Question

QUESTION 1 Ignore value added tax Kangaro Holdings Limited (Kangaro) is a company listed on the Johannesburg stock exchange. Kangaro operates in all provinces in

QUESTION 1

Ignore value added tax

Kangaro Holdings Limited (Kangaro) is a company listed on the Johannesburg stock exchange. Kangaro operates in all provinces in South Africa. Its main business activities are in construction industry. Kangaro and all its entities have a 31 December financial year end.

Acquisition of Rexel (Pty) Limited On 1 May 2016, Kangaro acquired 7 500 ordinary shares in Rexel (Pty) Ltd (Rexel) from Mr. S Holder (existing shareholder) for R 1 050 000. Rexel had a total of 10 000 ordinary shares in issue. On 1 May 2016, Kangaro obtained control in Rexel as defined in IFRS 10.

On 1 May 2016, when Kangaro acquired the controlling interest in Rexel, the credit balance for Retained earnings was R 950 000. The share capital has remained the same since acquisition at R100 000. Rexel also had an internally generated brand that was not recognized in their books as it didnt meet the requirement of IAS 38. The brand was deemed to have a fair value of R350 000 on 1 May 2016.

Non controlling interest was measure at fair value of R 550 000 at acquisition.

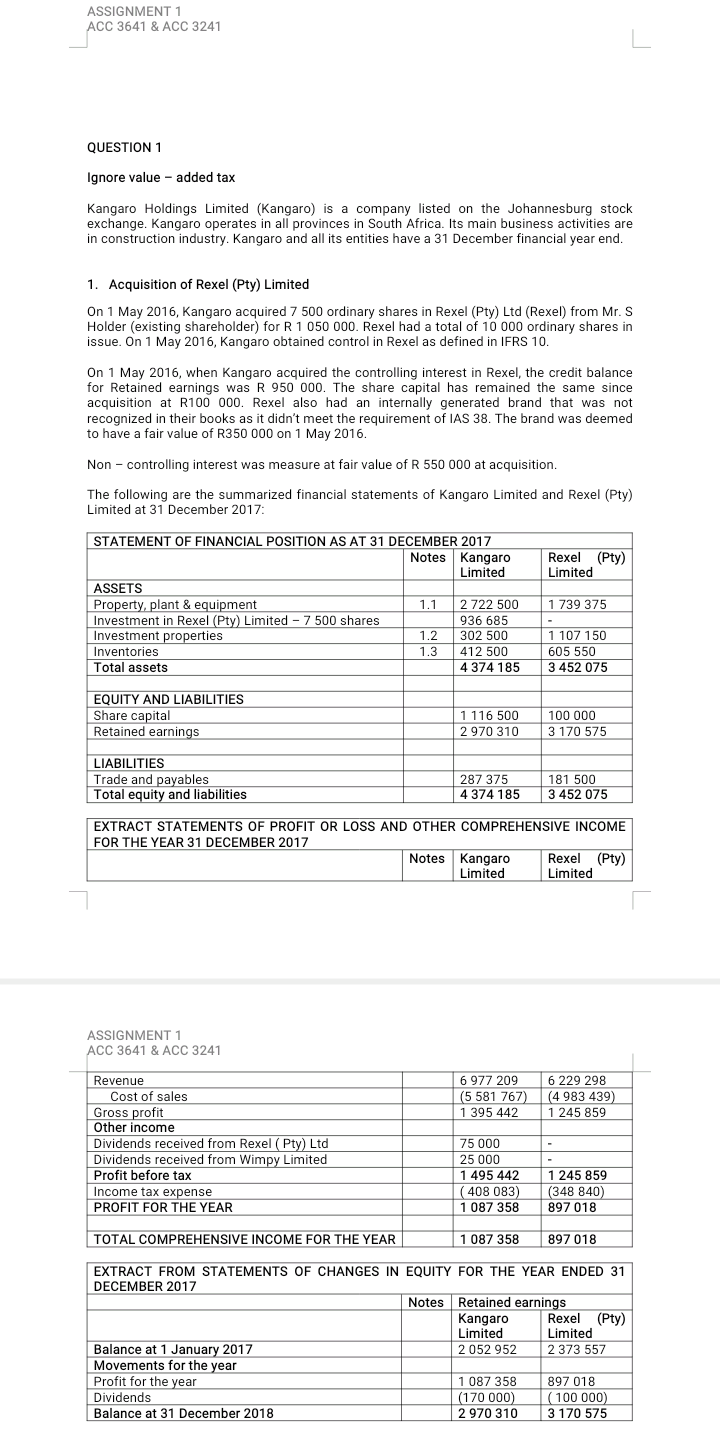

The following are the summarized financial statements of Kangaro Limited and Rexel (Pty) Limited at 31 December 2017:

STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2017

Notes Kangaro Limited Rexel (Pty) Limited

ASSETS

Property, plant & equipment 1.1 2 722 500 1 739 375

Investment in Rexel (Pty) Limited 7 500 shares

936 685 -

Investment properties 1.2 302 500 1 107 150

Inventories 1.3 412 500 605 550

Total assets

4 374 185 3 452 075

EQUITY AND LIABILITIES

Share capital

1 116 500 100 000

Retained earnings

2 970 310 3 170 575

LIABILITIES

Trade and payables

287 375 181 500

Total equity and liabilities

4 374 185 3 452 075

EXTRACT STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR 31 DECEMBER 2017

Notes Kangaro Limited Rexel (Pty) Limited

Revenue

6 977 209 6 229 298

Cost of sales

(5 581 767) (4 983 439)

Gross profit

1 395 442 1 245 859

Other income

Dividends received from Rexel ( Pty) Ltd

75 000 -

Dividends received from Wimpy Limited

25 000 -

Profit before tax

1 495 442 1 245 859

Income tax expense

( 408 083) (348 840)

PROFIT FOR THE YEAR

1 087 358 897 018

TOTAL COMPREHENSIVE INCOME FOR THE YEAR

1 087 358 897 018

EXTRACT FROM STATEMENTS OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 DECEMBER 2017

Notes Retained earnings

Kangaro Limited Rexel (Pty) Limited

Balance at 1 January 2017

2 052 952 2 373 557

Movements for the year

Profit for the year

1 087 358 897 018

Dividends

(170 000) ( 100 000)

