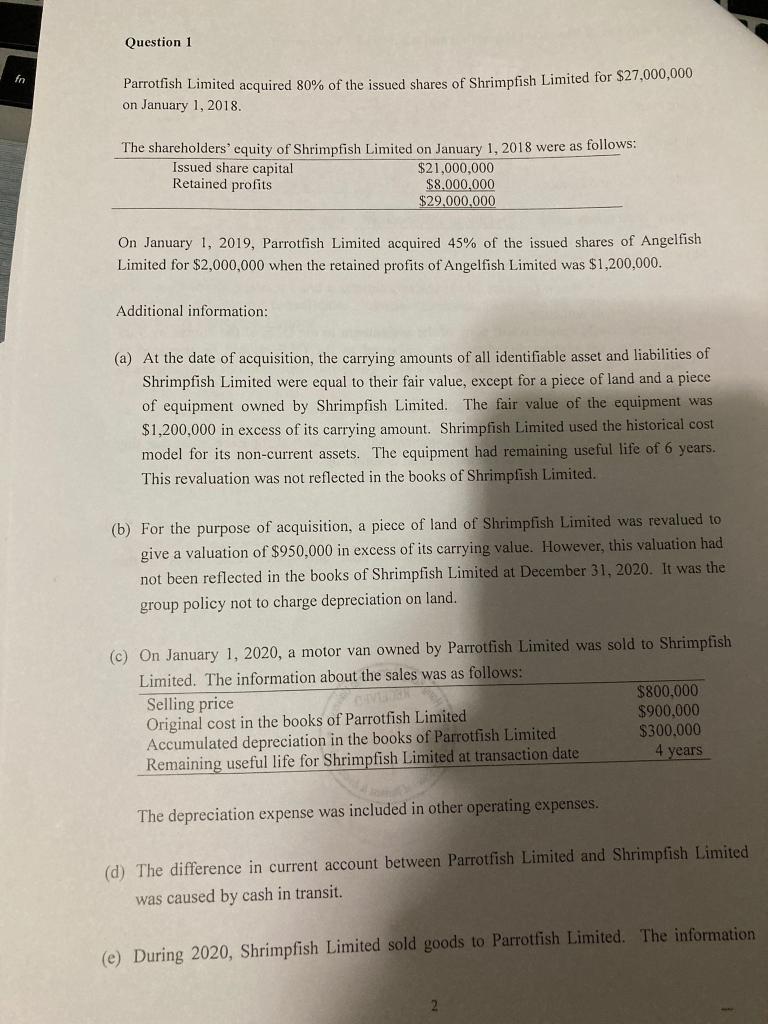

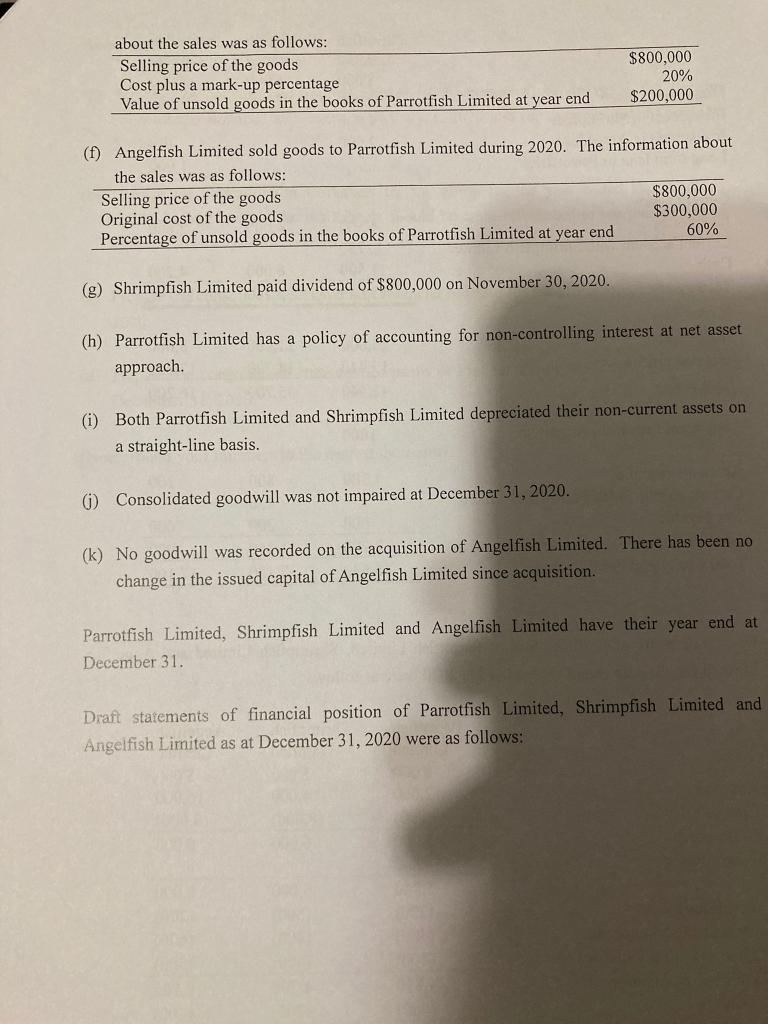

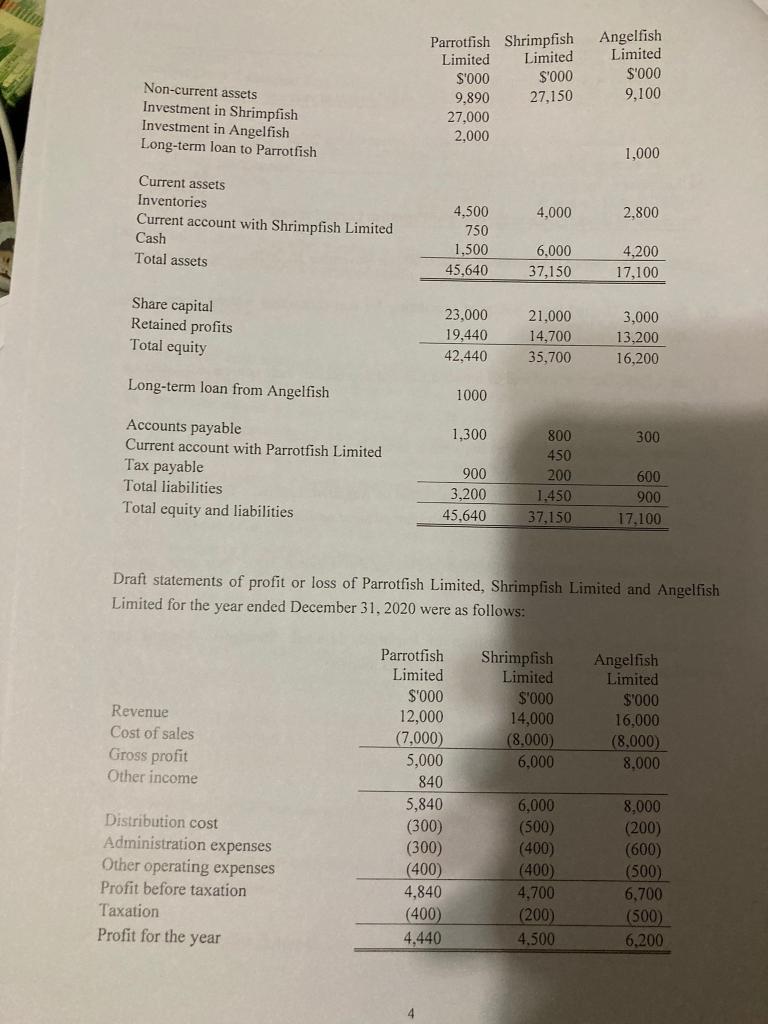

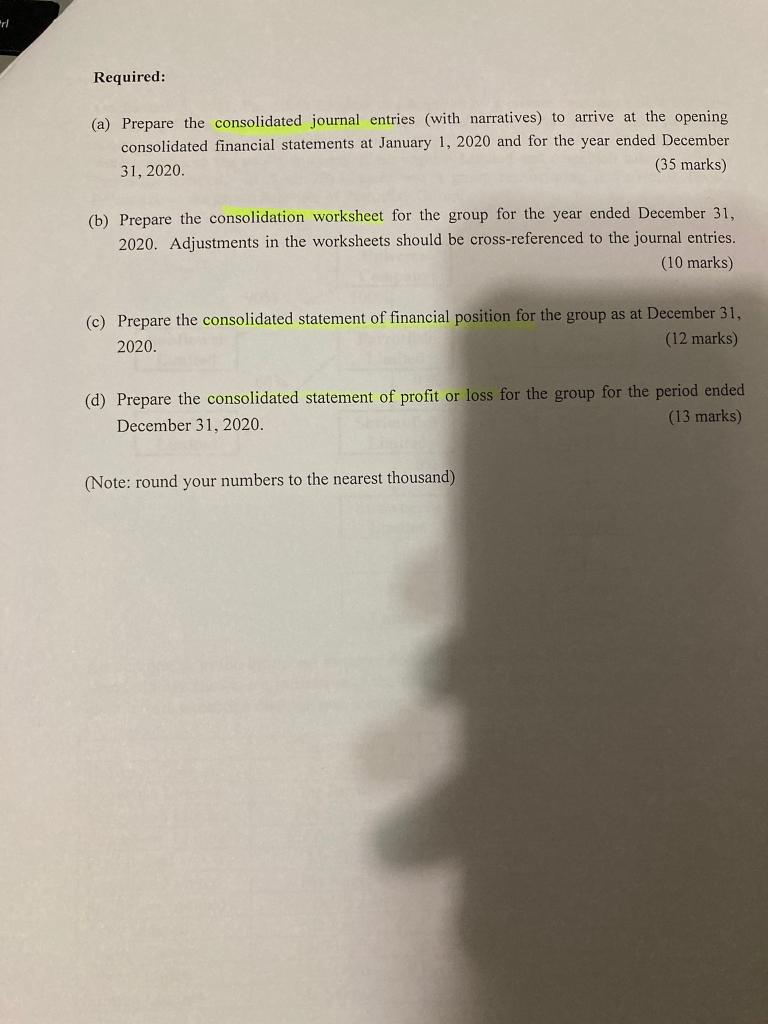

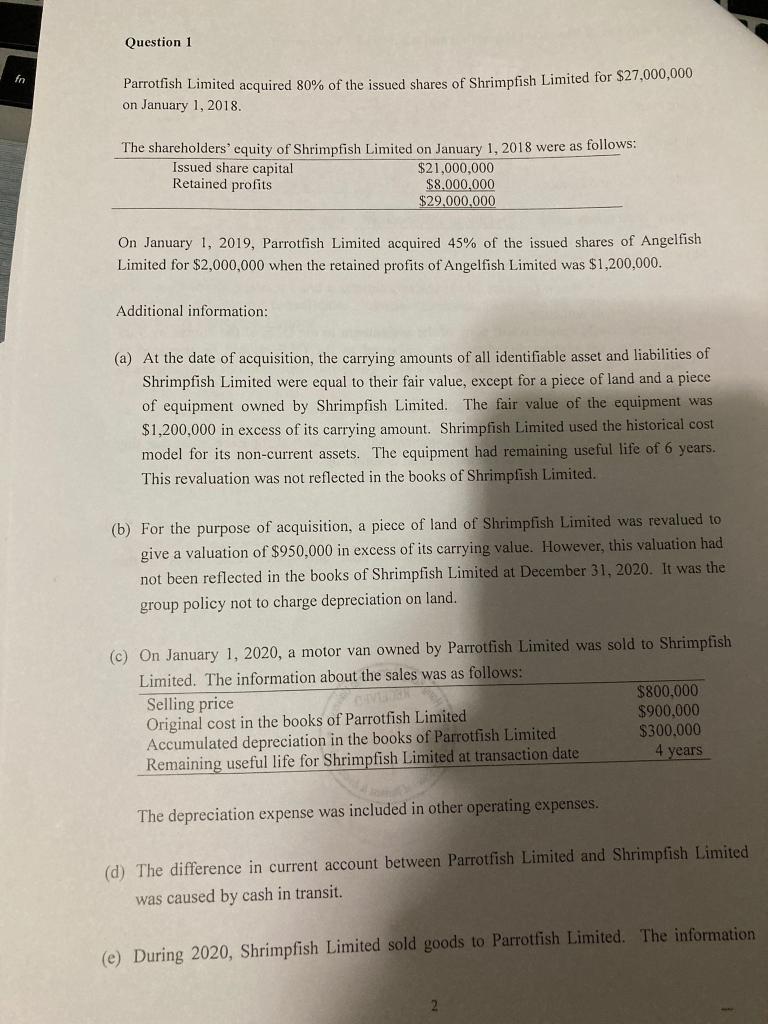

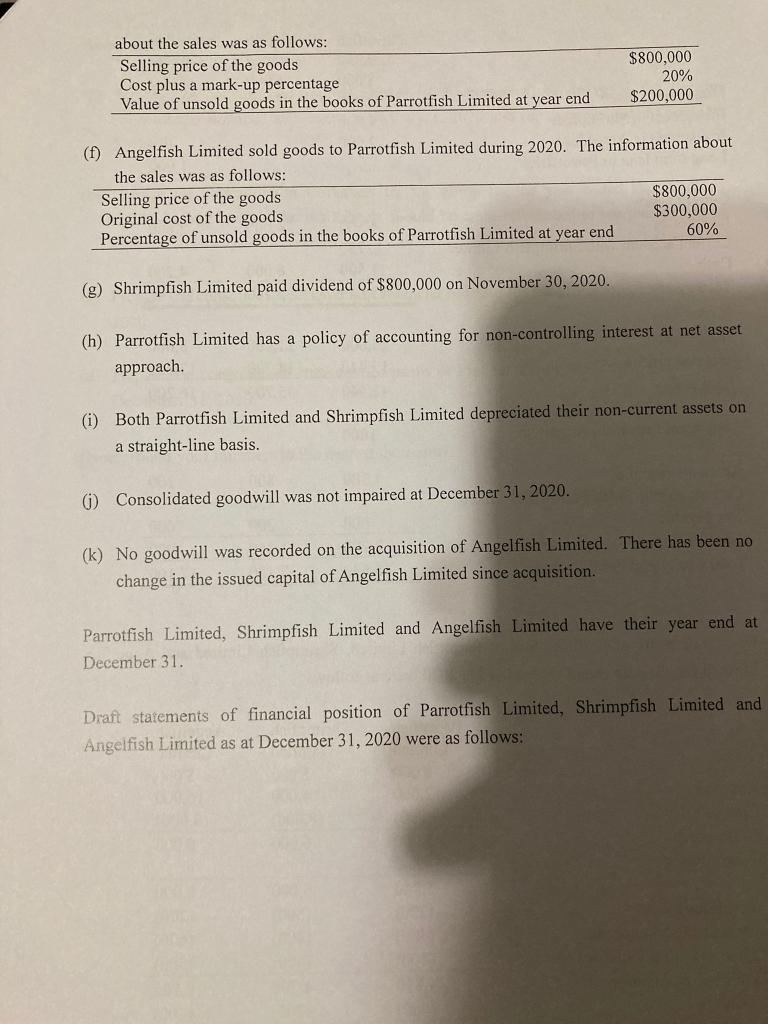

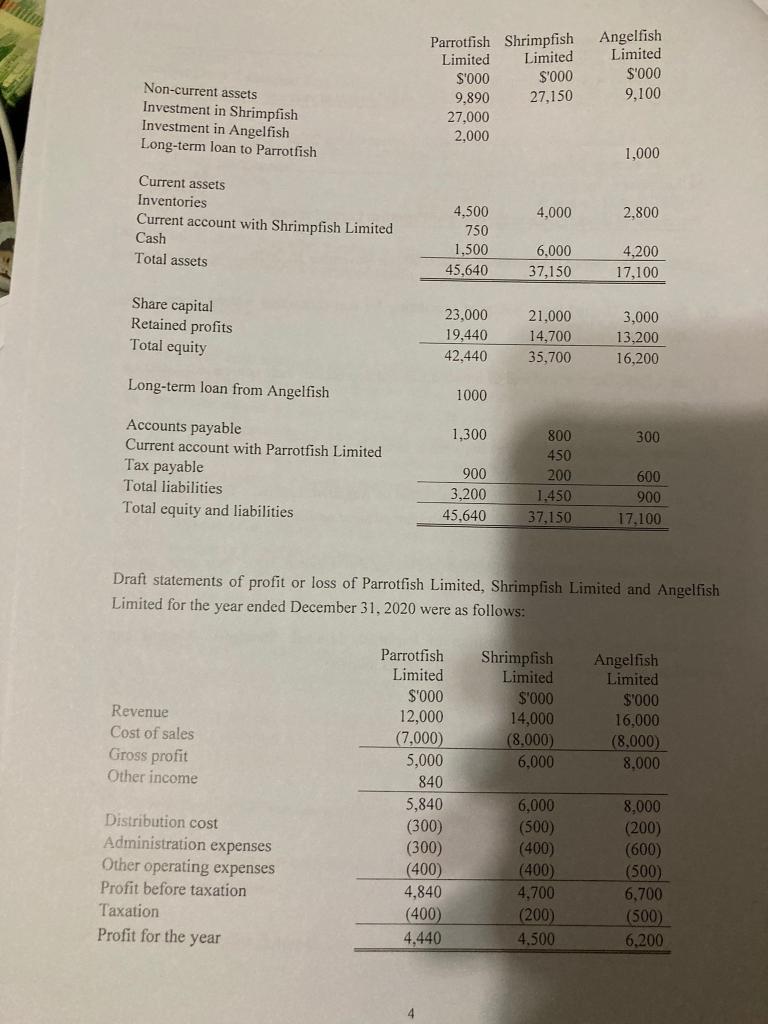

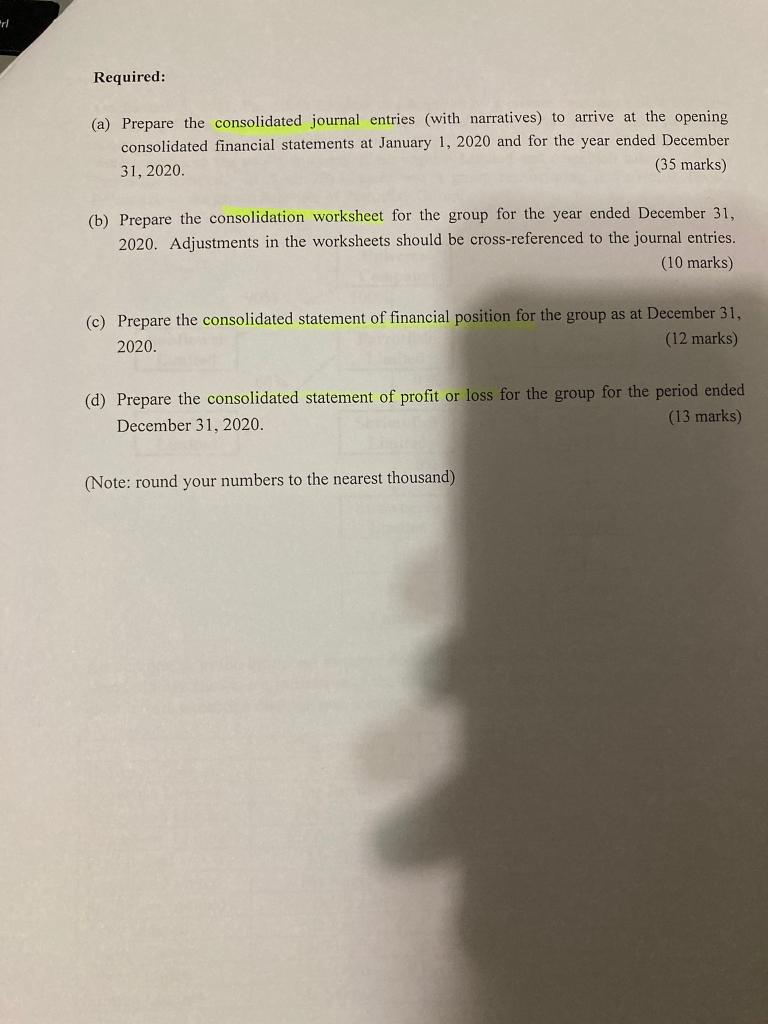

Question 1 In Parrotfish Limited acquired 80% of the issued shares of Shrimpfish Limited for $27,000,000 on January 1, 2018 The shareholders' equity of Shrimpfish Limited on January 1, 2018 were as follows: Issued share capital $21,000,000 Retained profits $8,000,000 $29,000,000 On January 1, 2019, Parrotfish Limited acquired 45% of the issued shares of Angelfish Limited for $2,000,000 when the retained profits of Angelfish Limited was $1,200,000. Additional information: (a) At the date of acquisition, the carrying amounts of all identifiable asset and liabilities of Shrimpfish Limited were equal to their fair value, except for a piece of land and a piece of equipment owned by Shrimpfish Limited. The fair value of the equipment was $1,200,000 in excess of its carrying amount. Shrimpfish Limited used the historical cost model for its non-current assets. The equipment had remaining useful life of 6 years. This revaluation was not reflected in the books of Shrimpfish Limited. (b) For the purpose of acquisition, a piece of land of Shrimpfish Limited was revalued to give a valuation of $950,000 in excess of its carrying value. However, this valuation