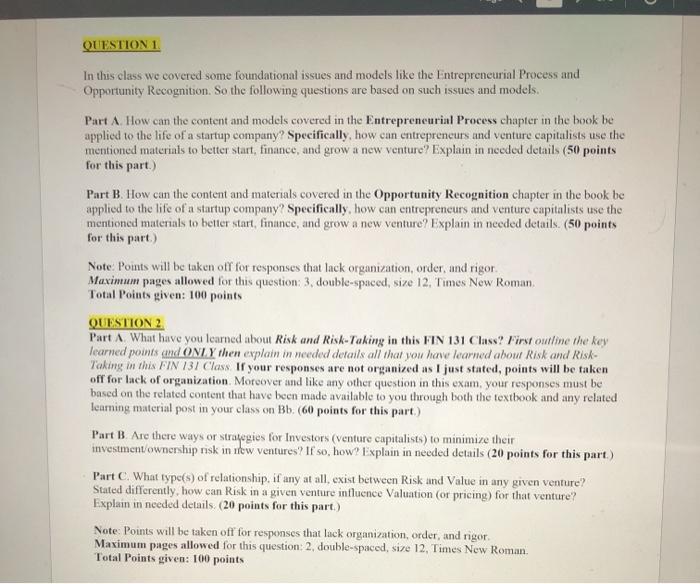

QUESTION 1 In this class we covered some foundational issues and models like the Entrepreneurial Process and Opportunity Recognition. So the following questions are based on such issues and models. Part A How can the content and models covered in the Entrepreneurial Process chapter in the book be applied to the life of a startup company? Specifically, how can entrepreneurs and venture capitalists use the mentioned materials to better start, finance, and grow a new venture? Explain in needed details (50 points for this part.) Part B. How can the content and materials covered in the Opportunity Recognition chapter in the book be applied to the life of a startup company? Specifically, how can entrepreneurs and venture capitalists use the mentioned materials to better start, finance, and grow a new venture? Explain in needed details. (50 points for this part) Note Points will be taken off for responses that lack organization, order and rigor Maximum pages allowed for this question: 3. double-spaced, size 12. Times New Roman, Total Points given: 100 points QUESTION 2 Part A What have you learned about Risk and Risk-Taking in this FIN 131 Class? First outline the key learned points and ONLY then explain in needed details all that you have learned about Risk and Risk- Taking in this FIN 137 Class. If your responses are not organized as I just stated, points will be taken off for lack of organization. Moreover and like any other question in this exam, your responses must be based on the related content that have been made available to you through both the textbook and any related learning material post in your class on Bb. (60 points for this part) Part B. Are there ways or strayegies for Investors (venture capitalists) to minimize their investment/ownership risk in new ventures? If so, how? Explain in needed details (20 points for this part) Part What type(s) of relationship, if any at all. exist between Risk and Value in any given venture? Stated differently, how can Risk in a given venture influence Valuation (or pricing) for that venture? Explain in needed details (20 points for this part.) Note: Points will be taken off for responses that lack organization, order, and nigor. Maximum pages allowed for this question: 2, double-spaced, size 12, Times New Roman. Total Points given: 100 points QUESTION 1 In this class we covered some foundational issues and models like the Entrepreneurial Process and Opportunity Recognition. So the following questions are based on such issues and models. Part A How can the content and models covered in the Entrepreneurial Process chapter in the book be applied to the life of a startup company? Specifically, how can entrepreneurs and venture capitalists use the mentioned materials to better start, finance, and grow a new venture? Explain in needed details (50 points for this part.) Part B. How can the content and materials covered in the Opportunity Recognition chapter in the book be applied to the life of a startup company? Specifically, how can entrepreneurs and venture capitalists use the mentioned materials to better start, finance, and grow a new venture? Explain in needed details. (50 points for this part) Note Points will be taken off for responses that lack organization, order and rigor Maximum pages allowed for this question: 3. double-spaced, size 12. Times New Roman, Total Points given: 100 points QUESTION 2 Part A What have you learned about Risk and Risk-Taking in this FIN 131 Class? First outline the key learned points and ONLY then explain in needed details all that you have learned about Risk and Risk- Taking in this FIN 137 Class. If your responses are not organized as I just stated, points will be taken off for lack of organization. Moreover and like any other question in this exam, your responses must be based on the related content that have been made available to you through both the textbook and any related learning material post in your class on Bb. (60 points for this part) Part B. Are there ways or strayegies for Investors (venture capitalists) to minimize their investment/ownership risk in new ventures? If so, how? Explain in needed details (20 points for this part) Part What type(s) of relationship, if any at all. exist between Risk and Value in any given venture? Stated differently, how can Risk in a given venture influence Valuation (or pricing) for that venture? Explain in needed details (20 points for this part.) Note: Points will be taken off for responses that lack organization, order, and nigor. Maximum pages allowed for this question: 2, double-spaced, size 12, Times New Roman. Total Points given: 100 points