Balance at 31 December 2018

2 970 310 3 170 575

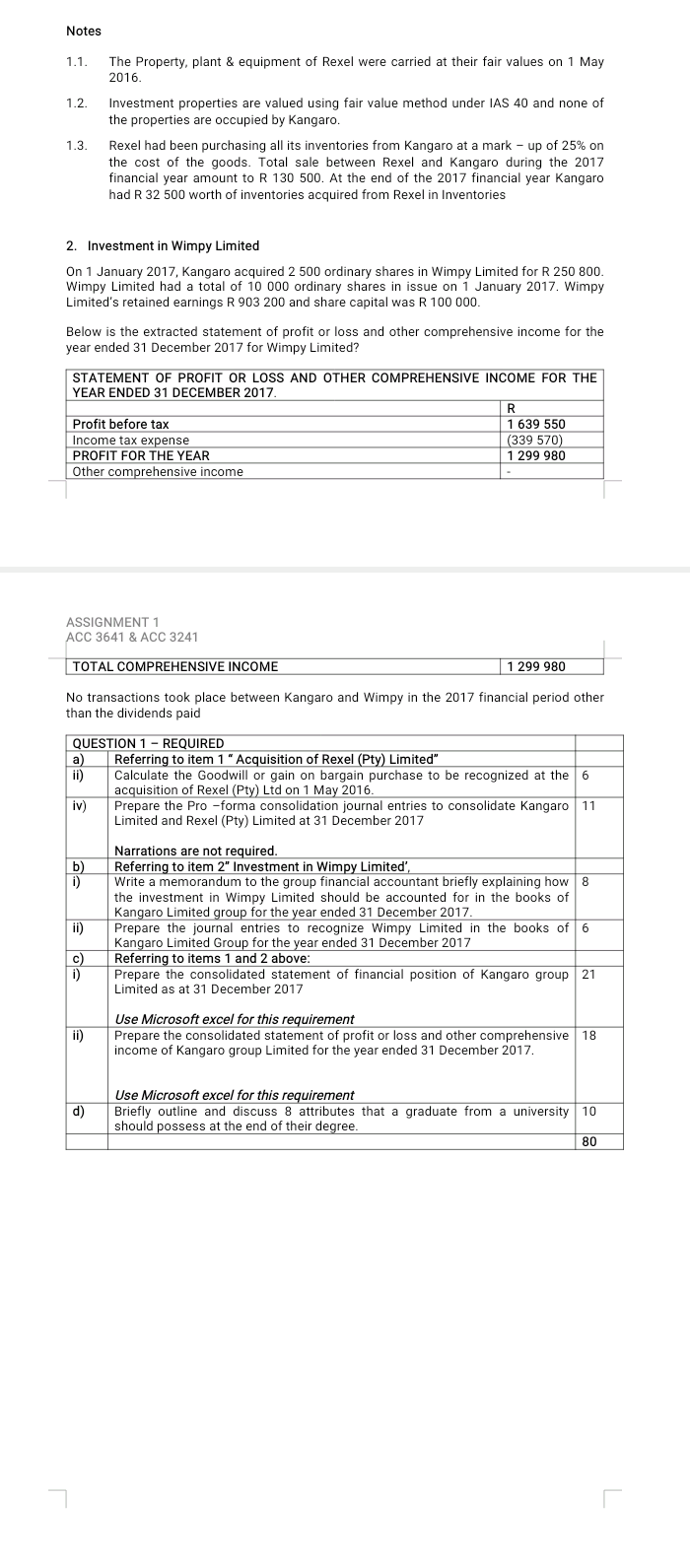

Notes

The Property, plant & equipment of Rexel were carried at their fair values on 1 May 2016. Investment properties are valued using fair value method under IAS 40 and none of the properties are occupied by Kangaro. Rexel had been purchasing all its inventories from Kangaro at a mark up of 25% on the cost of the goods. Total sale between Rexel and Kangaro during the 2017 financial year amount to R 130 500. At the end of the 2017 financial year Kangaro had R 32 500 worth of inventories acquired from Rexel in Inventories

Investment in Wimpy Limited On 1 January 2017, Kangaro acquired 2 500 ordinary shares in Wimpy Limited for R 250 800. Wimpy Limited had a total of 10 000 ordinary shares in issue on 1 January 2017. Wimpy Limiteds retained earnings R 903 200 and share capital was R 100 000.

Below is the extracted statement of profit or loss and other comprehensive income for the year ended 31 December 2017 for Wimpy Limited?

STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2017.

R

Profit before tax 1 639 550

Income tax expense (339 570)

PROFIT FOR THE YEAR 1 299 980

Other comprehensive income -

TOTAL COMPREHENSIVE INCOME 1 299 980

No transactions took place between Kangaro and Wimpy in the 2017 financial period other than the dividends paid

QUESTION 1 REQUIRED

a) Referring to item 1 Acquisition of Rexel (Pty) Limited

ii) Calculate the Goodwill or gain on bargain purchase to be recognized at the acquisition of Rexel (Pty) Ltd on 1 May 2016. 6

iv) Prepare the Pro forma consolidation journal entries to consolidate Kangaro Limited and Rexel (Pty) Limited at 31 December 2017

Narrations are not required. 11

b) Referring to item 2 Investment in Wimpy Limited,

i) Write a memorandum to the group financial accountant briefly explaining how the investment in Wimpy Limited should be accounted for in the books of Kangaro Limited group for the year ended 31 December 2017. 8

ii) Prepare the journal entries to recognize Wimpy Limited in the books of Kangaro Limited Group for the year ended 31 December 2017 6

c) Referring to items 1 and 2 above:

i) Prepare the consolidated statement of financial position of Kangaro group Limited as at 31 December 2017

Use Microsoft excel for this requirement 21

ii) Prepare the consolidated statement of profit or loss and other comprehensive income of Kangaro group Limited for the year ended 31 December 2017.