had not been reflected in the books of Shrimpfish Limited at December 31, 2020. It was the group policy not to charge depreciation on land. (c) On January 1, 2020, a motor van owned by Parrotfish Limited was sold to Shrimpfish Limited. The information about the sales was as follows: Selling price $800,000 Original cost in the books of Parrotfish Limited $900,000 Accumulated depreciation in the books of Parrotfish Limited $300.000 Remaining useful life for Shrimpfish Limited at transaction date 4 years The depreciation expense was included in other operating expenses. (d) The difference in current account between Parrotfish Limited and Shrimpfish Limited was caused by cash in transit. (e) During 2020, Shrimpfish Limited sold goods to Parrotfish Limited. The information about the sales was as follows: Selling price of the goods Cost plus a mark-up percentage Value of unsold goods in the books of Parrotfish Limited at year end $800,000 20% $200,000 (f) Angelfish Limited sold goods to Parrotfish Limited during 2020. The information about the sales was as follows: Selling price of the goods $800,000 Original cost of the goods $300,000 Percentage of unsold goods in the books of Parrotfish Limited at year end 60% (g) Shrimpfish Limited paid dividend of $800,000 on November 30, 2020. (h) Parrotfish Limited has a policy of accounting for non-controlling interest at net asset approach. (i) Both Parrotfish Limited and Shrimpfish Limited depreciated their non-current assets on a straight-line basis. 