average 30,000 km per year. It has been evaluated that every car purchased can be sold for 10% less than the approximate purchase price every year.

REQUESTED: Which model car do you think should be chosen? Calculate how much this choice gives compared to the other..

Question 3

Make the journal entries of the following independent transactions. Take the VAT rate of 18% for the necessary transactions.

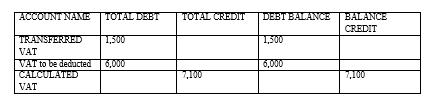

The balances of the VAT accounts of the business as of the end of December 2019 are as follows. Make the journal entry for the VAT deduction.

a. ABC Company's cost is 4,000 TL and its goods are 10,000 TL; He sold his VAT in cash, 3.000 TL via EFT, 2.000 TL against promissory note, the balance on credit/deductible to current account/time/credit) to KLM Enterprise. Register for ABC and KLM Businesses.

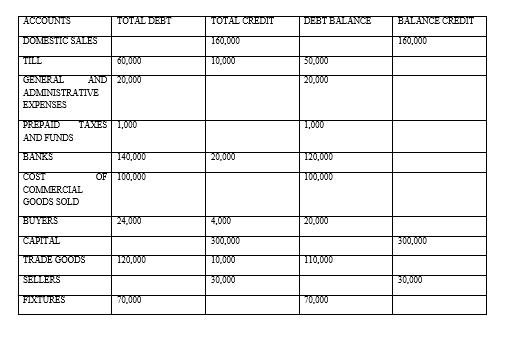

b. The "General Provisional Trial Balance" balances of the ANL Entity below are given in a mixed form. Using the accounts, make the transfer and closing records. Also calculate the amount of PROFIT OR LOSS FOR THE PERIOD.

c.

ACCOUNT NAME TOTAL DEBT 1,500 VAT VAT to be deducted 6,000 CALCULATED TRANSFERRED VAT TOTAL CREDIT 7,100 DEBT BALANCE 1,500 6,000 BALANCE CREDIT 7,100

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Lets start with the first question about the Has company increasing production by 25 1 The effect of increased fixed marketing selling and distribution expenses on the profit due to a 25 increase in p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started