Use Microsoft excel for this requirement 18

d) Briefly outline and discuss 8 attributes that a graduate from a university should possess at the end of their degree. 10

80

QUESTION 1 Ignore value - added tax Kangaro Holdings Limited (Kangaro) is a company listed on the Johannesburg stock exchange. Kangaro operates in all provinces in South Africa. Its main business activities are in construction industry. Kangaro and all its entities have a 31 December financial year end. 1. Acquisition of Rexel (Pty) Limited On 1 May 2016, Kangaro acquired 7500 ordinary shares in Rexel (Pty) Ltd (Rexel) from Mr. S Holder (existing shareholder) for R 1050000 . Rexel had a total of 10000 ordinary shares in issue. On 1 May 2016, Kangaro obtained control in Rexel as defined in IFRS 10. On 1 May 2016, when Kangaro acquired the controlling interest in Rexel, the credit balance for Retained earnings was R 950000 . The share capital has remained the same since acquisition at R100 000. Rexel also had an internally generated brand that was not recognized in their books as it didn't meet the requirement of IAS 38. The brand was deemed to have a fair value of R350 000 on 1 May 2016. Non - controlling interest was measure at fair value of R 550000 at acquisition. The following are the summarized financial statements of Kangaro Limited and Rexel (Pty) Limited at 31 December 2017: ASSIGNMENT 1 ACC 3641 \& ACC 3241 EXTRACT FROM STATEMENTS OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 Notes 1.1. The Property, plant \& equipment of Rexel were carried at their fair values on 1 May 2016. 1.2. Investment properties are valued using fair value method under IAS 40 and none of the properties are occupied by Kangaro. 1.3. Rexel had been purchasing all its inventories from Kangaro at a mark - up of 25% on the cost of the goods. Total sale between Rexel and Kangaro during the 2017 financial year amount to R 130 500. At the end of the 2017 financial year Kangaro had R 32500 worth of inventories acquired from Rexel in Inventories 2. Investment in Wimpy Limited On 1 January 2017, Kangaro acquired 2500 ordinary shares in Wimpy Limited for R 250800. Wimpy Limited had a total of 10000 ordinary shares in issue on 1 January 2017. Wimpy Limited's retained earnings R 903200 and share capital was R 100000. Below is the extracted statement of profit or loss and other comprehensive income for the year ended 31 December 2017 for Wimpy Limited? QUESTION 1 Ignore value - added tax Kangaro Holdings Limited (Kangaro) is a company listed on the Johannesburg stock exchange. Kangaro operates in all provinces in South Africa. Its main business activities are in construction industry. Kangaro and all its entities have a 31 December financial year end. 1. Acquisition of Rexel (Pty) Limited On 1 May 2016, Kangaro acquired 7500 ordinary shares in Rexel (Pty) Ltd (Rexel) from Mr. S Holder (existing shareholder) for R 1050000 . Rexel had a total of 10000 ordinary shares in issue. On 1 May 2016, Kangaro obtained control in Rexel as defined in IFRS 10. On 1 May 2016, when Kangaro acquired the controlling interest in Rexel, the credit balance for Retained earnings was R 950000 . The share capital has remained the same since acquisition at R100 000. Rexel also had an internally generated brand that was not recognized in their books as it didn't meet the requirement of IAS 38. The brand was deemed to have a fair value of R350 000 on 1 May 2016. Non - controlling interest was measure at fair value of R 550000 at acquisition. The following are the summarized financial statements of Kangaro Limited and Rexel (Pty) Limited at 31 December 2017: ASSIGNMENT 1 ACC 3641 \& ACC 3241 EXTRACT FROM STATEMENTS OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 Notes 1.1. The Property, plant \& equipment of Rexel were carried at their fair values on 1 May 2016. 1.2. Investment properties are valued using fair value method under IAS 40 and none of the properties are occupied by Kangaro. 1.3. Rexel had been purchasing all its inventories from Kangaro at a mark - up of 25% on the cost of the goods. Total sale between Rexel and Kangaro during the 2017 financial year amount to R 130 500. At the end of the 2017 financial year Kangaro had R 32500 worth of inventories acquired from Rexel in Inventories 2. Investment in Wimpy Limited On 1 January 2017, Kangaro acquired 2500 ordinary shares in Wimpy Limited for R 250800. Wimpy Limited had a total of 10000 ordinary shares in issue on 1 January 2017. Wimpy Limited's retained earnings R 903200 and share capital was R 100000. Below is the extracted statement of profit or loss and other comprehensive income for the year ended 31 December 2017 for Wimpy Limited

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started