6) Consolidated goodwill was not impaired at December 31, 2020. (k) No goodwill was recorded on the acquisition of Angelfish Limited. There has been no change in the issued capital of Angelfish Limited since acquisition. Parrotfish Limited, Shrimpfish Limited and Angelfish Limited have their year end at December 31. Draft statements of financial position of Parrotfish Limited, Shrimpfish Limited and Angelfish Limited as at December 31, 2020 were as follows: Parrotfish Shrimpfish Limited Limited S'000 $'000 9,890 27,150 27.000 2.000 Angelfish Limited $'000 9,100 Non-current assets Investment in Shrimpfish Investment in Angelfish Long-term loan to Parrotfish 1,000 Current assets Inventories Current account with Shrimpfish Limited Cash Total assets 4,000 2,800 4.500 750 1,500 45,640 6.000 37,150 4,200 17,100 Share capital Retained profits Total equity 23,000 19,440 42,440 21,000 14,700 35,700 3,000 13,200 16,200 Long-term loan from Angelfish 1000 1,300 300 Accounts payable Current account with Parrotfish Limited Tax payable Total liabilities Total equity and liabilities 900 3,200 45.640 800 450 200 1.450 37,150 600 900 17.100 Draft statements of profit or loss of Parrotfish Limited, Shrimpfish Limited and Angelfish Limited for the year ended December 31, 2020 were as follows: Revenue Cost of sales Gross profit Other income Shrimpfish Limited $'000 14,000 (8,000) 6,000 Angelfish Limited $'000 16,000 (8,000 8,000 Parrotfish Limited $'000 12,000 (7,000) 5,000 840 5,840 (300) (300) (400) 4,840 (400) 4,440 Distribution cost Administration expenses Other operating expenses Profit before taxation Taxation Profit for the year 6,000 (500) (400) (400) 4.700 (200) 4.500 8,000 (200) (600) (500) 6,700 (500) 6,200 4 ri Required: (a) Prepare the consolidated journal entries (with narratives) to arrive at the opening consolidated financial statements at January 1, 2020 and for the year ended December 31, 2020. (35 marks) (b) Prepare the consolidation worksheet for the group for the year ended December 31, 2020. Adjustments in the worksheets should be cross-referenced to the journal entries. (10 marks) (c) Prepare the consolidated statement of financial position for the group as at December 31, 2020. (12 marks) (d) Prepare the consolidated statement of profit or loss for the group for the period ended December 31, 2020. (13 marks) (Note: round your numbers to the nearest thousand) Question 1 In Parrotfish Limited acquired 80% of the issued shares of Shrimpfish Limited for $27,000,000 on January 1, 2018 The shareholders' equity of Shrimpfish Limited on January 1, 2018 were as follows: Issued share capital $21,000,000 Retained profits $8,000,000 $29,000,000 On January 1, 2019, Parrotfish Limited acquired 45% of the issued shares of Angelfish Limited for $2,000,000 when the retained profits of Angelfish Limited was $1,200,000. Additional information: (a) At the date of acquisition, the carrying amounts of all identifiable asset and liabilities of Shrimpfish Limited were equal to their fair value, except for a piece of land and a piece of equipment owned by Shrimpfish Limited. The fair value of the equipment was $1,200,000 in excess of its carrying amount. Shrimpfish Limited used the historical cost model for its non-current assets. The equipment had remaining useful life of 6 years. This revaluation was not reflected in the books of Shrimpfish Limited. (b) For the purpose of acquisition, a piece of land of Shrimpfish Limited was revalued to give a valuation of $950,000 in excess of its carrying value. However, this valuation had not been reflected in the books of Shrimpfish Limited at December 31, 2020. It was the group policy not to charge depreciation on land. (c) On January 1, 2020, a motor van owned by Parrotfish Limited was sold to Shrimpfish Limited. The information about the sales was as follows: Selling price $800,000 Original cost in the books of Parrotfish Limited $900,000 Accumulated depreciation in the books of Parrotfish Limited $300.000 Remaining useful life for Shrimpfish Limited at transaction date 4 years The depreciation expense was included in other operating expenses. (d) The difference in current account between Parrotfish Limited and Shrimpfish Limited was caused by cash in transit. (e) During 2020, Shrimpfish Limited sold goods to Parrotfish Limited. The information about the sales was as follows: Selling price of the goods Cost plus a mark-up percentage Value of unsold goods in the books of Parrotfish Limited at year end $800,000 20% $200,000 (f) Angelfish Limited sold goods to Parrotfish Limited during 2020. The information about the sales was as follows: Selling price of the goods $800,000 Original cost of the goods $300,000 Percentage of unsold goods in the books of Parrotfish Limited at year end 60% (g) Shrimpfish Limited paid dividend of $800,000 on November 30, 2020. (h) Parrotfish Limited has a policy of accounting for non-controlling interest at net asset approach. (i) Both Parrotfish Limited and Shrimpfish Limited depreciated their non-current assets on a straight-line basis. 6) Consolidated goodwill was not impaired at December 31, 2020. (k) No goodwill was recorded on the acquisition of Angelfish Limited. There has been no change in the issued capital of Angelfish Limited since acquisition. Parrotfish Limited, Shrimpfish Limited and Angelfish Limited have their year end at December 31. Draft statements of financial position of Parrotfish Limited, Shrimpfish Limited and Angelfish Limited as at December 31, 2020 were as follows: Parrotfish Shrimpfish Limited Limited S'000 $'000 9,890 27,150 27.000 2.000 Angelfish Limited $'000 9,100 Non-current assets Investment in Shrimpfish Investment in Angelfish Long-term loan to Parrotfish 1,000 Current assets Inventories Current account with Shrimpfish Limited Cash Total assets 4,000 2,800 4.500 750 1,500 45,640 6.000 37,150 4,200 17,100 Share capital Retained profits Total equity 23,000 19,440 42,440 21,000 14,700 35,700 3,000 13,200 16,200 Long-term loan from Angelfish 1000 1,300 300 Accounts payable Current account with Parrotfish Limited Tax payable Total liabilities Total equity and liabilities 900 3,200 45.640 800 450 200 1.450 37,150 600 900 17.100 Draft statements of profit or loss of Parrotfish Limited, Shrimpfish Limited and Angelfish Limited for the year ended December 31, 2020 were as follows: Revenue Cost of sales Gross profit Other income Shrimpfish Limited $'000 14,000 (8,000) 6,000 Angelfish Limited $'000 16,000 (8,000 8,000 Parrotfish Limited $'000 12,000 (7,000) 5,000 840 5,840 (300) (300) (400) 4,840 (400) 4,440 Distribution cost Administration expenses Other operating expenses Profit before taxation Taxation Profit for the year 6,000 (500) (400) (400) 4.700 (200) 4.500 8,000 (200) (600) (500) 6,700 (500) 6,200 4 ri Required: (a) Prepare the consolidated journal entries (with narratives) to arrive at the opening consolidated financial statements at January 1, 2020 and for the year ended December 31, 2020. (35 marks) (b) Prepare the consolidation worksheet for the group for the year ended December 31, 2020. Adjustments in the worksheets should be cross-referenced to the journal entries. (10 marks) (c) Prepare the consolidated statement of financial position for the group as at December 31, 2020. (12 marks) (d) Prepare the consolidated statement of profit or loss for the group for the period ended December 31, 2020. (13 marks) (Note: round your numbers to the nearest thousand)